Can you guess what it is? In the past, I used to specialize in long-term care insurance (LTCi), and I’d joke that it was probably the second to the last favorite type of insurance that people wanted to think about or talk about next to Final Expense (burial) insurance. After all, who can get excited about spending money for a piece of paper that you hope you’ll never use?

Most people don’t get emotional when they talk about automobile insurance, health insurance, or homeowners (fire) insurance, but when it comes to long-term care insurance or final expense insurance, that’s different. For many people, these are sensitive and uncomfortable subjects, which is understandable. However, the risk of a long-term care stay is significantly higher than the risk of an auto accident, a home fire, being hospitalized, etc. And I wonder what the risk of dying is? I’d venture to say that it’s probably around 100%! 😉 As my good (and cynical) friend likes to say, “There’s no getting out of here alive!”

Personally, I don’t get emotional when I think about insurance. I look at it strictly as a financial planning tool and nothing else. It is there to protect my loved ones and my assets, and I don’t want to get my money’s worth out of it! Although I’m sure that many of you reading this article cannot wait for me to delve into the topic of long-term care insurance, you’ll have to be patient and wait because I am going to focus on everyone’s least favorite insurance topic for now, which is Final Expense insurance!

What is Final Expense (Burial) Insurance?

Final expense plans are small, permanent whole-life insurance policies that are specifically designed to handle the last expenses a person’s family must handle for them including funeral costs, outstanding medical bills, and any other unexpected expenses or debt that may be left behind. Because they are whole-life and not term-life insurance policies, the premiums are locked in. Once you select the amount of coverage you want, the premiums are guaranteed to never increase for as long as you hold the policy, and the policy will never expire as long as you pay the premiums.

In addition, some policies include a small cash value component where tax-deferred savings can be built up over time. These funds may be withdrawn or borrowed against if you decide to do so. However, any unpaid loans or withdrawals will reduce the policy’s death benefit.

Today, funeral expenses can easily cost more than $10,000. Although the cost of a funeral may surprise you, if you plan ahead, a final expense plan can help reduce the burden of these costs on your family and help them focus on what is most important during a difficult time. Having a final expense plan in place can be a very loving and considerate thing to do, and it will give you the peace of mind that comes from knowing that you have planned ahead to ease the burden on loved ones.

Two Types of Final Expense Benefit Levels

Final expense plans usually have two types of benefit levels:

- Graded Benefit – The application process for these kind of final expense plans is the simplest and easiest. No medical exam is required and there are no health questions to answer. These plans are a guaranteed issue! You cannot be turned down, REGARDLESS OF YOUR HEALTH, as long as you meet the age requirements. There is usually a 24-month waiting period before the full face amount of the policy is in force. If death occurs within the first two policy years for any reason other than an accident, all premiums plus 10% interest are usually paid to the beneficiary. After the initial two year period, the full benefit is paid for death due to all causes.

- Level Benefit – The full face amount of the policy will be in-force the day the application is approved. The premiums for these policies are more competitive because health questions will be asked at the time of application. If someone wants a final expense plan, they should first apply for a level benefit final expense plan if they are in relatively good health. If they have health issues that might prevent them from getting accepted, they can always get a graded benefit plan.

Premiums Never Increase

Once you select the amount of coverage that you want, your premiums are guaranteed to never increase for as long as you hold the policy. The rates are based on your age at the time you signed the application, and they will never increase in the future.

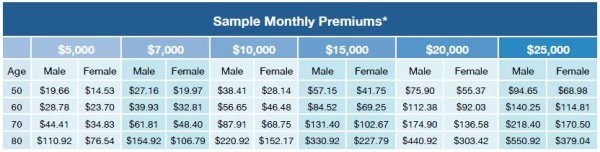

Sample Rates For a Graded Benefit Final Expense Plan

Gerber Life Insurance Company, which is a financially separate affiliate of the Gerber Products Company, offers a graded benefit final expense plan. With their plan, if you are a US citizen or permanent legal resident between the ages of 50 and 80, you can choose from $5,000 to $25,000 in guaranteed life insurance. Plus, under current federal law, the death benefit is not subject to federal income tax when paid to a named beneficiary.

The following chart shows some sample monthly premiums for the Gerber Life graded benefit final expense plan:

As you can see, the monthly premium for a $10,000 final expense plan for a 60 year old male is $56.65. For a 60 year old female, the monthly premium is $46.48 per month. Again, these rates will never increase and the plan cannot be canceled for any reason as long as the premiums are paid.

Sample Rates For a Level Benefit Final Expense Plan

United of Omaha Life Insurance Company offers a level benefit final expense plan, and their application is a simple one that has 10 health questions. If you answer “No” to every question, you would be eligible for their level benefit product. With their plan, if you are between the ages of 45 and 85, you can choose from $2,000 to $40,000 in life insurance.

The monthly premium for a $10,000 level benefit final expense plan for a 60 year old male is $42.76. For a 60 year old female, the premium is $32.87 per month. Again, these rates will never increase and the plan cannot be canceled for any reason as long as the premiums are paid.

Which Final Expense Plan (Level Benefit or Graded Benefit) Has the Best Rates?

If you are in relatively good health and you don’t have any serious medical conditions, you should first apply for a level benefit final expense plan because the rates would be less than the rates for a graded benefit final expense plan. For example, the monthly premium for a United of Omaha Life Insurance Company $10,000 level benefit final expense plan for a 60 year old male and female is currently $42.76 and $32.87 per month, respectively, compared to $56.65 and $46.48 per month for the Gerber Life graded benefit final expense plan. As you can see, the level benefit rates are more competitively priced than the graded benefit rates.

Again, final expense is probably everyone’s least favorite insurance topic, but it is something that should be taken into consideration, without emotion, as a financial planning tool, and nothing more. Remember, it’s peace of mind.

For more information or to get a quote, please give me a call at (760) 525-5769.