There has been a lot of confusion about when to sign up for a Medicare Part D Prescription Drug Plan (PDP) and how to avoid a lifetime Late Enrollment Penalty (LEP). There are a couple of different scenarios such as when you first turn 65 and sign up for Medicare or if you are coming off of an employer plan and starting Medicare Part B later on.

Turning 65 and Starting Medicare Part A and Part B

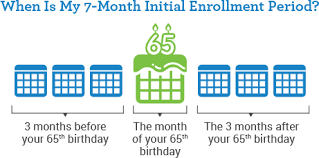

When you are turning 65, you can sign up for Medicare Part A (Hospital insurance) and Part B (Medical insurance) during your Initial Enrollment Period (IEP). The IEP is a seven-month open enrollment period that begins three months before the month that you turn 65, the month that you turn 65, and the three months after the month that you turn 65.

Your Medicare benefits normally begin on the 1st of the month that you turn 65. If your birthday is on the first of the month, your Medicare benefits will begin on the 1st of the previous month. For example, if you will be turning 65 on July 21st, the beginning of your IEP will begin three months earlier on April 1st, and it will go through October 31st. The Part A and Part B effective dates would both begin on July 1st. If your birthday is July 1st, your Part A and Part B effective dates will normally begin on June 1st.

If you don’t sign up for a prescription drug plan (PDP) during your seven-month IEP, a lifetime penalty will be added onto your monthly drug plan premiums if you sign up for a PDP later on.

IMPORTANT: To avoid the Part D penalty, you must sign up for a prescription drug plan within 63 days of your Medicare Part B effective date!

What Happens if I Stay On My Employer’s Health Insurance Plan?

Some people continue working after they turn 65, and they stay on their employer’s health insurance plan. If you or your spouse have “creditable” coverage through an employer and are eligible for Medicare, you won’t receive a penalty if you postpone your Medicare enrollment.

What is Creditable Coverage?

If you have health insurance through a large employer, it will qualify as creditable coverage if it covers as much as or more than original Medicare (Part A and Part B). It also refers to prescription drug benefits that cover as much as or more than Medicare Part D. Medicare defines a “large employer” as any company that has 20 or more full-time employees. You may be covered through your own large employer or through your spouse’s large employer. To make sure you qualify and to avoid any unpleasant surprises, I would recommend calling Social Security at 800.772.1213 to verify.

If you have creditable coverage and are eligible for Medicare, you won’t receive a penalty if you postpone your Medicare enrollment. Even if you can postpone your Medicare enrollment, most people still enroll in Part A (Hospital insurance), since it’s typically premium-free, and it may reduce hospitalization costs.

NOTE: For most people, the Part B monthly premium is $170.10 per month. It can be more for higher-income individuals.

How Much is the Part D Late Enrollment Penalty?

The lifetime monthly penalty is approximately $0.33 per month for every month you could have had a PDP after you started Medicare but didn’t. To use round numbers, if you went 10 months without a PDP and then decided to get one, the penalty would be $0.33 x 10 months = $3.30 penalty. If the regular monthly premium for the PDP is $10.00, you would pay $13.30 per month. Again, this is a lifetime penalty. If you change to a different PDP later on, you will still have to pay the penalty.

NOTE: Once you have a PDP, you can change it during the Annual Election Period (AEP), which is from October 15th through December 7th every year. The new coverage won’t go into effect until January 1st of the following year.

Do I Need a PDP if I Don’t Take Prescriptions?

This year, the cheapest premium for a PDP is $7.50 per month with SilverScript SmartRx. Signing up for a PDP is not required, but since there is a lifetime penalty if you decide to sign up later on, if it’s affordable and not a financial burden, I would normally recommend signing up for the cheapest PDP to avoid a future lifetime penalty. However, that’s a personal decision everyone has to make.

Once you come off of a creditable employer health plan, you must sign up for a prescription drug plan within 63 days of your Medicare Part B effective date to avoid the Medicare Part D late enrollment penalty.

Conclusion

To avoid the Medicare prescription drug plan (Part D) late enrollment penalty, you must sign up for a prescription drug plan within 63 days of your Part B effective date.

I’m an independent insurance agent with over 15 years of experience. My primary focus is with Medicare Supplement insurance. I work with most of the major insurance carriers throughout the state of California. Rates vary significantly between insurance carriers for the same identical plans and coverage. If you have any Medicare Supplement questions or comments or if you would like for me to shop around for you to find a better rate, my contact information is below. Please click here to see some references and testimonials.

Ron Lewis

CA License: 0B33674

www.MedigapShopper.com

Ron@RonLewisInsurance.com

760.525.5769