When Is the Best Time To Sign Up For a Medicare Prescription Drug Plan?

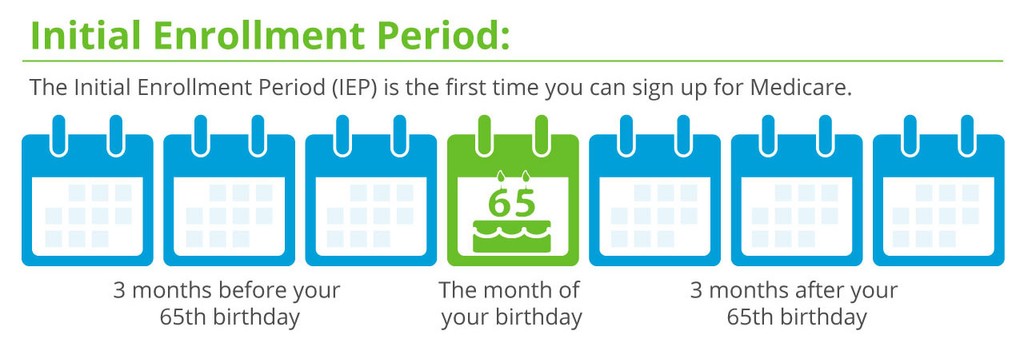

If you are eligible for Medicare, you can generally sign up for Medicare Part D, also known as a Medicare Prescription Drug Plan (PDP) during the Initial Enrollment Period (IEP), which is the 7-month period that starts 3 months before the month you turn 65, includes the month you turn 65, and ends 3 months after the month you turn 65.

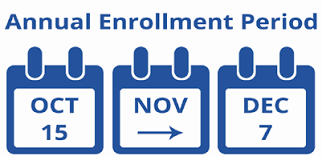

In addition, you can also sign up for a Medicare PDP during the Annual Enrollment Period (AEP), which runs from October 15th through December 7th each year. During this period, you can join, switch, or drop your Medicare PDP.

NOTE: The AEP is the annual open enrollment period to change prescription drug plans and Medicare Advantage plans, not Medicare Supplement plans. If you have a Medicare Supplement, you can change it any time of the year. If you change your Medicare PDP or your Medicare Advantage plan during the AEP, the new coverage will begin on January 1st of the following year.

If you don’t enroll in a Medicare PDP during your IEP or when you first become eligible for Medicare, you may be subject to a late enrollment penalty if you later decide to enroll in a plan.

What Happens If I Don’t Sign Up For a Prescription Drug Plan During the Initial Enrollment Period?

If you miss your IEP to sign up for a Medicare PDP, you generally have to wait until the AEP to sign up for a plan unless you qualify for a Special Enrollment Period (SEP). A SEP is a time outside of the IEP or AEP when you can make changes to your Medicare coverage.

Here are some examples of events that may qualify as a SEP:

- Moving to a new address: If an individual moves outside of their Medicare Advantage plan’s service area, they may be eligible for a SEP to enroll in a new plan.

- Losing other health coverage: If an individual loses coverage from an employer, union, or other health plan, they may be eligible for a SEP to enroll in a Medicare Advantage plan or a Medicare Part D prescription drug plan.

- Gaining new health coverage: If an individual gains coverage from an employer, union, or other health plan, they may be eligible for a SEP to disenroll from their Medicare Advantage plan or their Medicare Part D prescription drug plan.

- Becoming eligible for Medicaid: If an individual becomes eligible for Medicaid, they may be eligible for a SEP to enroll in a Medicare Advantage plan or a Medicare Part D prescription drug plan.

- Moving into or out of a nursing home or long-term care facility: If an individual moves into or out of a nursing home or long-term care facility, they may be eligible for a SEP to enroll in or change their Medicare coverage.

Not all events will qualify an individual for a Medicare SEP, and the rules and timelines for each SEP can vary. It’s always a good idea to check with Medicare or a licensed insurance agent to confirm eligibility and understand the options available. If you do qualify for a SEP, you have a limited time period to enroll in a Medicare PDP. The length of the SEP varies depending on the reason for the SEP. If you don’t qualify for a SEP, you will have to wait until the next AEP to sign up for a Medicare PDP.

When Do I Need to Sign Up For a Prescription Drug Plan When Coming Off An Employer Health Plan?

If you are coming off an employer health plan that included “creditable” prescription drug coverage and you enroll in a Medicare PDP within 63 days of losing your employer coverage, you generally will not be subject to a late enrollment penalty. Creditable coverage is prescription drug coverage that is expected to pay, on average, at least as much as Medicare’s standard prescription drug coverage. Your employer should notify you each year if your prescription drug coverage is creditable.

If you do not enroll in a Medicare PDP within 63 days of losing your employer coverage, you will be subject to a late enrollment penalty if you later decide to enroll in a plan. The penalty would be calculated based on the number of full months you were eligible for a Medicare PDP but did not have creditable prescription drug coverage.

Important: If you enroll in a Medicare Prescription Drug Plan after the 63-day period, you may also have a gap in coverage, which could result in higher out-of-pocket costs for your prescription medications.

What Is the Medicare Prescription Drug Plan Late Enrollment Penalty?

The Medicare PDP late enrollment penalty is a fee that may be imposed on individuals who enroll in a Medicare PDP after their IEP has ended, and who do not have creditable prescription drug coverage from another source (such as an employer).

The penalty is calculated based on the number of months that an individual went without creditable coverage, and is added to the monthly premium for the Medicare PDP. The penalty amount may increase each year, and the penalty is paid for as long as the individual is enrolled in a Medicare PDP. There are some exceptions to the penalty, such as if an individual had a valid reason for delaying enrollment, such as being covered under a spouse’s health insurance plan, etc.

How To Calculate the Medicare Prescription Drug Plan Late Enrollment Penalty

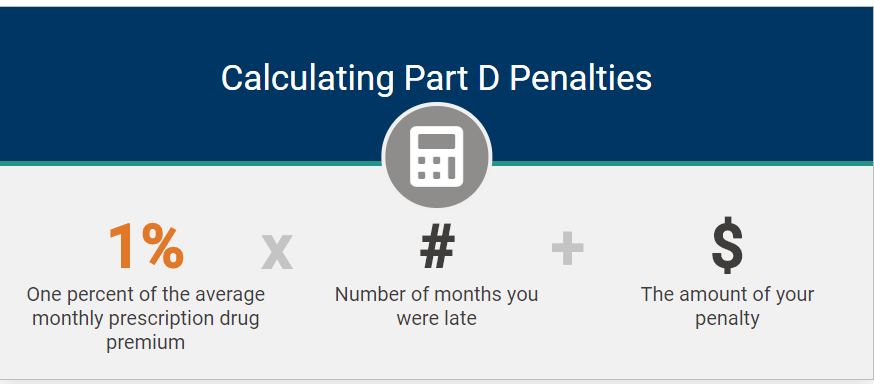

The Medicare PDP late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium” ($32.74 in 2023) by the number of full, uncovered months that an individual did not have creditable prescription drug coverage.

The national base beneficiary premium is the average monthly premium for a Medicare prescription drug plan in the United States, as determined by the Centers for Medicare & Medicaid Services (CMS). The amount of the penalty may increase each year, as the national base beneficiary premium changes.

Here’s an example of how to calculate the penalty:

In 2023, the national base beneficiary premium is $32.74. If an individual goes without creditable prescription drug coverage for 12 months (a full year) after their IEP has ended, the penalty would be 1% of $32.74, or approximately $0.33 per month. Therefore, the penalty amount would be $3.96 ($0.33 x 12 months = $3.96), and this amount would be added to the individual’s monthly premium for their Medicare PDP.

If an individual goes without creditable prescription drug coverage for a shorter period of time, the penalty amount would be lower, based on the number of full, uncovered months, etc. The late enrollment penalty is added to your monthly premium for as long as you have Medicare PDP coverage.

NOTE: The penalty is permanent and may increase each year based on changes to the national base beneficiary premium.

To avoid the late enrollment penalty, it’s important to enroll in a Medicare PDP during your IEP, or when you first become eligible for Medicare, or within 63 days of coming off of an employer health plan, even if you don’t currently take any prescription medications. In California, you can get a Medicare PDP for as low as $4.50 per month!

How Do I Know If I Have to Pay a Penalty?

After you join a Medicare PDP, the plan will tell you if you have to pay a penalty and what your premium will be. In general, you’ll have to pay this penalty for as long as you have a Medicare drug plan.

What If I Don’t Agree With the Late Enrollment Penalty?

You may be able to ask for a “reconsideration.” Your drug plan will send information about how to request a reconsideration. Complete the form, and return it to the address or fax the number listed on the form. You must do this within 60 days from the date on the letter telling you that you have to pay a late enrollment penalty. Also send any proof that supports your case, like a copy of your notice of creditable prescription drug coverage from an employer or union plan.

Do I Have to Pay the Penalty Even If I Don’t Agree With It?

By law, the late enrollment penalty is part of the premium, so you must pay the penalty with the premium. You must also pay the penalty even if you’ve asked for a reconsideration. Medicare PDP’s can dis-enroll members who don’t pay their premiums, including the late enrollment penalty portion of the premium.

How Soon Will I Get a Reconsideration Decision?

In general, Medicare makes reconsideration decisions within 90 days. They will try to make a decision as quickly as possible. However, you may request an extension. Medicare may sometimes take an additional 14 days to resolve your case.

If Medicare decides that all or part of your late enrollment penalty is wrong, Medicare will send you and your drug plan a letter explaining its decision. Your Medicare PDP will remove or reduce your late enrollment penalty. The plan will send you a letter that shows the correct premium amount and explains whether you’ll get a refund. If Medicare decides that your late enrollment penalty is correct, Medicare will send you a letter explaining the decision, and you must pay the penalty.

To Make a Long Story Short…

To avoid the Medicare late enrollment penalty…

- When you are turning 65, the best time to sign up for a Medicare PDP is during the 7-month IEP.

- If you or your spouse is coming off of a creditable employer health plan, the best time to sign up for a Medicare PDP is during the 63 days after your employer coverage ends.

About Me

I hope that you have found this information to be interesting and informative. I’m an independent insurance agent with over 15 years of experience specializing in Medicare Supplement insurance, primarily in California. As an independent agent, I work with most of the major insurance carriers including Mutual of Omaha, Cigna, Blue Shield of CA, Anthem Blue Cross, Health Net, Aetna, etc. I have hundreds of clients, and I shop around for them every year around their birthday. Please click here to see some of my client testimonials.

If you have any questions, or if you know anyone that is turning 65 or starting Medicare, or if you would like for me to shop around for you, I’m happy to help, and there is no charge for my service!!! Please feel free to contact me! Also, please feel free to forward this blog on to anyone you know who may be interested.

Thank you!

Ron Lewis

CA agent #0B33674

NV agent #3822123

Ron@RonLewisInsurance.com

866.718.1600 (Toll-free)

760.525.5769 (Cell)

www.MedigapShopper.com