Scripps Will No Longer Accept Medicare Advantage HMO Plans In 2024

Scripps recently began notifying about 32,000 Medicare beneficiaries that beginning on January 1st, 2024, the Scripps Clinic and Scripps Coastal medical groups will no longer accept Medicare Advantage (MA) HMO plans from carriers such as Anthem Blue Cross, Blue Shield of California, Health Net, UnitedHealthcare (UHc), etc. However, doctors from Scripps Clinic and Scripps Coastal will continue to accept Original Medicare Part A (Hospital insurance) and Part B (Medical insurance) as well as Medicare Supplement insurance, aka Medigap.

NOTE: Although Scripps will no longer accept MA HMO plans, I called and asked if they will accept MA PPO plans. I was told that individuals with MA PPO plans can still go to Scripps and see their doctors with those plans, BUT they will be billed as “out of network” instead of “in network” meaning that those individuals could have very high out-of-pocket costs if they continue going to Scripps with MA PPO plans.

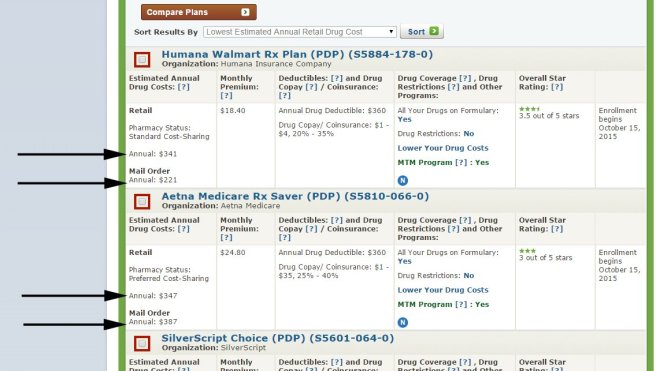

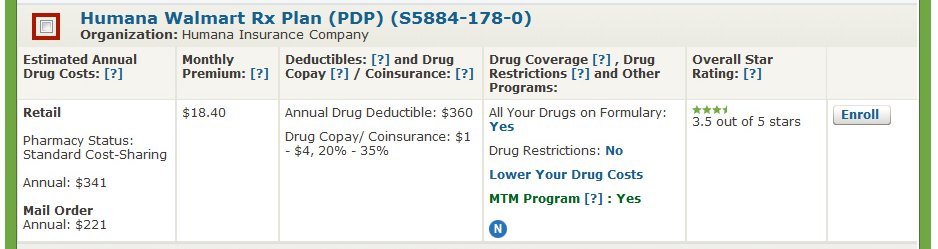

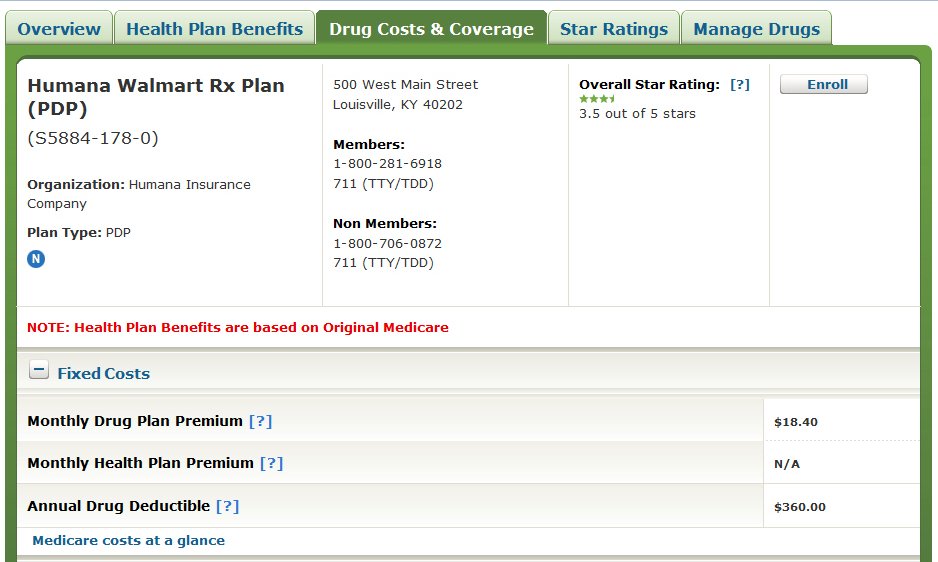

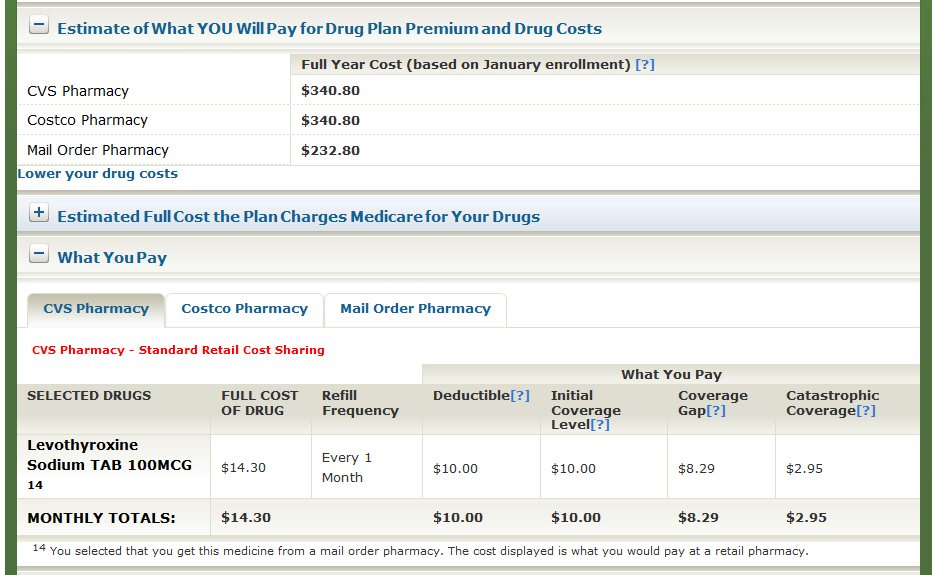

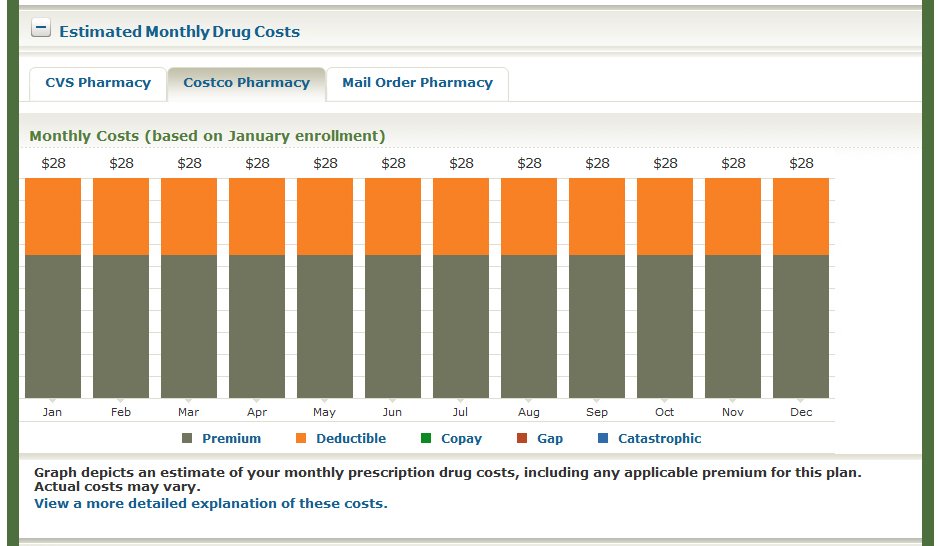

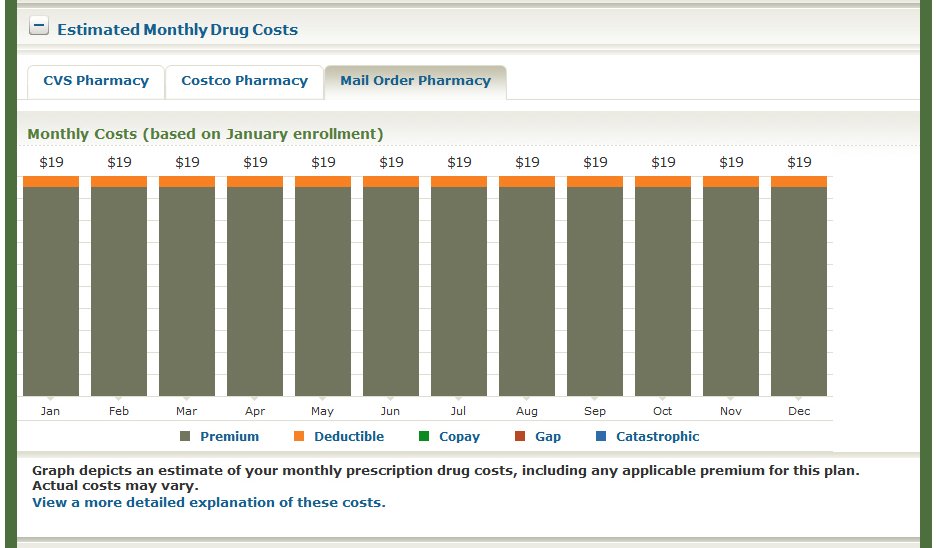

If you have to pay out-of-network costs for your MA PPO plan, they are very expensive. In the 92024 zip code, there are 66 MA plans offered in 2024. Of those plans, 56 are HMO’s, and 10 are PPO’s, which are shown below. As you can see, the in-network and out-of-network costs are very expensive for all of the MA PPO plans.

In and Out of Network Costs for 2024 MA PPO Plans Offered In the 92024 (Encinitas) Zip Code:

AARP Medicare Advantage from UHC CA-0035 (PPO)

$9,550 In and Out-of-network

$4,500 In-network

Aetna Medicare Choice Plan (PPO)

$8,950 In and Out-of-network

$5,500 In-network

Aetna Medicare Core Plan (PPO)

$8,900 In and Out-of-network

$3,900 In-network

Aetna Medicare Eagle Plus Plan (PPO)

$9,500 In and Out-of-network

$6,700 In-network

Alignment Health AVA (PPO)

$8,950 In and Out-of-network

$3,900 In-network

Blue Shield Select (PPO)

$8,950 In and Out-of-network

$4,200 In-network

Humana USAA Honor (PPO)

$9,550 In and Out-of-network

$5,900 In-network

Humana USAA Honor with Rx (PPO)

$9,050 In and Out-of-network

$6,100 In-network

HumanaChoice H5525-076 (PPO)

$7,000 In and Out-of-network

$3,900 In-network

HumanaChoice H5525-077 (PPO)

$8,900 In and Out-of-network

$5,900 In-network

If you get seriously sick with one of these MA PPO plans, you can still end up with very high out-of-pocket costs, even if you stay in-network!

The Problem

More than half of the nation’s seniors have MA plans, but many hospitals and care facilities throughout the country are dropping MA plans altogether. Some of the most common reasons are because of excessive prior authorization denial rates and slow payments from insurers. Also, some MA insurers have faced allegations of billing fraud from the federal government, and they are being investigated by lawmakers over their high denial rates. Please click here to read “Kaiser Permanente Sued By Federal Government Over Alleged Medicare Fraud.”

According to Chris Van Gorder, president and CEO of Scripps Health, “It’s become a game of delay, deny and not pay. The health system is facing a loss of $75 million this year on the MA contracts, which will end Dec. 31 for patients covered by UnitedHealthcare, Anthem Blue Cross, Blue Shield of California, Centene’s Health Net and a few more smaller carriers. If other organizations are experiencing what we are, it’s going to be a short period of time before they start floundering or they get out of Medicare Advantage. I think we will see this trend continue and accelerate unless something changes.” For more information, please click here to read “Hospitals are dropping Medicare Advantage left and right” by Jakob Emerson.

Scripps Health released a statement explaining the reason for their decision. “Scripps has long served seniors and others in our community who are enrolled in Medicare and Medicare Advantage plans. Scripps and health systems across the country are facing unprecedented financial pressures. We are looking at all we do and, when necessary, making difficult decisions to ensure that we can continue to meet the needs of the community we serve. The revenue from Medicare Advantage plans is not sufficient to cover the cost of the patient care we provide.”

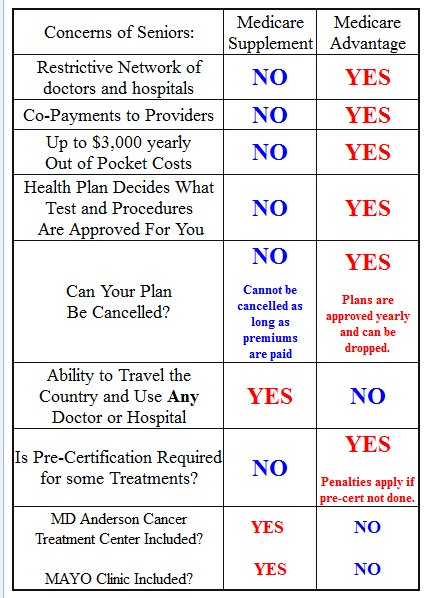

Understandably, many Scripps’ patients with MA plans are upset and panicking. If they keep their MA plans, they will no longer be able to keep the the same doctors and specialists they have been going to at Scripps, and they will have to go somewhere else and find new doctors. For those who are undergoing serious procedures such as cancer treatment, etc., this is not a viable option.

Scripps’ Patients Have Three Choices

If you are a Scripps patient with an MA plan, you have three choices for 2024:

- You can keep your MA HMO plan (or switch to a different MA HMO plan), but if you do, you will not be able to go to Scripps Clinic or Scripps Coastal in 2024, and you must find new doctors.

- You can keep your MA PPO plan (or switch from a MA HMO to a MA PPO plan, and continue going to Scripps and seeing your regular doctors, but you will incur very high out-of-pocket in-network and out-of-network costs.

- The third and best option, in my opinion, is to switch back to Original Medicare (Part A and Part B) and get a Medicare Supplement plan.

With the third option, you can continue going to Scripps in 2024 and you can still go to the same doctors, specialists, etc. that you have been going to in the past. For those who are undergoing any serious medical procedures, such as cancer treatment, etc., you will continue in January 2024 with no changes or interruption in service or treatment.

When To Make These Changes

The time to make any of these changes is during the upcoming Annual Enrollment Period (AEP), which begins on October 15th and ends on December 7th every year.

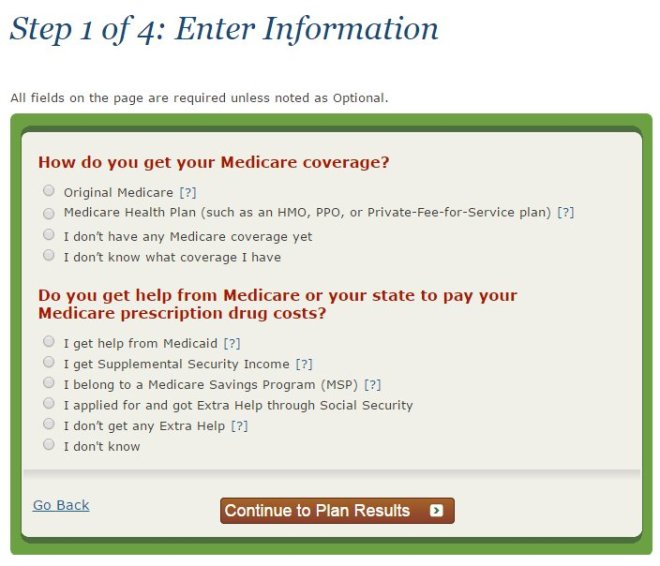

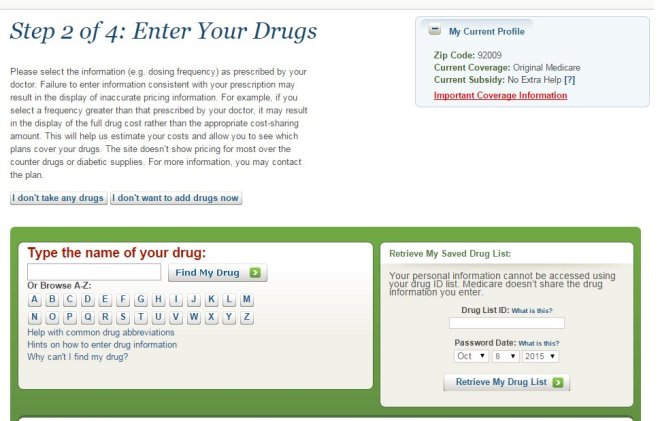

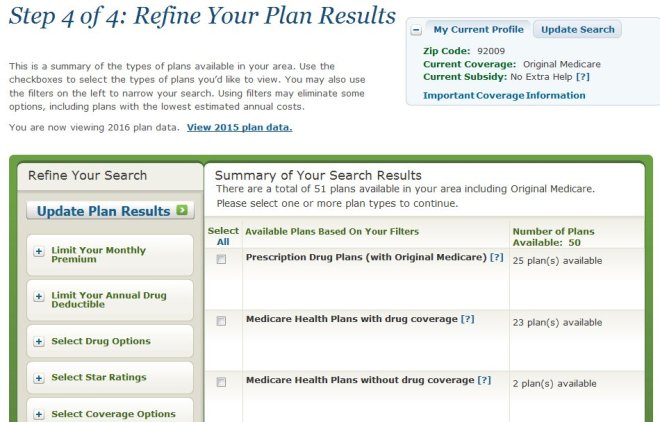

If you want to keep your current MA plan, you don’t have to do anything (as long as it is still being offered in 2024). If you have an MA plan and want to switch to a different MA plan, you must do so during the AEP. You can also apply for or change your Prescription Drug Plan (PDP) or switch back to Original Medicare (Part A and Part B) during the AEP.

NOTE: If you have a Medicare Supplement, the AEP does NOT apply to you unless you want to enroll in or change your PDP. You can change your Medicare Supplement any time of the year.

The Solution

If you would like to continue seeing your doctors at Scripps in 2024, your only option is to drop your MA plan, switch back to Original Medicare, and get a Medicare Supplement. Normally, when you switch from an MA plan to a Medicare Supplement, you must answer health questions and go through medical underwriting. If you have a serious health condition such as cancer, etc., you will not be approved for coverage.

And Now For The Good News!

For all Scripps’ patients that have any kind of a Medicare Advantage plan (HMO or PPO), you can get a Medicare Supplement beginning on 1/1/24 to replace your MA plan REGARDLESS OF YOUR HEALTH! Because of this current situation with Scripps, you will be in a “Guaranteed Issue” situation meaning that you can get the best Medicare Supplement plan available, Plan G, without answering any health questions or being medically underwritten! As a Guaranteed Issue, YOU CANNOT BE TURNED DOWN FOR COVERAGE!

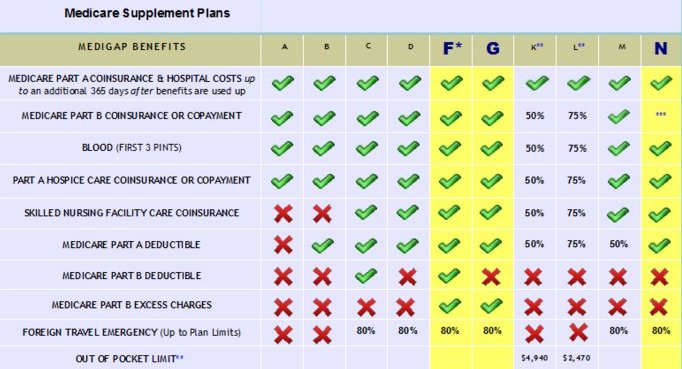

NOTE: With a Plan G Medicare Supplement, your only out-of-pocket cost for the entire calendar year is the Medicare Part B deductible, which will be $240 for all of 2024!

For example, with a Plan G Medicare Supplement, if you have multiple doctor visits, a couple of surgeries, and a hospital confinement in 2024, all you would pay is the $240 Part B deductible and that’s all! That’s a lot better and cheaper than the in-network and out-of-network maximums with MA plans!

Plus, with a Medicare Supplement, you can go to any doctor, specialist, care facility, hospital, etc. ANYWHERE in the US as long as they accept Medicare, and most do, about 93%. If you want to see a specialist, you can go directly to any specialist you want, anywhere in the country. With an MA plan, you must go to your primary care doctor first and get permission to see a specialist that’s in your local network, etc. You have much more freedom of choice with a Medicare Supplement than you do with an MA plan.

Other Guaranteed Issue Situations

There are other Guaranteed Issue situations that will qualify anyone with an MA plan to be able to bypass underwriting and get a Medicare Supplement as a guaranteed issue, REGARDLESS OF THEIR HEALTH. Regardless of your situation with Scripps, everyone with an MA plan should have received their Annual Notice of Change (ANOC) by now. The ANOC is a notice you receive from your Medicare Advantage or Prescription Drug Plan (PDP) every year in late September. The ANOC provides a summary of any changes in the plan’s costs and coverage that will take effect on January 1st of the following year.

If your MA plan did any of the following, you are in a guaranteed issue situation, which will allow you to get a Medicare Supplement, regardless of your health:

- If your MA plan increased your premium or co-payments by 15% or more from this year to next year.

- If your MA plan reduced any of your benefits next year from what they are this year.

- If your MA plan terminated its relationship with your medical provider or the certification of the organization or plan has been terminated, such as Scripps.

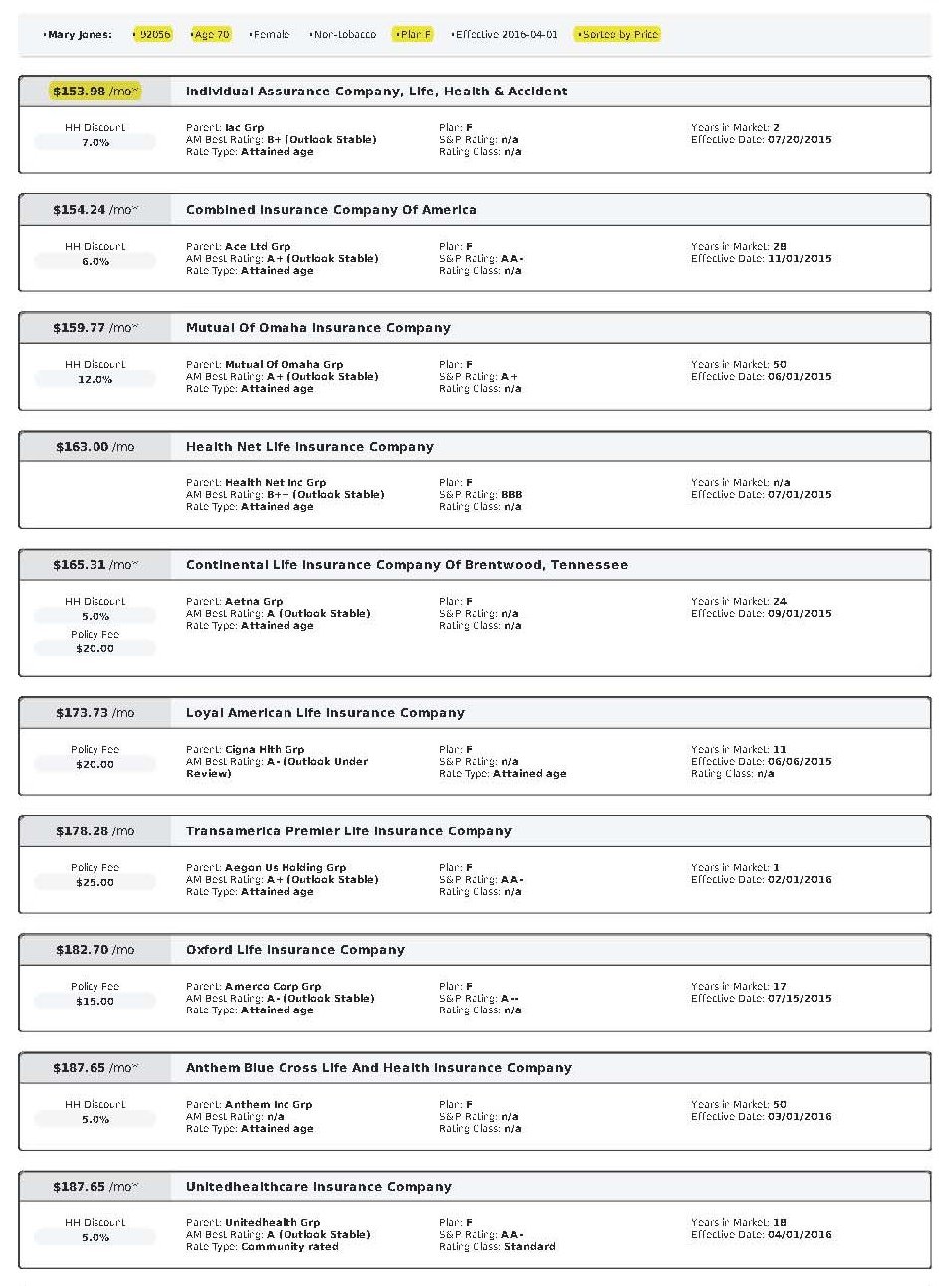

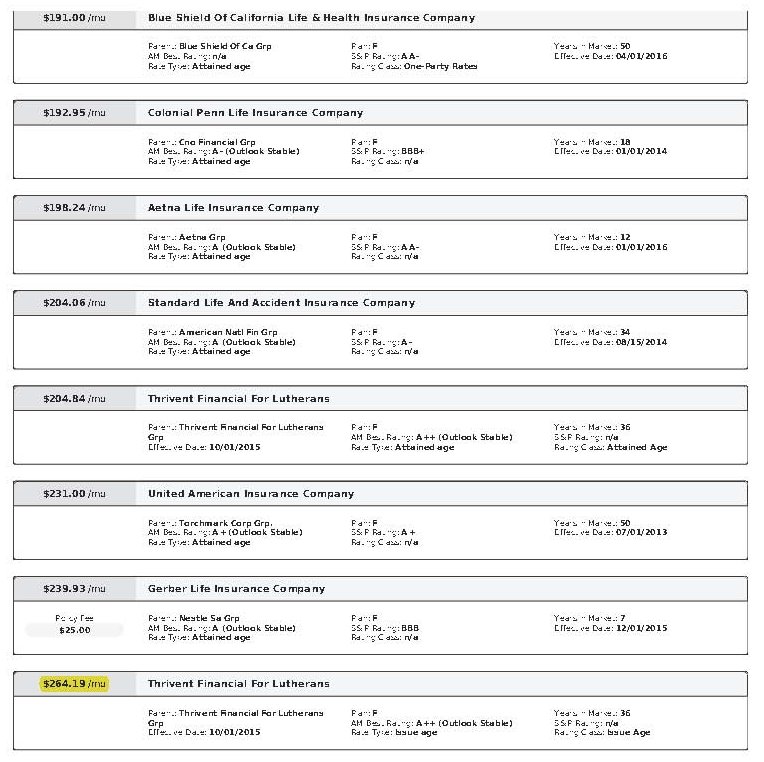

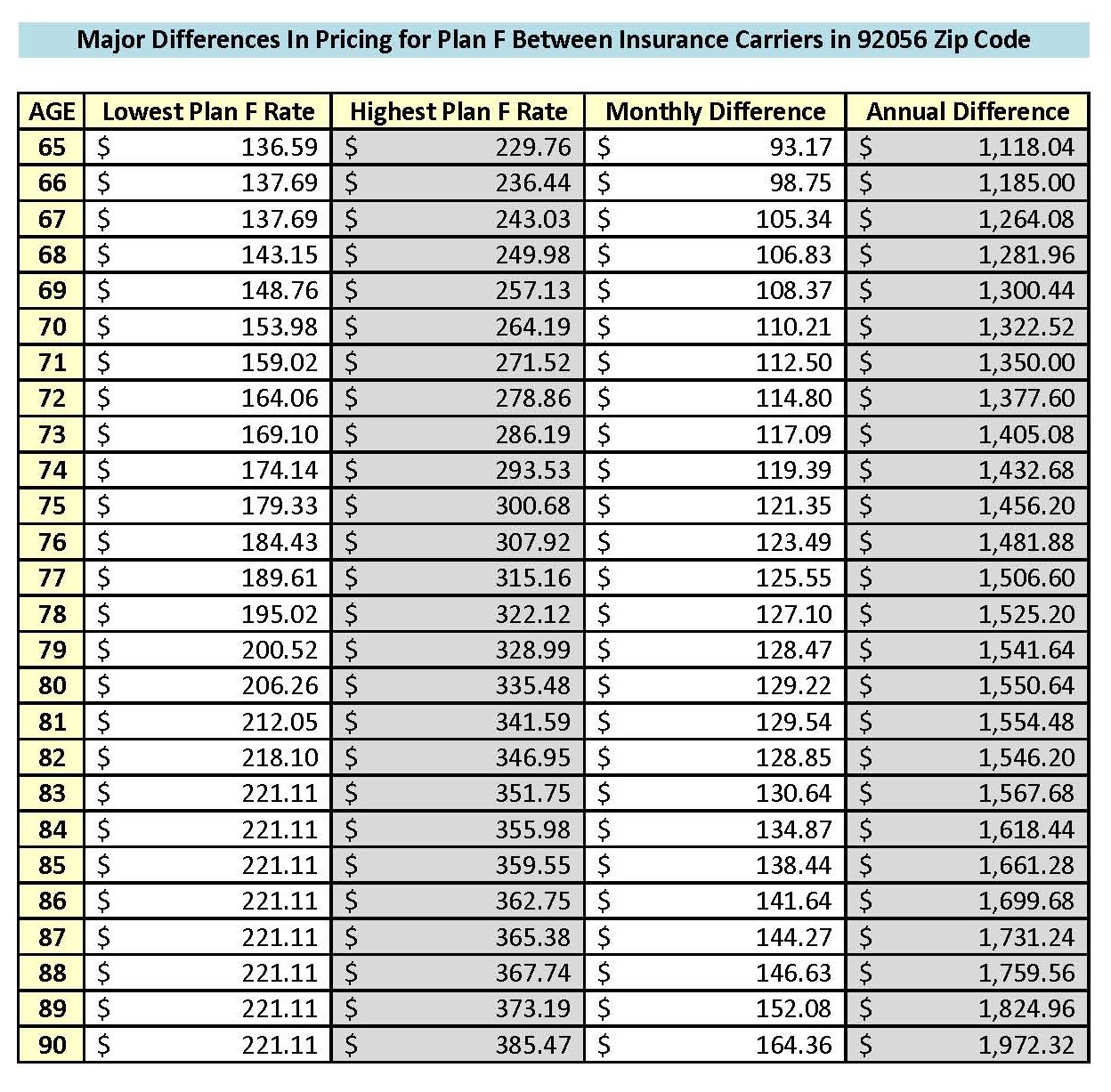

Are Medicare Supplement Plans Expensive?

Many people are under the incorrect impression that Medicare Supplement plans are very expensive. I guess that’s kind of a relative question. In California, rates are based primarily on age and zip code, and rates normally go up as we get older.

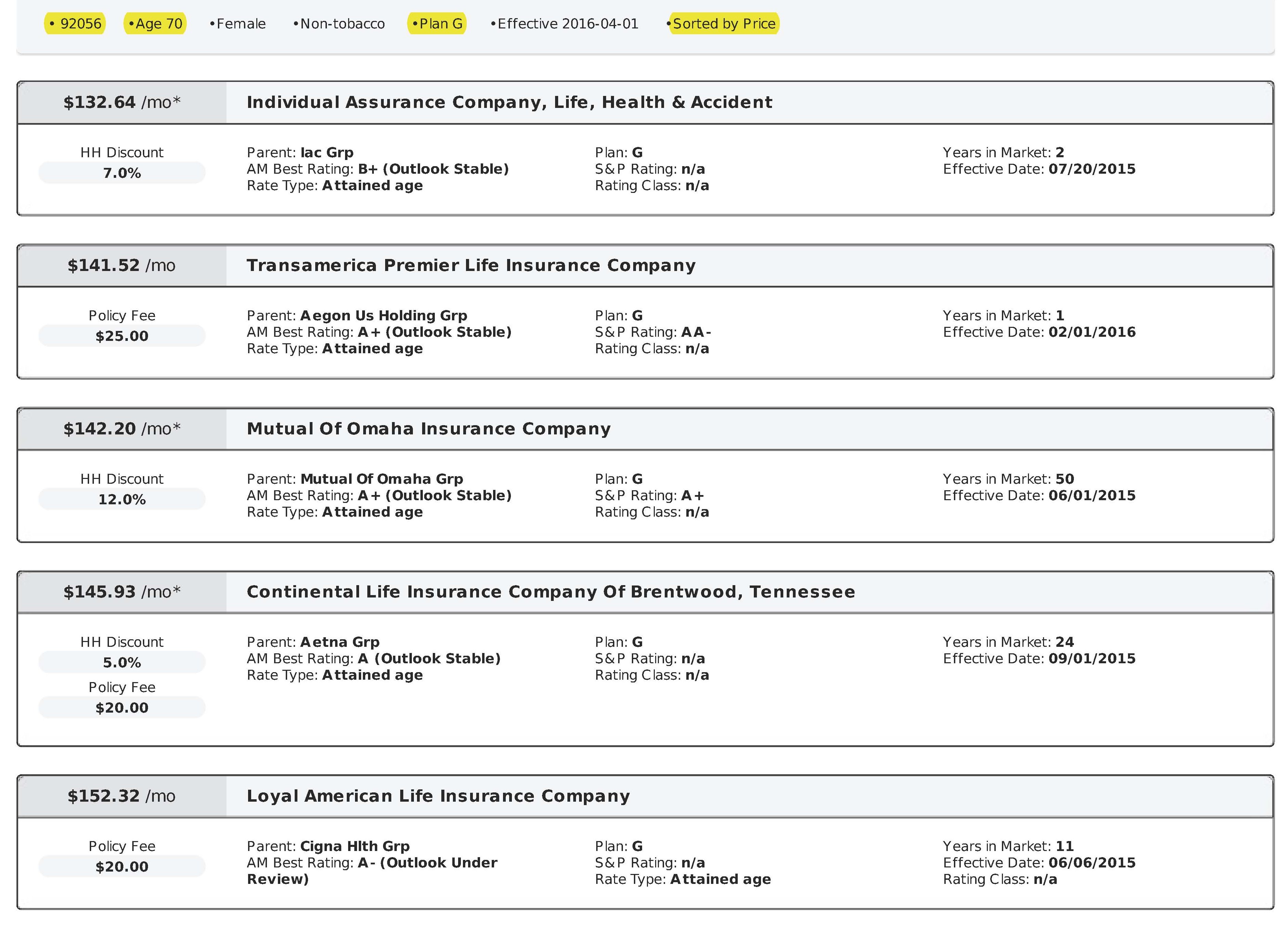

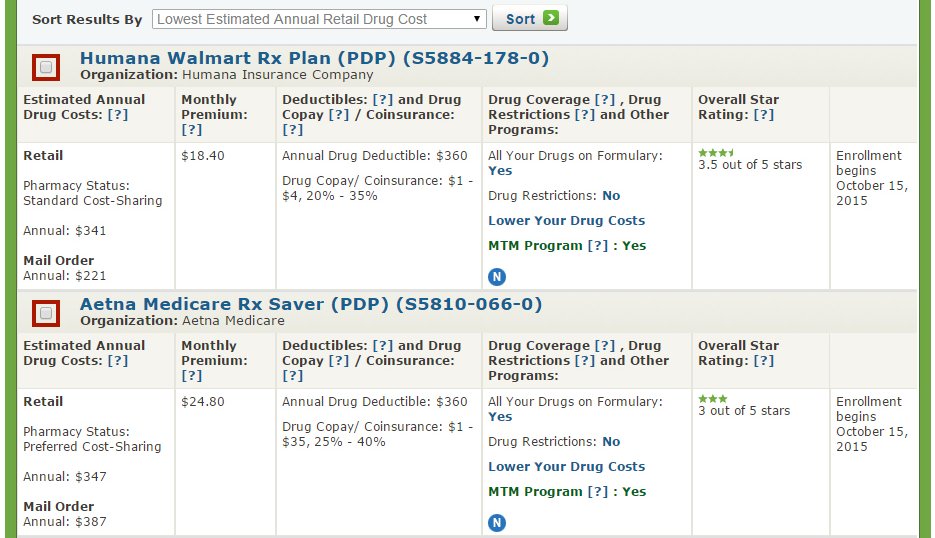

Nationwide, there are 10 standardized Medicare Supplement plans to choose from, Plan A through Plan N. The term “standardized” means that coverage and benefits for every Plan G, Plan N, etc. are exactly the same, regardless of what insurance carrier you are with. In other words, Plan G is Plan G, Plan N is Plan N, etc. Although these plans and coverage are standardized (exactly the same), the rates are not standardized and prices vary significantly from one insurance carrier to another. For example, in the 92024 zip code (Encinitas), the Plan G rate for a 70 year old ranges from $158.29 per month with Cigna up to $262.04 per month with Humana!

As mentioned before, Plan G is the best Medicare Supplement plan offered today because your only out-of-pocket cost for the entire year is the Medicare Part B deductible, which will be $240 in 2024. As an independent agent, I work with all the major insurance carriers, and I shop around for my clients, every year, to find them the best rates as well as the best insurance carriers.

Do You Want to Change Your MA Plan to a Medicare Supplement Plan?

If you would like to switch from your MA plan to a Medicare Supplement in 2024, I can help you! Please call, text, or email me. My contact information is below. Please send me your birth date, zip code, and whether you live alone or if you have lived with someone else for longer than a year, and I can let you know what the best Medicare Supplement rates are for your age and zip code.

NOTE: Some carriers will give you a household discount (HHD), up to 12%, just for living with someone, even if they don’t have a plan. If this applies to you, please let me know their exact age.

If you’d like to apply for a Medicare Supplement, I can handle everything for you, and there is no charge for my service. If you have any questions or would like a no-obligation quote, please don’t hesitate to let me know.

Thank you!

Ron Lewis

CA agent #0B33674

NV agent #3822123

Ron@RonLewisInsurance.com

866.718.1600 (Toll-free)

760.525.5769 (Cell)

www.MedigapShopper.com