Choosing a Medicare Prescription Drug Plan (PDP), which is also known as Part D, can feel overwhelming. With dozens of plans available, each with different premiums, deductibles, copays, and pharmacy networks, it’s easy to make a costly mistake.

As a Medicare Supplement (Medigap) insurance agent, I often get questions from clients who also want help selecting a Part D plan. While I’d love to help, I recently learned that helping someone choose or enroll in a Part D plan without proper certification could put my insurance license at risk. However, there’s a better option that is free, unbiased, and comprehensive through the Health Insurance Counseling and Advocacy Program (HICAP).

Many Insurance Agents Have Stopped Selling Prescription Drug Plans

If you’ve noticed that fewer independent agents are offering Medicare Prescription Drug (Part D) plans, you’re not imagining things. Over the past couple of years, the Centers for Medicare & Medicaid Services (CMS) has introduced an increasing number of onerous regulations that have made it extremely difficult for many agents to continue offering these plans, especially independent agents who value personal service and client relationships.

For example, CMS recently began requiring insurance agents to record every marketing, sales, and enrollment call related to Medicare Prescription Drug Plans (Part D). This means any discussion involving benefits, costs, or plan comparisons must be recorded, both inbound and outbound, and those recordings must be securely stored for 10 years. Agents don’t like this and many Medicare beneficiaries don’t want their conversations recorded.

While these rules were intended to protect consumers from misleading marketing, the burden of compliance has become overwhelming for many professionals in the field. For more detailed information, please click here to check out my other blog called “Why Many Insurance Agents Have Stopped Selling Prescription Drug and Advantage Plans,” and click here to to check out another related blog called “Why You May Be Better Off Choosing Your Own Medicare Prescription Drug Plan (Part D).”

Why an Insurance Agent Might Not Be Enough

Many insurance agents are only certified to sell PDP’s from certain insurance carriers, which means:

- They may not have access to every plan available in your area.

- Their guidance could be influenced by commissions or appointments, even unintentionally.

- You may not get a complete picture of your options, which can lead to higher costs or gaps in coverage.

That’s where HICAP comes in.

What is HICAP and How It Helps

The Health Insurance Counseling and Advocacy Program (HICAP) is a free, state-run program in California that provides free, confidential one-on-one counseling, education, and assistance to individuals and their families on Medicare, Long-Term Care insurance, other health insurance related issues, and planning ahead for Long-Term Care needs.

HICAP also provides legal assistance or legal referrals in dealing with Medicare or Long-Term Care insurance related issues. HICAP counselors are trained in Medi-Cal and Medicare and can help you understand the complex insurance options to find the best fit for you.

HICAP counselors:

- Can show all available Part D plans in your area.

- Provide completely unbiased guidance, with no sales pressure.

- Help you compare costs, deductibles, co-pays, and pharmacy networks.

- Walk you through the Medicare Plan Finder tool or help you understand your plan options.

What HICAP Services Are Available?

HICAP can help you with the following:

- Have questions on prescription drug coverage, co-pays, or eligibility rules?

- Wondering how to sign up for Medicare now that you are almost 65?

- Confused about all the different parts to Medicare, do you need A, B, C, D?

- Need help filing an appeal or challenging a denial?

- Considering long-term care insurance?

- Need a speaker for a community education event?

How a HICAP Session Works

Whether over the phone or in person, the process is simple:

- Prepare your information: Have a list of all your prescriptions, your preferred pharmacy, and your zip code.

- Enter your own prescriptions: You input your medication information into Medicare.gov.

- Guided support: The HICAP counselor explains your options, interprets plan details, and answers questions.

- Compare plans: They help you see which plan offers the best coverage for your needs.

- Enrollment: You complete the enrollment yourself online or by calling the plan.

Who Can Get These Services?

Counseling is provided to the following individuals:

- Persons 65 years of age or older and are eligible for Medicare

- Persons younger than age 65 years of age with a disability and are eligible for Medicare

- Persons soon to be eligible for Medicare

Why HICAP is the Best Choice

HICAP counselors provide a full picture of your options, which an insurance agent cannot always do. Their guidance is independent, comprehensive, and free. This ensures you make an informed decision about your prescription coverage without missing important details or paying more than necessary.

Check Out My Video — How to Sign Up for a PDP on the Medicare Website

This past year, I created a step-by-step YouTube video that shows you how to use the Medicare Plan Finder tool. Nothing has changed since last year. Instead of contacting a HICAP counselor, you should be able to watch the video and be able to select a PDP and enroll on your own. It’s really very easy! Please click here to watch the video. It’s only 14 minutes long.

Next Steps

If you’re ready to compare Medicare Prescription Drug Plans for 2026:

- Click here to watch my Youtube video that explains how to to use the Medicare Plan Finder tool to select a PDP and enroll on your own.

- Call HICAP at 1-800-434-0222 or click here to find a local office in California.

- In other states besides California, you can get help at your local State Health Insurance Assistance Program (SHIP). Their phone number is 1-877-839-2675 or click here to find a local office outside of California.

And if you have questions about Medicare Supplement (Medigap) plans, I’m here to help guide you through your options.

Conclusion

Choosing a Part D plan doesn’t have to be stressful. By using HICAP’s free, unbiased services, you can get all the information you need to make the best decision for your health and budget, while staying in control of the process.

About the Author

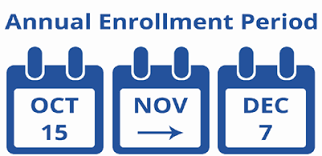

As an independent Medicare Supplement insurance specialist, I work with most of the major insurance carriers throughout California, Nevada, Arizona, and several other states. I shop around for my clients every year during their 60-day annual open enrollment period under the California Birthday Rule to help them save money on their Medicare Supplement premiums. Many of my clients have saved hundreds, even thousands of dollars on the same exact plan and coverage! Please click here to see what my clients have to say about my services.

There is no charge for my services as I’m compensated by the insurance carriers, not my clients. My goal is to help you find the lowest premiums and provide the best personal service possible, year after year. Unlike many agents, I won’t do a magic act and disappear after you sign up! 🙂

If you enjoyed this blog and found it helpful, please leave your comments, questions, or feedback below and feel free to share this article with your friends!

Thank you!

Ron Lewis

Ron@RonLewisInsurance.com

www.MedigapShopper.com

(760) 525-5769 – Cell

(866) 718-1600 – Toll-free