Each year, many people in California decide to leave their Medicare Advantage (Part C) plan and return to Original Medicare (Part A and Part B) with a Medicare Supplement (Medigap) plan. Often, this happens when premiums, copays, or out-of-pocket costs increase, or when clients find their favorite doctors or hospitals are no longer in their plan’s network.

If you’ve ever wondered how to switch from Medicare Advantage to Medigap, it’s important to understand how the process works, and the potential challenges if you have existing health conditions.

You Can Switch Back to Original Medicare — But You’re Not Automatically Guaranteed Medigap Approval

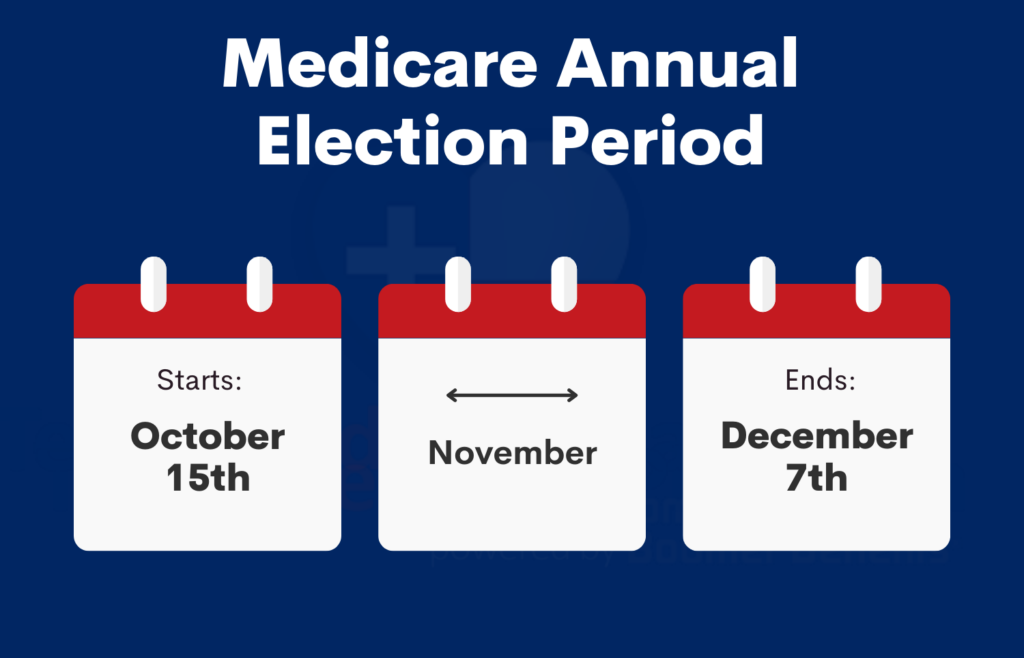

You can drop your Medicare Advantage plan and go back to Original Medicare during certain times of the year, such as the Annual Election Period (AEP), which goes from October 15th through December 7th every year or during the Medicare Advantage Open Enrollment Period, which goes from January 1st through March 31st.

However, many people are surprised to learn that once they return to Original Medicare, they must apply separately for a Medicare Supplement plan, and approval is not guaranteed. In most cases, insurance companies can review your health history, which is called “medical underwriting,” and deny coverage if you have serious or chronic health conditions. That’s why timing and knowing the rules can make all the difference.

Medicare Guaranteed Issue Rights: The Hidden Opportunities

Here’s the good news… even if you have health problems, there are special Guaranteed Issue (GI) rights or situations that often let you enroll in a Medigap plan without health questions or underwriting.

These rights apply in specific situations and many beneficiaries don’t realize they qualify. Some are tied to Medicare Advantage plan changes, others to state-specific protections. In California, there are several lesser-known GI opportunities that can help people switch to Medigap coverage, even when they’ve been told “no” before.

I work with clients every year who thought they couldn’t qualify due to health issues and I’ve helped them get accepted for Medicare Supplement coverage using legitimate Guaranteed Issue options that most agents aren’t aware of or don’t mention to their clients.

Why Work with a Specialist Who Knows the California Rules

The Medicare rules in California are unique. Between the California Birthday Rule and other state-specific guaranteed issue protections, there are several ways to save money and secure coverage without medical underwriting.

As an independent Medicare Supplement insurance specialist, I work with all the major insurance carriers throughout California, Nevada, and several other states. My goal is simple. I want to help you find the best Medicare Supplement plan with the lowest premium and the most reliable coverage, year after year.

Let’s See What You Qualify For

If you’re considering leaving your Medicare Advantage plan or want to see if you qualify for a Guaranteed Issue Medicare Supplement, don’t wait until it’s too late.

There is no cost for my help. I’m paid by the insurance carriers, not my clients. I can review your situation, identify any Guaranteed Issue opportunities, and help you apply for the coverage that fits your needs and budget.

Contact me today to learn your options and see how much you could save on your Medicare Supplement plan.

About the Author

As an independent Medicare Supplement insurance specialist, I work with all the major insurance carriers throughout California, Nevada, and several other states. I shop around for my clients every year during their annual open enrollment period under the California Birthday Rule to help them save money on their Medicare Supplement premiums. Many of my clients have saved hundreds, even thousands of dollars for the same exact plan and coverage! Please click here to read what my clients have to say about my services.

There is no charge for my services as I’m compensated by the insurance carriers, not my clients. My goal is to help you find the lowest premiums and provide the best personal service possible, year after year. Unlike many agents, I won’t disappear after you sign up!

If you enjoyed this blog and found it helpful, please leave your comments, questions, or feedback below and feel free to share this article with your friends!

Thank you!

Ron Lewis

Ron@RonLewisInsurance.com

www.MedigapShopper.com

(760) 525-5769 – Cell

(866) 718-1600 – Toll-free