Under the California Birthday Rule, you can change your Medicare Supplement, also known as Medigap, every year during the 30 days following your birthday, to any other Medigap plan that has “equal or lesser” benefits.

For example, you can switch from Plan F to Plan F, Plan G to Plan G, Plan F to Plan G, Plan G to Plan N, etc. You just can’t switch from Plan G to Plan F, etc. under the birthday rule. You can do this REGARDLESS OF YOUR HEALTH and without answering any of the health questions on the application. You CANNOT be turned down for coverage!

NOTE: You can change Medigap plans any time of the year, but if you do so at any time other than around your birthday, you will have to answer the health questions on the application and your application will be medically underwritten.

Most states don’t have a birthday rule, so this law is definitely beneficial for California residents because in other states, if your health should change and your rates go up significantly, or you are not happy with your Medigap plan or carrier, you could be stuck because your application will be medically underwritten.

As of July 1st, 2020, the 30-day annual open enrollment period under the California Birthday Rule will be increasing from 30 to 60 days. Most carriers will let you apply for a Medigap plan under the birthday rule during the 30 days before or after your birthday; the new rule will be a 90-day window starting 30 days before and up to 60 days after your birthday each year.

Some carriers, such as Health Net, Mutual of Omaha, and Transamerica, have already implemented these changes. With these carriers, you can now qualify as a “guaranteed issue” under the California Birthday Rule during the 30 days before and up to 60 days following your birthday. These new changes with other carriers such as Anthem Blue Cross, Blue Shield of California, and Cigna won’t go into effect until July 1st, 2020.

10 Standardized Plans To Choose From

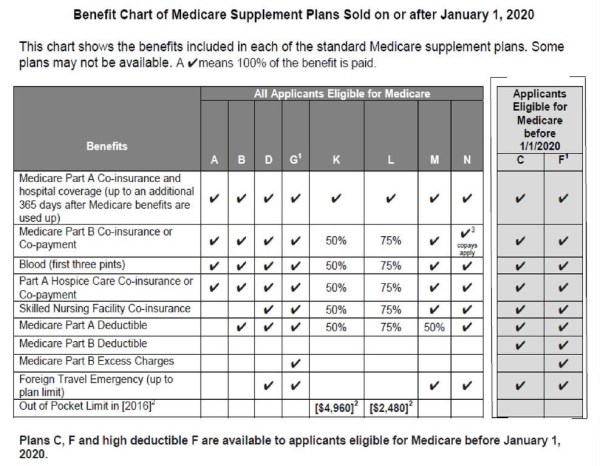

Nationwide, there are 10 standardized Medigap plans to choose from, Plan A through Plan N. The term “standardized” means that the coverage and benefits for every Plan F, Plan G, Plan N, etc. are exactly the same no matter what carrier you are with. Plan F is Plan F, Plan G is Plan G, etc.

Medigap Premiums Are Not Standardized

Although Medigap plans are standardized, the premiums for these plans are not standardized, and the rates vary significantly from one insurance carrier to another for the same exact plan and coverage.

Under the California Birthday Rule, the main reason you would want to change plans is to save money on your Medigap insurance premiums. In California, there are over two dozen Medigap insurance carriers to choose from. The only difference between them is the price.

For example, Julie will be turning 70 on April 25th, and her Plan G rate with Humana has increased to $205.00 per month. I contact Julie during the 30 days before her birthday (as I do for my clients) to compare rates and review her Medigap options. I let her know that she can get the same exact plan and coverage she now has (Plan G) with Transamerica for $153.00 per month.

Because Julie has had some serious health issues recently, she normally would not be able to change her Medigap insurance coverage. However, because of the California Birthday Rule, Julie can apply for Plan G with Transamerica during the 30 days before her birthday, and her new Plan G coverage will begin on May 1st. (Coverage usually begins on the first of the month following your birthday.) Because of the California Birthday Rule, Julie is now saving $52 per month or $624 per year for the same exact plan and coverage she had before by switching her Plan G from Humana to Transamerica.

NOTE: As of Julie 1st, 2020, Julie can take advantage of the California Birthday Rule every year during the 30 days prior to her birthday and up to 60 days following her birthday. As mentioned earlier, some carriers have already made this change.

Rates Vary Significantly Between Insurance Carriers

Although Medigap plans are standardized, Medigap rates are not standardized, and they vary significantly between insurance carriers. For example, in the 92009 zip code (Carlsbad, California), the Plan G rates for a 70 year old single female range from $152.14 per month with Transamerica to $269.87 per month with UnitedHealthcare (UHc) through AARP! That is a difference of $117.73 per month or $1,412.76 per year!

The Application Process

Most Medigap insurance carriers in California use online applications. I work with clients throughout California and in several different states, so it’s not necessary to meet face to face. The application process is simple, and it usually takes less than 15 minutes to complete.

In addition to the application, most carriers request a copy of your current Medigap card showing which plan you currently have. Some carriers also want something such as a copy of a current bill or bank statement showing that a recent payment has been made. Once the application has been submitted, the entire application process takes about a week or two to complete.

New MACRA Law

As of January 1st, 2020, the Medicare Access and CHIP Reauthorization Act (MACRA) went into effect. Under MACRA, if you turn 65 or become eligible for Medicare Part B on or after January 1st, 2020, Plan F and Plan C will not be an option for you since they pay the Medicare Part B deductible, which is $198 per calendar year in 2020. If you turned 65 or became eligible for Medicare prior to January 1st, 2020, then you can still sign up for Plan F, Plan C, etc., and those plans will still be available in the future.

Not All Insurance Carriers Are the Same

Although Medigap plans are standardized, some insurance carriers include some “extra” benefits with their plans such as free gym memberships, vision, hearing, and free personal emergency response systems (PERS), etc. Some insurance carriers guarantee and lock their rates for the first 12 months while others don’t. Some have better customer service, etc. It’s important to shop around and compare rates and to find the right plan and insurance carrier for you. I can help you with that.

For More Information

As an independent insurance agent, I work with all the major insurance carriers in California and several other states. I shop around for my clients, every year, to find them the best rates.

If you have any questions about the California Birthday Rule, etc. or if you would like a free, no-obligation Medigap quote, please don’t hesitate to contact me toll-free at (866) 718-1600 or at Ron@RonLewisInsurance.com. And please feel free to visit my website!