In several months from now, a good friend of mine will be turning 65 years old. While he is not anxious to get any older than he already is, he is happy about one thing… he will be getting off of Obamacare and onto Medicare!

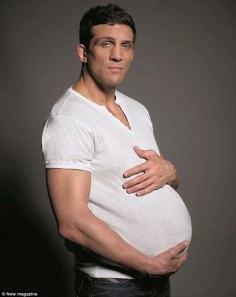

My friend used to have a really good, low-deductible health insurance plan that was very affordable. But under Obamacare, all of that changed. The quality of his health insurance decreased significantly while his Affordable Care Act (ACA) premiums, co-payments, and deductibles increased dramatically. But fortunately, he now has maternity coverage, which is something that he never had before! Sorry about the sarcasm!

When he goes onto Medicare, it will be just the opposite; the quality of his health insurance will increase significantly while the cost of his premiums, co-payments, co-insurance, and deductibles will all decrease!

Current Coverage

For example, he currently has a Bronze 60 ACA plan. The annual deductible is $4,800 per calendar year if he goes to “participating” providers and $9,000 per calendar year if he goes to “non-participating” providers! According to his health plan, “You must pay all the costs up to the deductible amount before this plan begins to pay for covered services you use. The integrated deductible applies to both medical and pharmacy services.” Therefore, the deductibles apply to prescription drug coverage as well.

Once the deductible is met, my friend must pay 40% of the remaining costs until he has reached the maximum out-of-pocket (OOP) cost, which is $6,550 per calendar year for “participating” providers and $9,650 per calendar year for “non-participating” providers.

NOTE: According to his current health insurance plan, OOP costs do not include “Premiums, balance-billed charges, some co-payments, charges in excess of specified benefit maximums, and health care this plan doesn’t cover.” So, total OOP costs are really much higher than $6,550 or $9,650 per calendar year when you factor in premiums and other miscellaneous costs.

The deductible and OOP costs start all over again every January. If he got really sick in the last six months of the year, there is a real possibility that he could reach his maximum OOP costs of $6,550 (or $9,650) again in the first six months of the following year. That means that he could potentially have total OOP costs in excess of $13,100 to $19,300 in a twelve-month period, not including his premiums!

My friend has a subsidized plan through Covered California. Although he pays $268.52 per month for his Bronze 60 PPO plan, the full premium that others are paying for the same identical (non-subsidized) plan is $784.79 per month, which isn’t exactly cheap for a high-deductible, catastrophic plan! I’m pretty sure you can buy or lease a luxury automobile for a lot less than that!

Medicare Coverage

In contrast, he won’t have to pay anything for his Medicare Part A (Hospital) insurance, and he will pay $134.00 per month for his Medicare Part B (Medical) insurance. In addition to his Original Medicare, he will need to take out a Medicare Supplement plan to pick up the difference in co-payments, deductibles, and co-insurance that Medicare does not pay.

Medicare Supplement Coverage

Of the 10 standardized Medicare Supplement plans (aka Medigap plans because they pick up the “gaps” in coverage that are not covered by Medicare), Plan F and Plan G are the two best plans:

- Plan F pays for ALL of the co-payments, deductibles, and co-insurance that is not covered by Medicare. With Plan F, there are NO DEDUCTIBLES OR OUT-OF-POCKET COSTS!

- Plan G is identical to Plan F except for the $183 per calendar year deductible for outpatient treatment such as physician services, inpatient and outpatient medical and surgical services and supplies, physical and speech therapy, diagnostic tests, and durable medical equipment.

NOTE: In 2017, the Part B deductible is $183 per calendar year. This amount can change from year to year, but historically, it has been very stable. With Plan G, once you have met the $183 per calendar year deductible, there are no other out of pocket costs, and Plan G is exactly the same as Plan F. The monthly premiums for Plan G are usually significantly less than the monthly premiums for Plan F, so Plan G usually ends up being more cost effective than Plan F.

For this reason, many people with Plan F have been switching to Plan G. Also, beginning on January 1st, 2020, Plan F will no longer be available for new people who are turning 65.

Although my friend’s ACA health plan is a PPO, he is still restricted to doctors, specialists, hospitals, care facilities, etc. that are within his health plan’s network. If he goes out of the network or goes to “non-participating” providers, he pays even more!

With Original Medicare and Medicare Supplements, there are no networks, HMO’s, or PPO’s, so my friend will have much more freedom of choice than he presently has with his ACA plan.

With a Medicare Supplement plan, you can go to ANY doctor, specialist, care facility, or hospital in the United States, as long as they accept Medicare! If you later move to another state, you can keep your Medicare Supplement plan and use it ANYWHERE in the US!

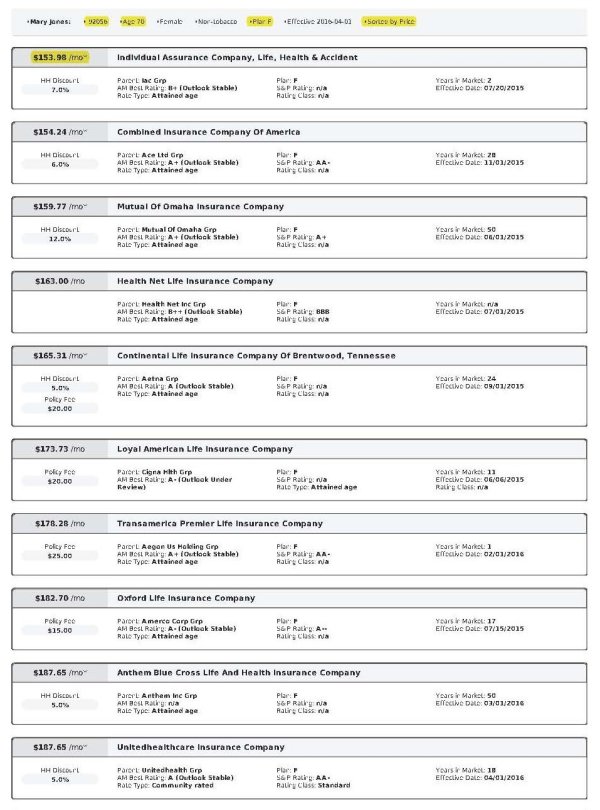

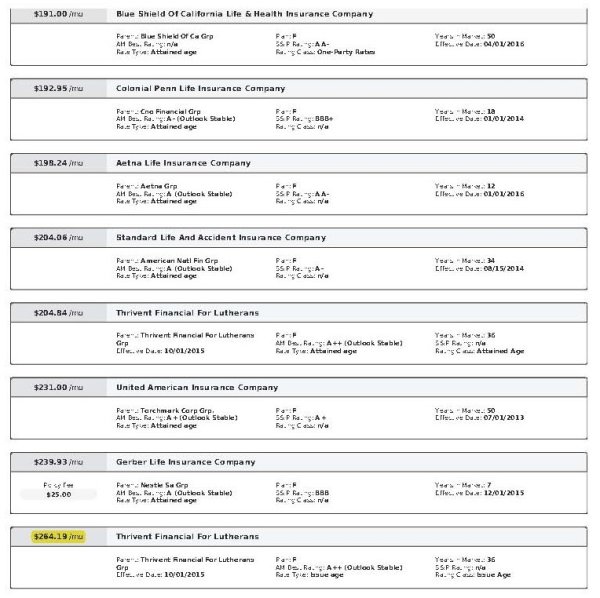

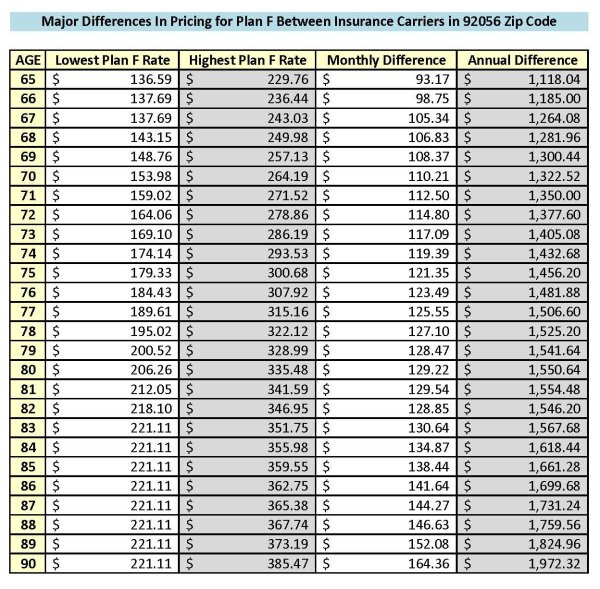

Medicare Supplement Premiums

In California, Medicare Supplement rates are based primarily on your age and zip code. If my friend decides to splurge and go with Plan F (the “Cadillac” plan) he will have a $0 deductible and no out-of-pocket costs! For age 65, his monthly premium will be as low as $132.00 per month!

Rates can vary significantly between insurance carriers for the same identical plan and coverage, so it’s important to shop around every year!

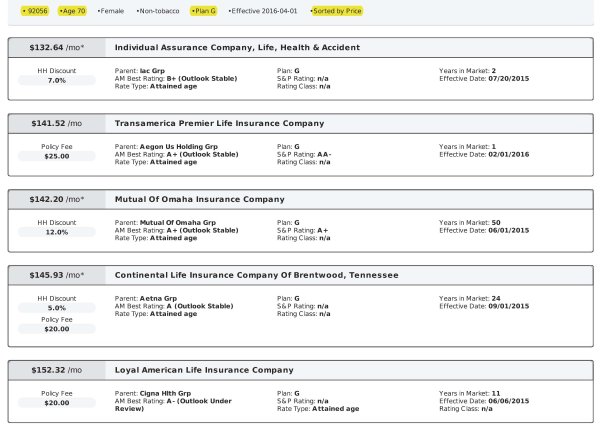

If my friend wants to save money on his Medicare Supplement premiums by signing up with Plan G, his maximum calendar year deductible AND out-of-pocket costs combined will be $183 per calendar year, and his monthly premium will be as low as $119.36 per month!

Scenario #1 – Total Costs if My Friend Signs up with Plan F

If he decides to sign up with Plan F, the most expensive Medicare Supplement plan, his total monthly premiums for his Medicare Part A ($0), Medicare Part B ($134.00), and his Plan F Medicare Supplement ($132.00) will be $266.00 per month!

NOTE: If he wants to, my friend can also pick up a good Prescription Drug Plan (PDP) for $17.00 per month.

Scenario #2 – Total Costs if My Friend Signs up with Plan G

If he decides to sign up with Plan G, the most popular Medicare Supplement plan, his total monthly premiums for his Medicare Part A ($0), Medicare Part B ($134.00) and his Plan G Medicare Supplement ($119.36) will be $253.36 per month!

Conclusion

My friend is currently paying $268.52 per month for a high-deductible, catastrophic ACA health insurance plan that is basically worthless.

If he decides to sign up for a Plan F Medicare Supplement with no deductibles or out-of-pocket costs, his total cost for coverage under Medicare and his Medicare Supplement will be $266.00 per month!

If he decides to sign up for a Plan G Medicare Supplement with a $183 per calendar year deductible and no out-of-pocket costs, his total cost for coverage under Medicare and his Medicare Supplement will be $253.36 per month!

And now you know why my friend is smiling about his upcoming 65th birthday…

“Hello Medicare, and good riddance Obamacare!”

*****************************************************

Let me do the shopping for you and save you money on your Medicare Supplement! Contact me today for a for a free insurance quote and price comparison!

Ron Lewis

www.MedigapExpress.com

Ron@RonLewisInsurance.com

866.718.1600 (Toll-free)

Congress passed this legislation to ensure that doctors would be paid adequately for providing Medicare services and to provide an incentive for doctors to continue accepting Medicare patients. Previous legislation had budgeted for doctors to have rate decreases over the years and there was concern that many doctors would stop accepting Medicare patients.

Congress passed this legislation to ensure that doctors would be paid adequately for providing Medicare services and to provide an incentive for doctors to continue accepting Medicare patients. Previous legislation had budgeted for doctors to have rate decreases over the years and there was concern that many doctors would stop accepting Medicare patients.