Introduction

If you’re a Medicare Supplement (Medigap) policyholder living in California, there’s a little-known benefit that could save you hundreds (or even thousands) of dollars a year and many people don’t even know that it exists. It’s called the California Birthday Rule, and it gives you the right to switch your Medigap plan every year around your birthday, REGARDLESS OF YOUR HEALTH!

IMPORTANT: You can change your Medicare Supplement any time of the year, but if you do it around your birthday, it’s a lot easier because you don’t have to answer any health questions, there’s no medical underwriting, and YOU CAN’T BE TURNED DOWN FOR COVERAGE!

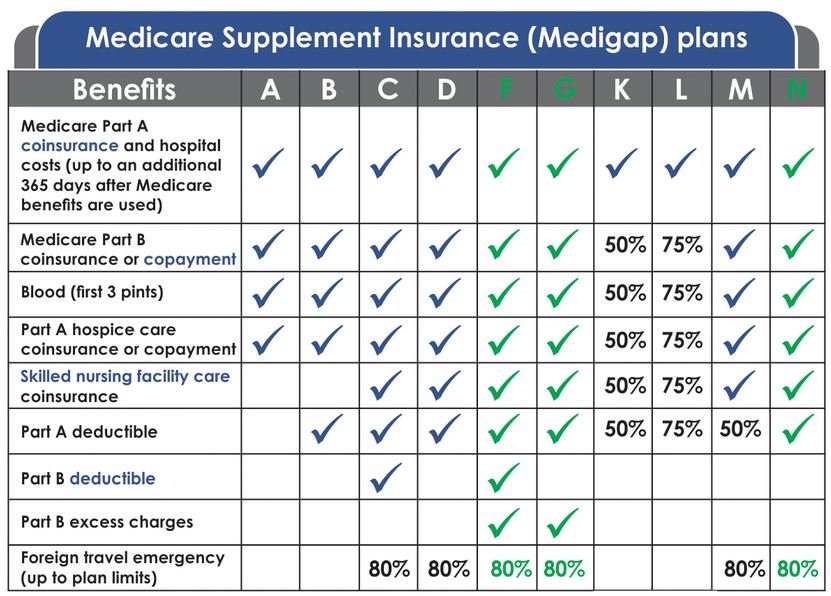

Medigap Plans Are Standardized

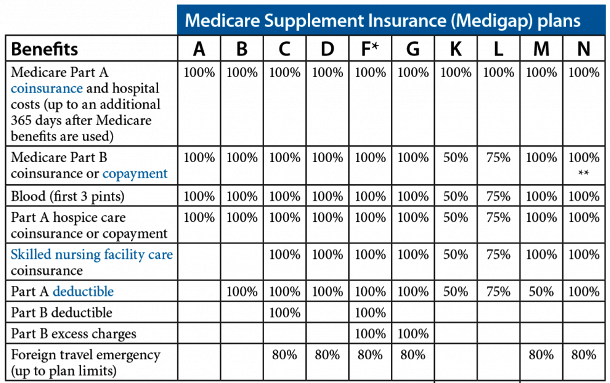

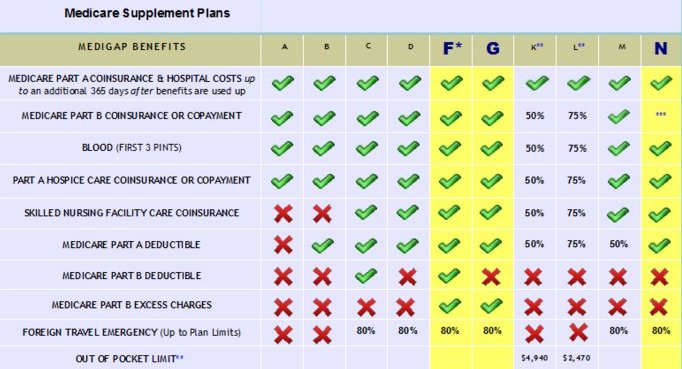

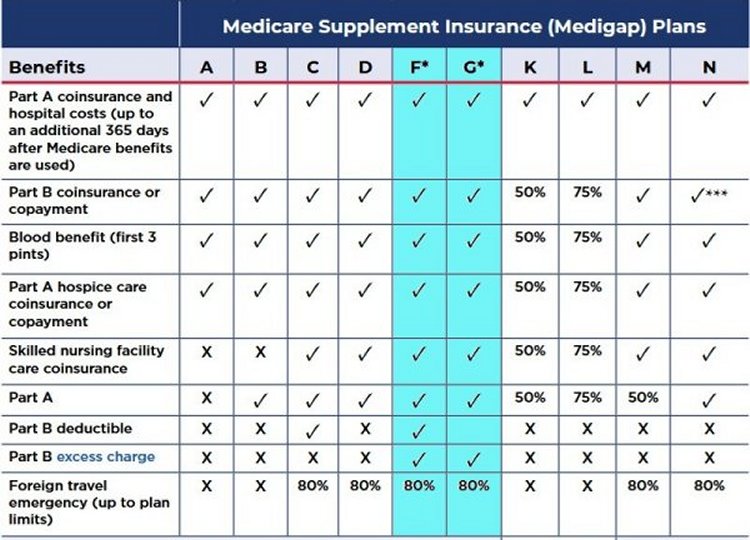

Nationwide, there are 10 standardized Medicare Supplement lettered plans to choose from, Plan A through Plan N. When I say “standardized,” that means that the coverage and benefits for every lettered plan are exactly the same regardless of what insurance carrier you sign up with. In other words, Plan G is Plan G, Plan N is Plan N, etc., regardless of what insurance carrier you are with. So it’s much easier to compare plans since every plan is exactly the same no matter which insurance carrier offers it.

NOTE: Technically, there are actually 12 standardized Medigap plans to choose from because there are high-deductible versions of Plan F and Plan G. In 2025, you will pay a $2,870 deductible before your coverage for either of these plans would begin.

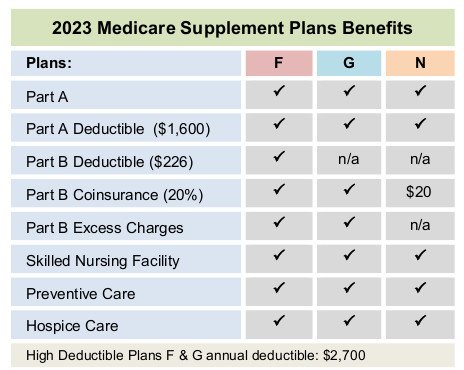

As you can see, the only difference between Plan F and Plan G is the Medicare Part B deductible.

Which Medigap Plan is Best?

For those who are turning 65 or starting Medicare today, the best and most comprehensive Medigap plan is Plan G, which pays for everything except for the Medicare Part B deductible. The current annual Part B deductible (in 2025) is $257. That amount can change from year to year, but historically, it hasn’t changed by much.

Medicare Access and CHIP Reauthorization Act of 2015

Due to the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Medigap Plan C and Plan F were discontinued for new Medicare beneficiaries starting on January 1st, 2020. This legislation eliminated the availability of Medigap plans that cover the Medicare Part B deductible for individuals who became eligible for Medicare on or after that date. However, Plan C and Plan F are still available for people who were eligible for Medicare before 2020 or who already have one of those plans. They just aren’t available for those individuals that turned 65 or started Medicare on or after January 1st, 2020.

Let’s look at a common example of how switching under the Birthday Rule can save you money.

Why Plan G is More Popular Than Plan F

If you have a Plan F Medicare Supplement, you’re probably paying more than you need to. It’s usually much cheaper and more cost effective to switch to Plan G because both plans are identical in coverage except for the Medicare Part B deductible, which is $257 in 2025. Plan F covers that small deductible, while Plan G does not. That is the only difference between the two plans, yet the premiums for Plan F are usually significantly higher.

Even though Plan F covers that $257, it often costs $400–$1,000 more per year in premiums than Plan G, so in most cases, you’d save money by paying the lower monthly premium for Plan G and just covering that $257 deductible yourself.

IMPORTANT: If you can save more than $257 per year by switching from Plan F to Plan G, then Plan G is cheaper and more cost effective.

For example, if your Plan F premium is $250 per month and you can get Plan G for $200 per month, that’s a gross savings of $50 per month or $600 per year. If you pay the $257 on your own, your net savings will still be $343 per year ($600 – $257 = $343)! The Medicare Part B deductible is payable only one time per calendar year, so after you pay that small deductible, there is absolutely no difference between Plan F and Plan G for the remainder of the year!

NOTE: If you have Plan F and you switch to Plan G, if you’ve already met your $257 Part B deductible, you won’t pay it again until the following year since that small deductible is payable only one time per calendar year.

What Is the California Birthday Rule?

The California Birthday Rule is a special California state law that allows active Medigap policyholders in California to switch to a new Medigap plan with “equal or fewer” benefits every year around their birthday without medical underwriting during a 60-days following their birthday.

NOTE: In California, most carriers accept applications from 30 days before your birthday up to 60 days after your birthday, a 91-day window to switch Medigap plans without medical underwriting.

Most states don’t have a birthday rule, and if you develop a serious health condition, you could be stuck with your current health insurer and Medigap plan. But thanks to the California Birthday Rule, you have a guaranteed open enrollment period every year to shop around and save money on your premiums without worrying about being stuck or declined.

What Does Equal or Fewer Mean?

Again, under the birthday rule, you can switch to any Medigap plan that offers “equal or fewer” benefits than your current plan. In other words, you can switch from your current Medigap plan to any other Medigap plan that offers benefits that are the same or less comprehensive than what you currently have.

For example:

- You cannot upgrade to a plan with more benefits (such as Plan N to Plan G).

- You can switch to a plan with the same level of benefits (such as Plan G to another Plan G with a different carrier).

- You can downgrade to a plan with fewer benefits (such as Plan F to Plan G, Plan G to Plan N, etc.).

This rule exists to prevent people from waiting until they are sick to “upgrade” to more generous coverage. However, it does give you freedom to shop around for lower prices on the same or lesser coverage without worrying about health questions or being declined.

Examples of “Equal or Fewer”

- If you have Plan F, you can switch to Plan F with a different insurance carrier or to Plan G, Plan N, etc.

- If you have Plan G, you can switch to Plan G with another insurance carrier or to Plan N, etc.

- If you have Plan N, you can switch to Plan N with a different insurance carrier or to Plan A, etc.

Even if you’re not sure whether your current plan is the best deal, you can always switch to the same plan with a different insurance carrier during your birthday rule window, often saving hundreds and sometimes thousands of dollars per year without changing any of your benefits.

What States Have a Medigap Birthday Rule?

Today, more states are slowly adding their own birthday rules. Here is a current list of states that have a Medicare birthday rule:

- California

- Illinois

- Idaho

- Kentucky

- Louisiana

- Maryland

- Nevada

- Oklahoma

- Oregon

- Utah

- Virginia

- Wyoming

States with Year-Round Guaranteed Issue or Open Enrollment Rights

These states don’t have a Medicare birthday rule, but they offer year-round guaranteed issue or open enrollment periods without underwriting:

- Connecticut

- Maine

- Missouri

- New York

- Washington

Do Most People Use the Birthday Rule?

Surprisingly, no! Many people don’t know this rule exists and they stay on overpriced Medigap plans for years thinking they’re stuck because of health issues, etc. If you take advantage of the birthday rule each year, you can keep your premiums under control and avoid being overcharged.

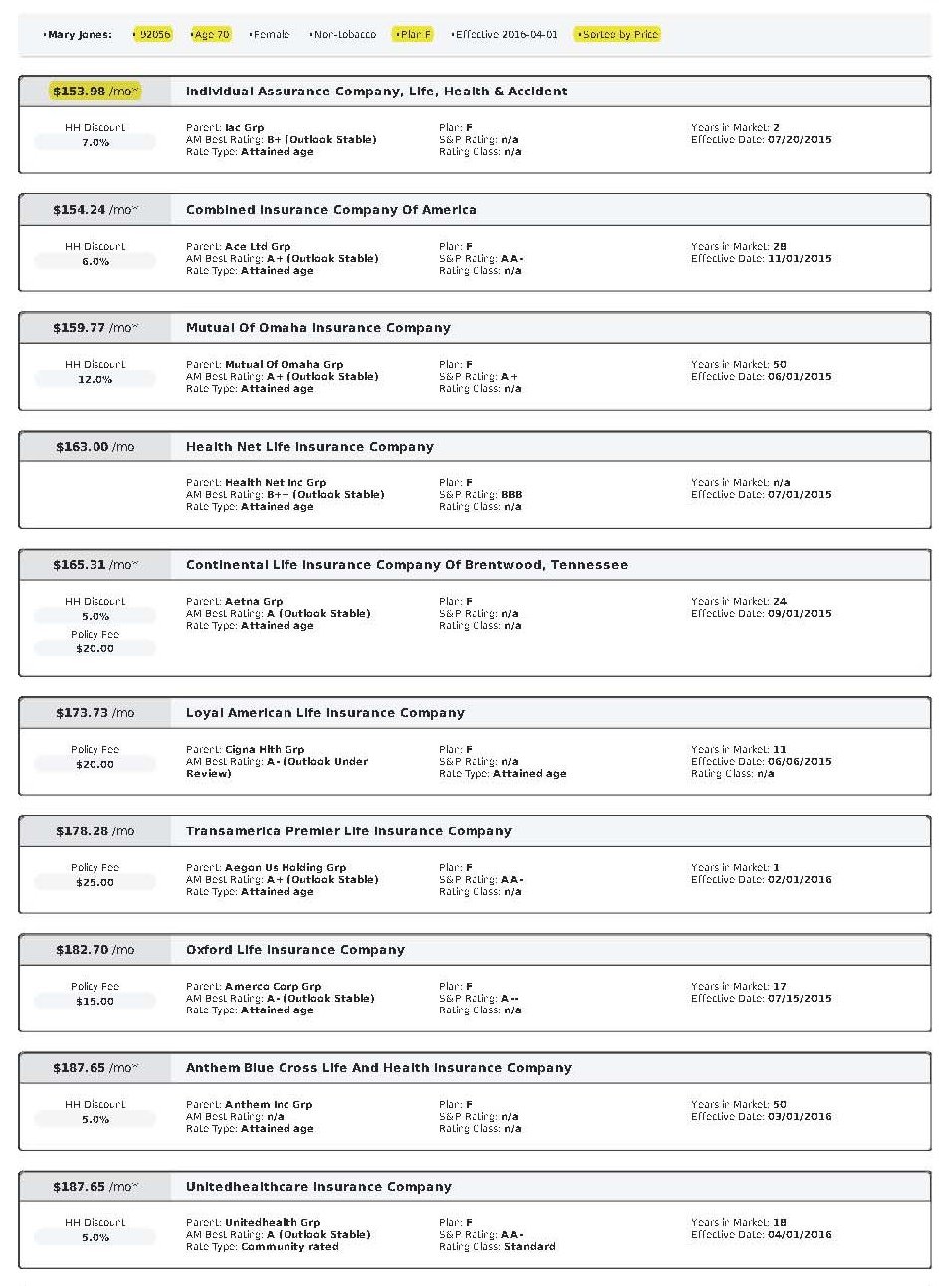

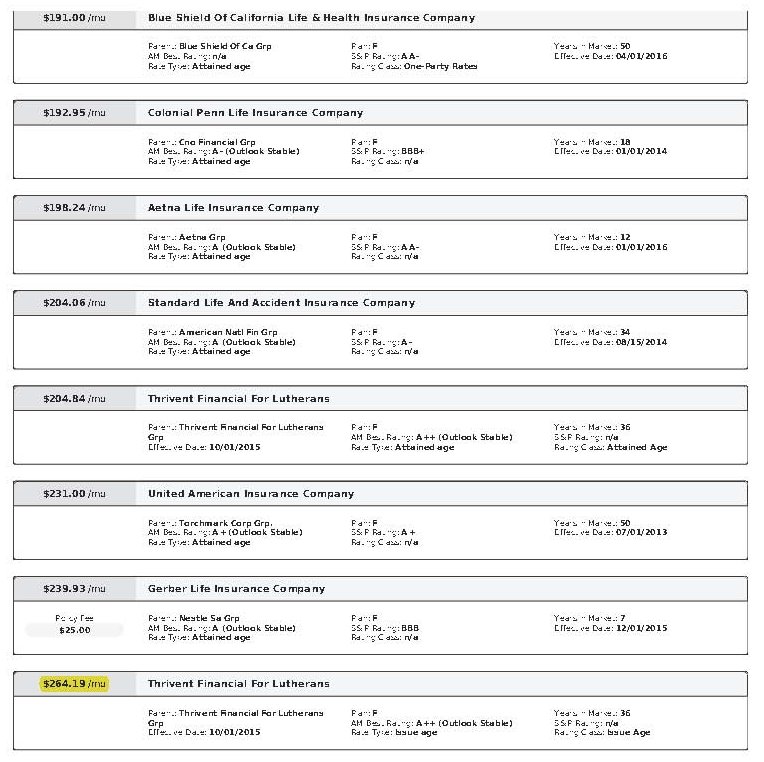

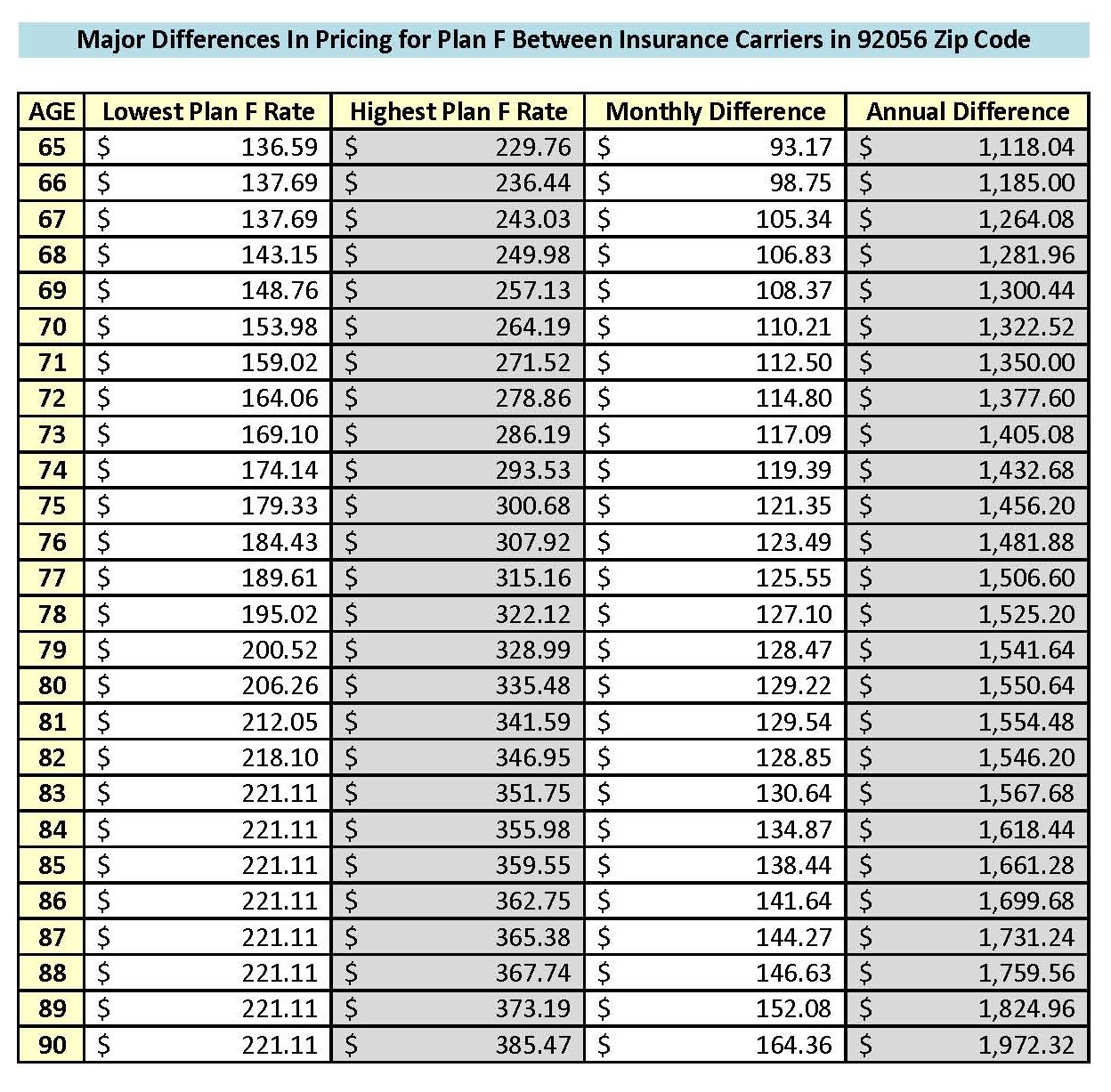

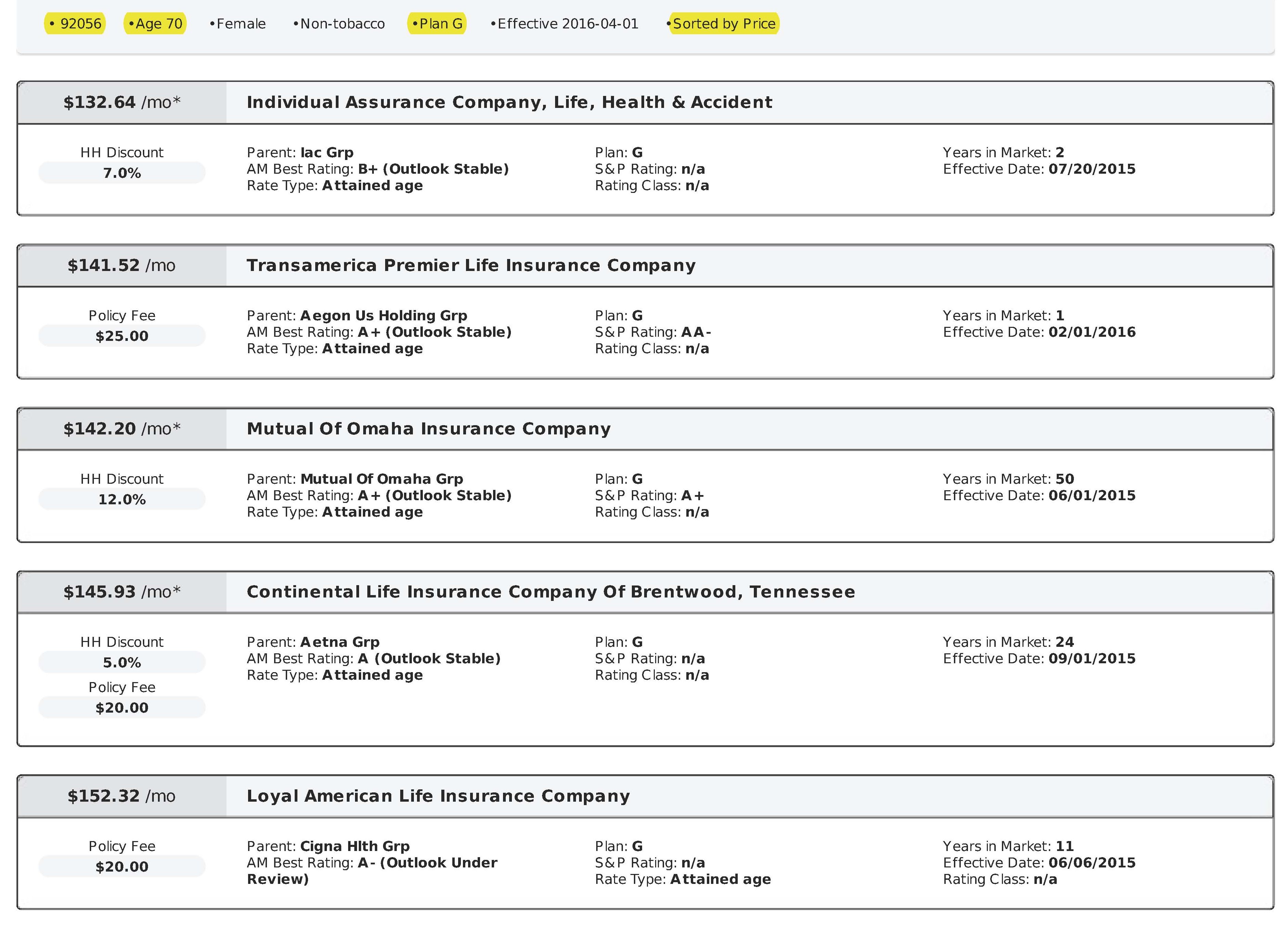

Rates Vary Significantly Between Insurance Carriers

As mentioned before, Medigap plans are “standardized” meaning that Plan G is Plan G, Plan N is Plan N, etc. The coverage and benefits for every Plan G, etc. are exactly the same regardless of what insurance carrier you are with. However, the rates between insurance carriers are not standardized. Every insurance carrier charges their own rates.

For example, right now in the 92024 zip code (San Diego), the Plan G rates for a 70 year old single female range from $217.78 to $319.79 per month! That’s a difference of $102.01 per month or $1,224.12 per year for the same identical plan and coverage!

NOTE: Several years ago, one of my clients, a husband and wife, moved to San Diego from Los Angeles. They were paying $809.00 per month for Plan G with United American, and I got them Plan G with Mutual of Omaha for $367.01 per month, which was a savings of $441.99 per month or $5,303.88 per year for the save identical plan and coverage! Rates are based primarily on age and zip code, and they are constantly changing. It‘s critically important to shop around every year!

How to Apply and Save Money!

To take advantage of the California birthday rule, you must do the following:

- Live in California

- Have an active Medigap plan

- Switch to a Medigap plan with “equal or fewer” benefits

- Apply during the 30 days before up to 60 days after your birthday

- Email me at Ron@RonLewisInsurance.com or call me at 760.525.5769 (cell) or 866.718.1600 (toll-free) for a free quote or to switch plans

It only takes a few minutes to apply and there is never a charge for my service!

Conclusion

If you currently have a Medigap plan, you can change your plan every year around your birthday, REGARDLESS OF YOUR HEALTH! If you apply during your annual 60-day open enrollment period under the California Birthday Rule, YOU CANNOT BE TURNED DOWN FOR COVERAGE!

As an independent insurance agent specializing in Medicare Supplements, I work with all the major insurance carriers, not just one. (A “captive” insurance agent can only represent one insurance carrier.) I will do the shopping for you and find you the best rates, not just this year, but I shop around for all my clients every year around their birthday! The monthly premiums are exactly the same whether you let me do the shopping for you to save you money on your premiums or if you contact an insurance carrier directly! Please visit Client Testimonials to read what some of my clients have to say about me.

Call, text, or email me today, and I’ll help you review your options in just a few minutes with no pressure or obligation. Let me help you save hundreds, or even thousands of dollars, on the exact same Medigap plan you already have. Won’t that be a nice birthday present?

If you liked this blog and found it informative, please click the “Like” button, and please send me your questions, comments, or feedback! And please feel free to share this article with your friends!

Thank you!

Ron Lewis

Ron@RonLewisInsurance.com

www.MedigapShopper.com

(760) 525-5769 – Cell

(866) 718-1600 – Toll-free