If you are turning 65 or you are new to Medicare, it can be very confusing trying to figure out which Medicare Supplement plan (aka Medigap plan) is right for you. The purpose of this article is to answer your questions and to make the Medicare transition easier for you and a lot less stressful!

10 Standardized Medicare Supplement Plans To Choose From

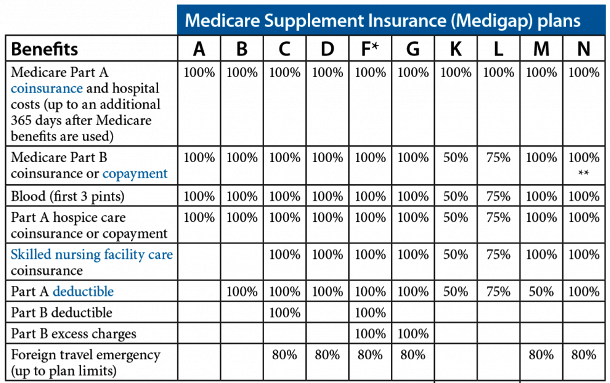

Nationwide, there are 10 standardized Medigap plans to choose from, Plan A through Plan N. The term “standardized” means that the coverage and benefits for every Medigap plan are identical regardless of what carrier you sign up with. For example, Plan G is Plan G, Plan N is Plan N, Plan F is Plan F, etc.

Medigap Plans Are Standardized But Premiums Are Not Standardized

While the coverage and benefits for each of these plans are standardized, the monthly premiums are not standardized, and prices vary significantly between insurance carriers for the same identical plan and coverage. Other factors can affect the premiums such as your age, zip code, marital status, whether you use tobacco products, etc.

For example, in the 92024 zip code (Encinitas, CA), the Plan G rates for a 70 year old female range from $152 per month to $262 per month, which is a difference of $110 per month or $1,320 per year for the same identical plan and coverage! In California, rates usually go up every year as we get older. For this reason, it’s important to shop around every year to make sure you aren’t paying more than you should be! I periodically stay in touch with my clients, and I shop around for them every year around their birthday.

IMPORTANT: As an independent insurance agent, I work with the major insurance carriers, not one particular company. If you or someone you know has a Medigap plan, I’m happy to shop around for you, and there is no charge for my service!

The California Birthday Rule

In California, we have a law called the California Birthday Rule. This law applies to all California residents who already have a Medigap policy.

Under the birthday rule, you have an annual 90-day open enrollment period that begins 30 days before your birthday and ends 60 days after your birthday. During this period, you can switch to any other Medigap policy that has “equal or fewer” benefits.

For example, if you have Plan G with Carrier A, you can switch to Plan G with Carrier B, regardless of your health and without answering any health questions. There is no medical underwriting and you cannot be turned down for coverage! If you have Plan G, you can also switch to Plan N because Plan N has fewer benefits than Plan G.

If you have Plan N, you can switch to Plan N with another carrier, but you cannot switch to Plan G because Plan G has more benefits than Plan N, etc.

NOTE: You can change your Medigap plan any time of the year, but if you do so outside of your 90-day annual open enrollment period under the California Birthday Rule, you will have to answer health questions and be medically underwritten, and you can be turned down for certain health conditions.

The Three Best Medicare Supplement Plans

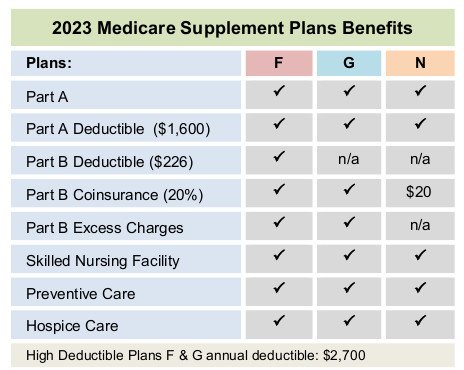

Although there are 10 standardized Medigap plans to choose from, Plan F, Plan G, and Plan N are the three best and most popular plans.

As you can see from the chart, Plan F provides the most comprehensive coverage. Plan G is identical to Plan F except it does not cover the Medicare Part B deductible. Plan N also does not cover the Part B deductible and there are co-payments for doctor visits, emergency room visits, and it does not cover Part B excess charges. Please continue reading for more detailed information.

Plan G Medicare Supplement

For those who are turning 65 on or after January 1st, 2020, Plan G is the best plan today because your only out-of-pocket (OOP) expense is the Medicare Part B deductible, which is currently $226 for all of 2023.

NOTE: That small deductible can change from year to year, but historically, it hasn’t changed significantly. In fact, the Part B deductible decreased from $233 in 2022 to $226 in 2023.

The Part B deductible zeros out every January and starts all over again. Once you meet that small annual deductible, you won’t have any other OOP costs for the remainder of the calendar for any Medicare-approved doctors visits, surgeries, hospitalizations, etc.

Plan F Medicare Supplement

Prior to January 1st, 2020, Plan F was considered to be the best Medicare Supplement plan because there were no deductibles, co-payments, or OOP costs. The only difference between Plan F and Plan G is the Medicare Part B deductible. Plan F pays for that small deductible, and Plan G doesn’t. That is the only difference between the two plans!

NOTE: For those individuals that had Plan F prior to January 1st, 2020, they can still keep their plan and switch to Plan F with other insurance carriers if they want, but Plan F isn’t available for individuals who started Medicare on or after January 1st 2020 because of the Medicare Access and CHIP Reauthorization Act (MACRA) of 2015.

Although Plan F covers the Medicare Part B deductible and Plan G doesn’t, the premiums for Plan F are significantly more than the premiums for Plan G, which is why most people with Plan F have switched to Plan G.

Most People With Plan F Have Switched to Plan G

Most people who had Plan F have switched to Plan G because in most cases, the premiums for Plan G are significantly less, and even if you have to pay the $226 Part B deductible, you still end up saving money by switching to Plan G!

For example, if someone has Plan F and their premium is $250 per month and they can get Plan G for $180 per month, that’s a gross savings of $70 per month or $840 per year! If you subtract the $226 Medicare Part B deductible, that’s still a net savings of $614 per year!

NOTE: If you have Plan F and you want to switch to Plan G, if you have already met your $226 Medicare Part B deductible for this year, you would not have to pay it again until the following year since the Part B deductible is payable only one time per calendar year.

Medicare Supplement Plan N

Plan N isn’t as popular as Plan G because there are more OOP costs, but the premiums are usually a little lower, but not significantly lower than the Plan G premiums. If you are in relatively good health and rarely go to the doctor, you may want to consider Plan N if you want lower monthly premiums and you are willing to incur more OOP costs. However, Plan G is a better option if you’re willing to pay slightly higher premiums for much better coverage than Plan N.

NOTE: If you are not in the best of health and you go to the doctor often, Plan N is not a good choice as you are required to pay co-payments for every office visit, and with all those payments, Plan G would normally be more cost effective.

With Plan N, you are responsible for paying the annual $226 Medicare Part B deductible (like you are with Plan G). You must also pay co-payments of up to $20 per doctor visit and co-payments of up to $50 for emergency room visits. However, if you are admitted to the hospital, the emergency room co-payment is waived.

Another difference between Plan N and Plan G is that Plan G covers the Medicare Part B “excess charges” and Plan N doesn’t. If your doctor doesn’t accept “Assignment” (the amount Medicare agrees to pay for a service), they may charge you up to an additional 15% of the bill. This fee is known as an excess charge.

Between Plan N and Plan G, I would recommend Plan G if the premiums aren’t significantly different and it’s not a financial burden to pay the Plan G premiums.

About Me

I hope that you have found this information to be interesting and informative. I’m an independent insurance agent with over 15 years of experience specializing in Medicare Supplement insurance, primarily in California.

As an independent agent, I work with the major insurance carriers including Mutual of Omaha, Cigna, Blue Shield of CA, Anthem Blue Cross, Health Net, Aetna, etc. I have hundreds of clients, and I shop around for them every year around their birthday to find them the best Medigap rates. Please click here to see some of my client testimonials.

If you have any questions, please don’t hesitate to contact me. If you have any friends that are turning 65 or that have Medicare Supplements, I’m happy to shop around for them, and there is no charge for my service!!! Also, please feel free to forward this blog on to anyone who may be interested!

Thank you!

Ron Lewis

CA agent #0B33674

NV agent #3822123

Ron@RonLewisInsurance.com

866.718.1600 (Toll-free)

760.525.5769 (Cell)

www.MedigapShopper.com

Hi Ron,

my mutual of ohama plan G just went up to $202.85. Anything cheaper or better? Also I belong to the YMCA, 92024 zip code. Is there a plan rolling my YMCA membership dues into my supplement?

Hi Robert. Rates are based primarily on your age, zip code, and if you live alone or with someone for at least the last 12 months. You can change Medigap plans any time of the year, but it’s easier to do so around your birthday under the California Birthday Rule. If you apply then, you don’t have to answer any health questions and you can’t be turned down for coverage. If you can let me know your birth date and if you live alone or with someone, I can let you know the best Plan G rate that I’m seeing. I’m assuming you live in the 92024 zip code? Thanks… ~Ron