Today, there are 10 standardized Medicare Supplement plans (Plans A through N). The coverage for these plans is the same no matter which insurance company you have. For example, the coverage and benefits for Plan F is exactly the same at Aetna, Cigna, Blue Shield, Stonebridge, Blue Cross, etc., so it’s much easier to shop around and compare plans and prices today.

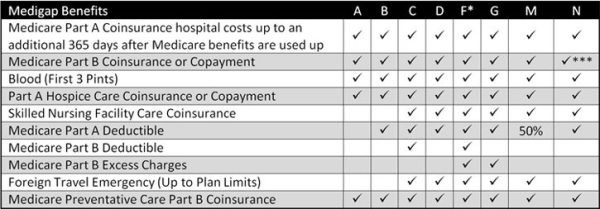

As you can see in the following chart, Plan F provides the most extensive Medicare Supplement coverage. (The plans with the empty boxes indicate coverage that is not included with that particular plan.)

Of the 10 standardized Medicare Supplement plans (aka “Medigap” plans), Plan F is considered to be the best plan because it provides the most comprehensive coverage. Plan F pays for all of the coinsurance, copayments, and deductibles not paid for by Medicare.

Plan F pays for the following benefits:

- Medicare Part A Hospital Deductible (Currently $1,216 per benefit period) *

- Medicare Part A Hospital Coinsurance

- Medicare Part B Deductible (Currently $147 per year)

- Medicare Part B Coinsurance

- Medicare Part B Excess Charges

- Hospice Care Coinsurance or Copayments

- Skilled Nursing Facility Care Coinsurance

- Charges for First Three Pints of Blood

- Foreign Travel Emergencies

* A benefit period begins on the first day you receive service as an inpatient in a hospital and ends after you have been out of the hospital and have not received skilled care in any other facility for 60 days in a row. Therefore, there can be multiple Part A hospital deductibles in one calendar year.

Plan F and Plan G include the following benefits:

- Freedom to choose any doctor or hospital that accepts Medicare patients.

- Benefits start immediately with no waiting period for pre-existing conditions.

- There are no networks and no referral needed.

- No cancellation for age, health or the number of claims you file.

- Covers 100% of all Medicare allowable excess charges.

- Coverage that expands automatically with any future changes in Medicare.

- Virtually eliminates all claims paperwork for you.

- 30-day, no-risk free look guarantees your satisfaction or you get your money back.

Medicare Plan G Is Identical To Plan F Except For the Part B Deductible

Medicare Plan G provides the same identical coverage as Plan F except it does not cover the $147 Part B calendar year deductible (in bold above). That is the only difference between the two plans. They are exactly the same in every other way! Plan F and Plan G are the only two Medicare Supplement plans that pay 100% of any excess charges, so there would rarely be any unexpected out-of-pocket expenses. (Excess charges are additional expenses incurred outside of the Medicare-approved charge. For example, if you go to a doctor that charges more than the Medicare-approved amount.)

Why Would I Choose Medicare Plan G Over Plan F?

The decision to go with Plan G depends on whether the annual savings will exceed the $147 Part B deductible. For example, if your Plan G premiums are $30 per month less than the Plan F premiums, then you will save $360 per year in premiums ($30 x 12 = $360). If you are healthy, and you didn’t go to a doctor that year, you would have saved $360 on your premiums. If you had to pay the $147 Part B deductible, then you still would have saved $213 for the year in premiums ($360 – $147 = $213). On the other hand, if your annual premium savings would be just slightly more than, equal to, or less than $147 per year, then you are unquestionably better off with Plan F.

The Likelihood of Future Rate Increases is Less With Plan G Than With Plan F

Under federal law, Plan F falls under certain Guaranteed Issue (GI) requirements while Plan G doesn’t. For example, if someone has their health insurance with an employer plan or if they are on a Medicare Advantage plan and they loose their coverage, in most cases, they are guaranteed the right to switch to Plan F, regardless of their health and without medical underwriting.

Plan G is not a guaranteed issue plan. Consequently, the overall pool of people with Plan G are healthier than those on Plan F, and the quantity of submitted medical claims is lower with Plan G. Rate increases are often a result of too much GI business, so “F” plans have historically had greater and more frequent rate increases than “G” plans. That’s not a guarantee that “G” plans won’t have future rate increases, but if they do, the increases will more than likely be smaller.

The Only Potential Risk That I See With Plan G…

The only potential risk that I see for the future is that nobody knows for sure what the Part B deductible for Medicare will be in the future. Between 2011 and 2012, the Part B deductible actually went down from $162 per year to $140 per year. For the last few years, from 2013 through 2015, the Part B deductible has been stable and remained the same at $147 per year.

Here is the history of Medicare Part B deductibles:

- 2017 — $183

- 2016 — $166

- 2015 — $147

- 2014 — $147

- 2013 — $147

- 2012 — $140

- 2011 — $162

- 2010 — $155

- 2009 — $135

- 2008 — $135

- 2007 — $131

- 2006 — $124

- 2005 — $110

- 1991 through 2004 the Part B deductible was $100

- 1982 through 1990 the Part B deductible was $75

- 1973 through 1981 the Part B deductible was $60

- 1966 through 1972 the Part B deductible was $50

As you can see, the historical Part B deductible rates have been relatively stable over the years. For me, it wouldn’t be an issue if I could otherwise save $200 to $300 per year by having a Plan G Medicare Supplement. On the other hand, many of my clients can afford to pay for the best and most comprehensive plan, Plan F, and they don’t want the uncertainty of not knowing for sure what the future will bring. Saving $200 to $300 per year isn’t always a big enough motivator for many to warrant switching from Plan F to Plan G. Then again, many retirees are on tight budgets and fixed incomes, and if that is the case, I would unquestionably recommend that they switch from Plan F to Plan G if they can save money on their premiums.

The California Birthday Rule

With the California Birthday Rule, you are guaranteed the right to switch plans every year within 30 days after your birthday, regardless of your health and without underwriting, if another company is offering the same plan or a lesser plan for less money. In other words, if you have Plan F, you can switch to Plan F with a different company if their rates are lower, or you could switch from Plan F to Plan G with a different company since Plan G is considered to have less benefits (the $147 Part B deductible) than Plan F. Rates vary significantly from one company to the next for the same identical plan and coverage, so it’s important to shop around every year.

Please let me know if you have any questions or comments!

If you or someone that you know would like a Medicare Supplement quote, please let me know, or click here to visit my website. Or, you can compare Medicare Supplement prices on your own by clicking the “Get A Quote” button below.

—

Really enjoyed reading this blog. It was very interesting! I didn’t realize that the “G” plan is basically the “F” plan with a deductible. I have a higher deductible on my car and homeowner’s insurance to save money on my premiums. I’m going to look into this with my Medigap plan as well. Can you help me with that? Thank you!

Thank you, Rick! So happy to hear that you enjoyed the article! Please call or shoot me an email at RonLewisInsurance@yahoo.com, and I will send you the various Plan F and Plan G prices so you can compare them. If you apply within 30 days after your birthday, you won’t have to answer any health questions. Also, please include your birthdate and zip code. Those are the two factors that affect the rates. Thanks again! ~Ron

So glad you made us aware that we should check rates every year and that we have that 30 day window after our birthday each year to change plans, even if we have health conditions. So many people don’t know that or understand that each company offers the exact same coverage for a particular plan, and the rates can differ considerably. Sounds like you are up to the minute with current information. Thanks for being so informative! I enjoyed the article!

Thanks for the kind words, Adrienne. I’m glad that you found the information to be informative and that you enjoyed reading this article! ~Ron

Ron, thanks for writing these articles and keeping us all up to date on the available information.

Jan, you are welcome! I’m glad to hear that you are finding this information to be useful! ~Ron

Great article, informative and easy to understand for anybody having to deal with supplementary insurance for the first time.

Thank you, Hermina! I appreciate your feedback! ~Ron

Ron,

I appreciate the article, Keep them coming.

Thanks,

Sandy

Thank you, Sandy! I intend to write more! ~Ron

I enjoyed reading this article. I thought it was well written, and it had a lot of useful and important information that I wasn’t aware of. Thank you for bringing this to my attention!

Thank you, Jay! I’m glad to hear that! ~Ron