As of July 1st, 2020, under Senate Bill No. 407, the California Birthday Rule will be changing. Under the current law, for those individuals that have a Medicare Supplement, also known as Medigap, you can change your current plan to any Medigap plan that offers benefits “equal to or lesser than” your current plan during the 30 days following your birthday each year.

Under the new law, you will have the same opportunity to change plans, but the 30 day period has been extended to 60 days.

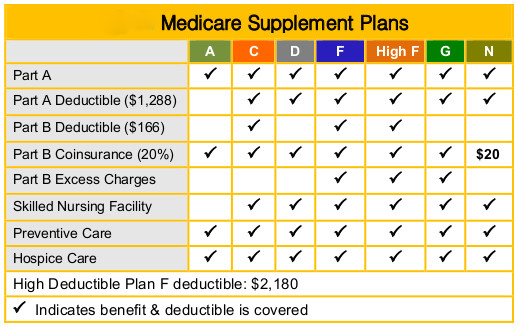

Nationwide, there are 10 standardized Medigap plans to choose from, Plan A through Plan N. The term “standardized” means that every Plan F, every Plan G, every Plan N, etc. has the same exact coverage and benefits no matter what insurance carrier you have your coverage with. In other words, Plan F is Plan F, Plan G is Plan G, Plan N is Plan N, etc. Because Medigap plans are standardized, it is much easier to compare “apples with apples.”

Medigap Plans Are Standardized but Rates Aren’t

Although Medigap plans are standardized, Medigap rates are not standardized, and they vary widely between insurance carriers. For example, in the 92009 zip code in San Diego, for a 72 year old male, Plan G rates range from $165.78 per month to $223.47 per month. That’s a difference of $57.69 per month or $692.28 per year for the same identical plan and coverage!

Medigap rates are based primarily on your age and zip code, and whether you use tobacco or not. In California, rates usually increase every year as we get older. An insurance carrier that has competitive rates this year may increase rates and not be as competitive next year. For this reason, it is very important to take advantage of the California Birthday Rule and shop around every year to make sure that you aren’t paying too much money for your Medigap insurance premiums.

This is a free service that I provide to all of my California clients every year around their birthday.

NOTE: You can change your Medigap plan or insurance carrier any time of the year, but if you do so other than around your birthday, you will have to answer health questions on the application, and your application will be medically underwritten, and you could be turned down for coverage. If you have a serious health condition, you should definitely take advantage of the California Birthday Rule and apply around your birthday. That way, you cannot be turned down for coverage, REGARDLESS OF YOUR HEALTH.

Innovative Medigap Plans Are Also Changing On July 1st

There is another significant change that will be occurring beginning on July 1st under Senate Bill No. 407. Several insurance carriers have recently introduced new “Innovative” Medigap plans that are the same as the standardized plans, but they also include some additional non-medical coverage for such things as hearing and vision.

For example, Blue Shield of California replaced their “standardized” Plan F with a different plan called “Plan F Extra.” Anthem Blue Cross offers two different Plan F Medigap plans, Plan F and “Plan F Innovative,” which also includes some additional coverage for vision and hearing. And Health Net now offers two different Plan F supplements as well, Plan F and “Plan F Innovative.” Blue Shield currently offers two Plan G Medigap plan, Plan G and “Plan G Extra,” and Health Net offers Plan G and and a “Plan G Innovative” plan as well.

As you can see, the recent introduction to these newer innovative plans has made the Medigap marketplace confusing and defeated the purpose of having standardized Medigap plans. It is no longer so easy to compare Medigap plans and benefits because the “extra” and “innovative” benefits are all similar yet slightly different from each other.

The real problem however, is that when someone wants to take advantage of their open enrollment period under the California Birthday Rule, Blue Shield and Anthem Blue Cross do not allow someone with a “regular” Plan F or Plan G to switch to one of their “Extra” or “Innovative” plans. Both of these companies claim that their innovative plans have “richer” benefits, and they do not qualify under the California Birthday Rule.

Furthermore, Blue Shield no longer offers their “regular” Plan F, only their Plan F Extra, so this has prevented anyone with Plan F with a different insurance carrier to switch to Blue Shield’s Plan F during their annual open enrollment period under the birthday rule. And you would think that someone with Blue Shield’s Plan F Extra could switch to Anthem’s Plan F Innovative plan under the California Rule or vice versa around their birthday, but no. Neither carrier will accept these plans during someone’s 30 day open enrollment period because they consider their plans superior to the other carrier’s plan.

NOTE: Health Net has always allowed someone with the “regular” Plan F or Plan G to switch to their Plan F Innovative or Plan G Innovative plans.

As of July 1st, 2020, Blue Shield of California, Anthem Blue Cross, and all insurance carriers are now required to accept any Plan F or Plan G Medigap plans for any of their innovative Medigap plans under the California Birthday Rule! For example, if you have Plan F with Mutual of Omaha, you can now switch to Blue Shield’s Plan F Extra or Anthem’s Plan F Innovative plan under the birthday rule.

Which is Better, Plan F or Plan G?

Many people with Plan F have switched to Plan G because both plans are identical except Plan F covers the Medicare Part B deductible, which is currently $198 per calendar year, and Plan G does not cover the Part B deductible. Other than that, both plans are identical in coverage.

NOTE: The Medicare Part B deductible can change from year to year, but historically, it has never increased significantly.

Since the only difference between Plan F and Plan G is the $198 Medicare Part B deductible, if you can save more than $198 per year on your premiums by switching from Plan F to Plan G, then Plan G ends up being more cost effective.

If you are saving exactly $198 per year, you are breaking even, and you’re better off staying with Plan F. If you are saving $300 or more per year by switching, it will definitely cost you less money by switching from Plan F to Plan G.

NOTE: If you decide to switch from Plan F to Plan G, and you have already met the $198 Medicare Part B deductible for the current year, you would not have to pay that deductible again until the following year.

Conclusion

As of July 1st, 2020, your annual open enrollment period under the California Birthday Rule is increasing from 30 to 60 days after your birthday. Most carriers will let you apply for coverage during the 30 days prior to your birthday, but the effective date of your new policy would normally be the 1st of the month following your birthday. And if you have Plan F or Plan G with another insurance carrier and you want to switch to an “Innovative” plan under the birthday rule with Blue Shield of CA, Anthem Blue Cross, Health Net, etc., you can now do so.

Since rates vary significantly between insurance carriers for the same identical plan and coverage, it is important to shop around, EVERY YEAR, to make sure that you aren’t paying too much.

As an independent insurance agent specializing in Medicare Supplement (Medigap) insurance, I work with all the major insurance carriers in California and several other states. If you have any questions or if you would like for me to shop around for you to save you money on your Medicare Supplement insurance, please don’t hesitate to let me know.

Ron Lewis

CA Lic# 0B33674

760.525.5769 (Cell)

760.718.1600 (Toll-free)

Ron@RonLewisInsurance.com

www.MedigapExpress.com

Thanks for the info, Ron. We’ll read it a couple times to “digest” and if questions,

will contact you.

All our best,

Eloise and Carlos Huerta