Do you know that Medicare Supplement (MediGap) rates vary significantly between insurance carriers for the same identical plan and coverage? In the US, there are 10 “standardized” Medicare Supplement plans to choose from, plans A through N.

NOTE: The plans are labeled A, B, C, D, F, G, K, L, M and N to signify the plan differences. (Plans E, H, I and J are no longer available.)

The word “standardized” means that the coverage for Plan F, Plan G, etc. is exactly the same no matter what insurance carrier you have. For example, the coverage for Plan F is exactly the same with Mutual of Omaha, UnitedHealthcare, Blue Shield of CA, Aetna, Cigna, Anthem Blue Cross, etc.

Although the coverage is exactly the same between insurance carriers for the standardized plans, the PREMIUMS ARE NOT THE SAME! In fact, most people are paying hundreds of dollars per year more for their insurance premiums than they should be!

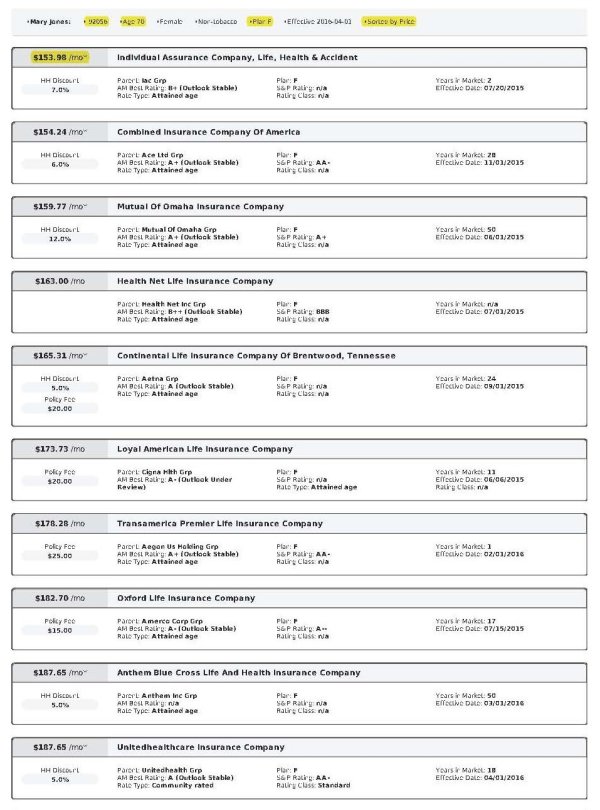

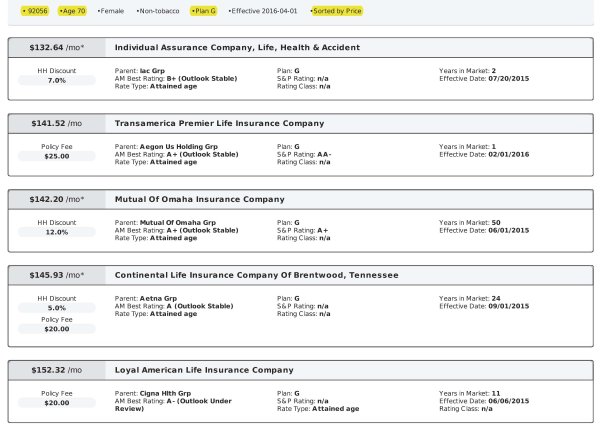

For example, the Plan F premiums for a 70 year old living in the 92056 zip code in San Diego range in price from $153.98 per month to $264.19 per month. That’s a difference of $110.21 per month or $1,322.52 per year for the same identical plan and coverage! On the following rate sheet, you can see the different Plan F rates for 18 different insurance carriers in the 92056 zip code. Obviously, some carriers are more competitively priced than others!

As you can see, in the 92056 zip code, the Plan F rates for a 70 year old range in price from $153.98 per month to $264.19 per month! Again, that’s a difference of $110.21 per month or $1,322.52 per year for the same exact plan and coverage!

It’s Important to Shop Around Every Year!

The Medicare Supplement market is constantly changing, and so are the premiums. If you have a Medicare Supplement and you haven’t shopped around during the last year, there’s a good chance that you’re paying hundreds of dollars a year more for your insurance than you should be! Many people that I meet haven’t shopped around at all since they first signed up for Medicare! Many of these individuals haven’t heard from their insurance agent since then as well!

This past year, two of my clients (a husband and wife) had Plan G, and they were paying $809 per month for both of them, approximately $404.50 each! I shopped around for them and found them Plan G with a different carrier, Mutual of Omaha, and their total monthly premium is now $367.01 per month! That’s a savings of $441.99 per month or $5,303.88 per year! While this is not the norm, I can usually save most of my clients from $300 to $600 per year each on their Medicare Supplement insurance premiums and often more.

What is the Price Range for Plan F Medicare Supplement Rates?

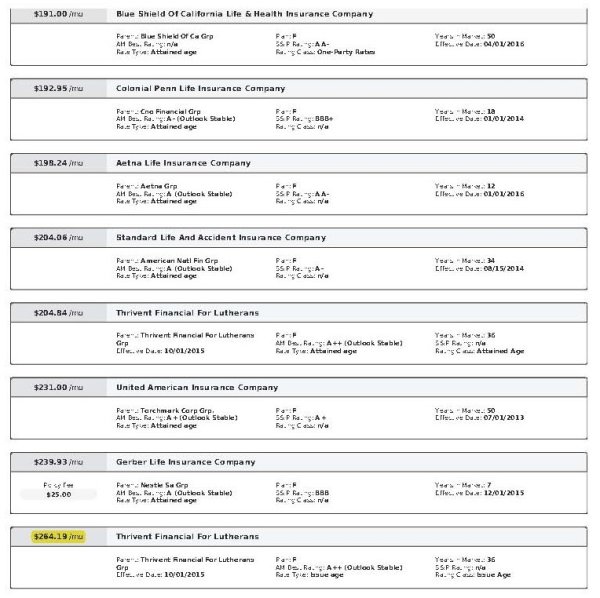

In the following chart, I have taken the lowest and highest Plan F premiums for ages 65 through 90 in the 92056 zip code. As you can see, the monthly and annual differences are significant for every age group.

Is There An Open Enrollment Period for Medicare Supplement Plans?

No. Unlike Medicare Advantage (MA) plans, which have an annual open enrollment period from October 15th through December 7th every year, you can shop around and apply for Medicare Supplement plans all year long.

NOTE: There is a six month-open enrollment period for Medicare Supplements when you first sign up for Medicare Part B.

Do I Need to Be In Good Health to Get a New Medicare Supplement Plan?

Unless you are in a Special Enrollment Period (SEP), if you already have a Medicare Supplement, you need to be in relatively good health to apply for a new Medicare Supplement with a different carrier. However, if you have a Medicare Supplement and you apply during the 30 days before or after your birthday, you don’t have to answer any health questions on the application, and you cannot be turned down due to health reasons if you apply for the same plan or another plan with fewer benefits. For more details, please see the California Birthday Rule section below.

What Happens If I Am Not In Good Health? Can I Still Apply For a New Medicare Supplement Plan?

Yes, absolutely! Because of the California Birthday Rule, if you already have a Medicare Supplement and you have serious health issues, YOU CANNOT BE TURNED DOWN FOR COVERAGE if you apply during the 30 days before or after your birthday.

California Birthday Rule

In California, there is a law called the California Birthday Rule. This law guarantees you the right to apply for a new Medicare Supplement plan EVERY YEAR, as long as you apply during the 30 days following your birthday. This is also known as the annual 30-day open enrollment period.

NOTE: Although the California Birthday Rules specifies that you can apply, REGARDLESS OF YOUR HEALTH, during the 30 days following your birthday without being turned down for coverage, several insurance carriers will let you apply during the 30 days BEFORE or AFTER your birthday!

This is more advantageous for you because the premiums with these carriers are based on your current age when you apply, and your rates will be lower if you apply during the 30 days prior to your birthday. With these carriers, your new rates are also guaranteed and locked in for the first 12 months of your policy, so there won’t be any unexpected rate increases.

NOTE: Not all insurance carriers lock your rates for the first 12 months.

If you want to take advantage of the California Birthday Rule and apply during the 30 days before or after your birthday, YOU CANNOT BE TURNED DOWN FOR COVERAGE as long as you apply for the same plan that you currently have OR if you apply for a different plan that has fewer benefits. For example, if you have Plan F (the most comprehensive plan) and you want to apply for Plan F with another carrier to save money on your premiums, or if you have Plan F and you want to apply with Plan G, etc.

NOTE: If you apply under the California Birthday Rule, there are no preexisting waiting periods for prior health conditions.

If you are in relatively good health, you can apply for a new Medicare Supplement plan any time of the year. If you have serious health issues, you should take advantage of the California Birthday Rule and apply for coverage during the 30 days before your birthday to save money on your premiums.

Consider Plan G to Save More Money On Your Premiums

Besides shopping around every year to make sure that you aren’t paying too much for your premiums, if you currently have Plan F, you should consider Plan G. Why? Because Plan G is identical to Plan F in EVERY way except you would pay a small $166 Part B (Medical) deductible one time per calendar year. That is the only difference between the two plans!

NOTE: I have an Obamacare Bronze plan, and my individual medical deductible is only $6,000 per year! I would gladly pay $166 per year for my medical deductible!

In other words, the most you would pay for any out-of-pocket expense with Plan G in any calendar year is $166. However, in most cases, you will save significantly more than $166 per year on your premiums, which usually makes Plan G a better value and more cost effective.

NOTE: The Part B (Medical) deductible is subject to change each year, but historically, it has remained stable.

To see the difference in coverage between Plan F and Plan G, please see the following chart:

As you can see, when you compare Plan F and Plan G, everything is exactly the same except for the $166 Part B deductible. Plan F has no deductible, and Plan G is basically Plan F with a small, $166 deductible.

Price Differences Between Plan F and Plan G

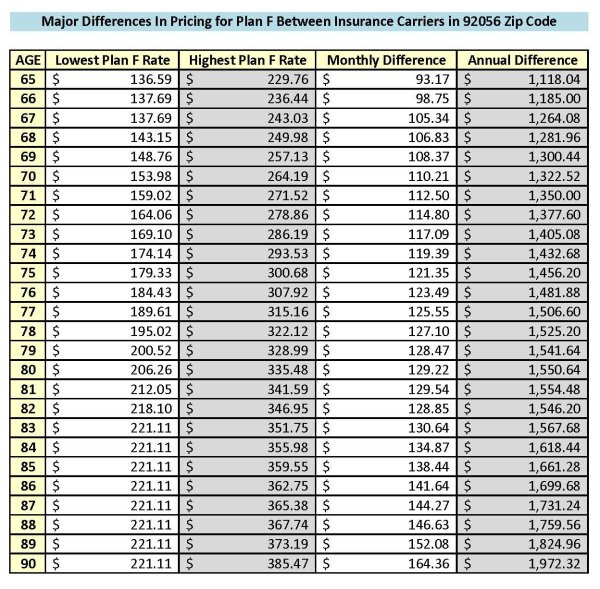

Although the two plans are almost identical in coverage, the rates for Plan G are usually significantly less than the Plan F rates. For a 70 year old in the 92056 zip code, the Plan F rates (above) range in price from $153.98 per month to $264.19 per month. The Plan G rates (below) range in price from $132.64 per month to $152.32 per month!

As you can see, the Plan G rates are significantly less than the Plan F rates for almost the same identical coverage.

Conclusion

The rates vary significantly from one insurance carrier to the next for the same identical plan and coverage. I recommend that you take advantage of the California Birthday Rule and shop around, every year, to make sure that you aren’t paying too much for your insurance. I would also suggest that you check out Plan G as another way to save a lot of money on your insurance premiums.

If you have any questions, or if you would like a free, no obligation quote, please don’t hesitate to let me know! I’m always happy to help!

Also, your feedback and comments are appreciated!

Thanks!

Ron Lewis

Ron@RonLewisInsurance.com

(760) 525-5769 – Cell

(866) 718-1600 – Toll-free

Pingback: Major Medicare Supplement Rate Discrepancies Between Insurance Carriers! — The End Zone | BMC Insurance Service Medicare Supplement Specialist