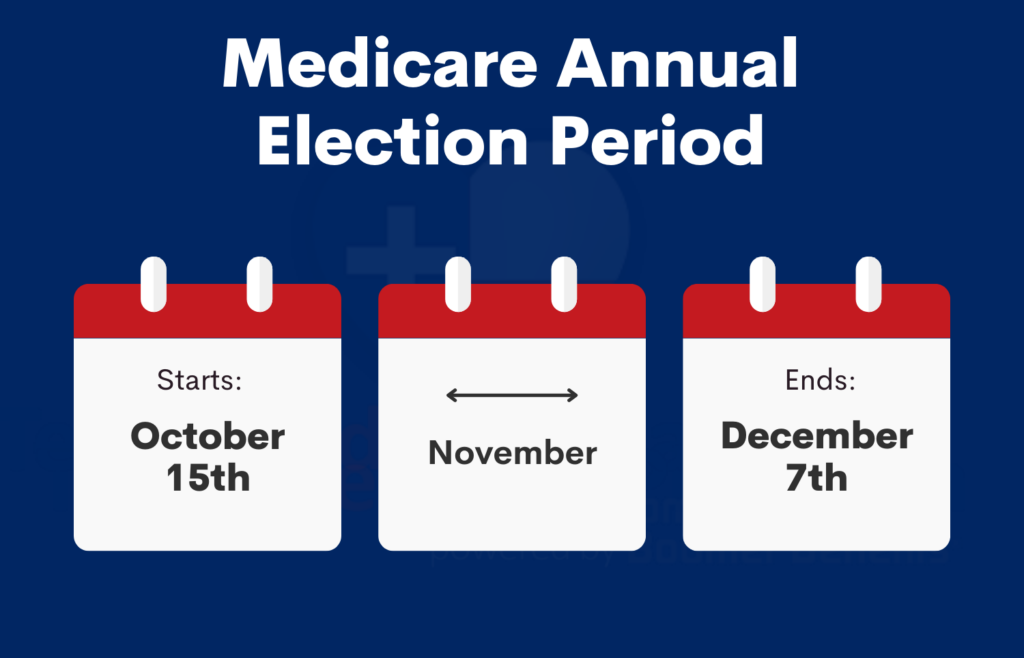

The Annual Enrollment Period (AEP), which is from October 15th through December 7th each year, is almost here!

If you currently have a Medicare Advantage (MA) plan, you should switch back to Original Medicare and get a Medicare Supplement plan instead!

IMPORTANT: If you have a Medicare Supplement plan (aka “Medigap” because it picks up the “gap” in Medicare coverage) the AEP does not apply to you unless you want to enroll in or change your Prescription Drug Plan (PDP).

Why Medicare Supplement Plans Are Better

With Original Medicare (Part A and Part B) and a Medicare Supplement, you have much more freedom of choice and lower costs than you do with an MA plan!

NOTE: Medicare Part A is hospital insurance and Part B is medical insurance.

Which Plan Gives You the Most Freedom?

With an MA plan, you are locked into the plan’s network of doctors, specialists, hospitals, and care facilities. If you want to see a specialist, you often have to see your preferred care provider first, who acts as a gatekeeper, before you can see a specialist within your network. If you want to see a specialist or doctor that is outside of your network, good luck! That will cost you a lot more in out-of-pocket (OOP) costs.

With a Medicare Supplement plan, you can go to ANY doctor, specialist, hospital, or care facility in the US as long as they accept Medicare!

For example, the MD Anderson Cancer Treatment Center in Texas accepts Medicare and therefore, they accept ALL Medicare Supplement plans. They don’t, however, accept most MA plans!

Which Plan Has Lower Out-Of-Pocket Costs?

With an MA plan, your OOP costs can be as high as $6,700 per calendar year and even higher if you go to doctors and/or care facilities that are outside of your network! With a Plan F or Plan G Medicare Supplement (the two best Medigap plans), the most you would normally pay in OOP costs in a calendar year is either $0 with Plan F or $183 with

Plan G!

NOTE: The $183 is the Medicare Part B (Medical) deductible, which is $183 per calendar year in 2017. That amount can change from year to year, but historically, it has always been very stable.

Maximum Out-Of-Pocket Costs for MA Plans in San Diego

The following data was obtained from the Medicare.gov website and shows the current OOP costs for MA plans in the 92009 zip code in San Diego. These costs currently range from $3,300 to $6,700 per calendar year!

If you go out-of-network with your MA plan, your OOP costs will be even higher!

Current (in-network) Maximum OOP Costs for MA Plans in the 92009 Zip Code:

- AARP MedicareComplete SecureHorizons Essential (HMO) – $4,900

- AARP MedicareComplete SecureHorizons Plan 4 (HMO) – $3,400

- AARP MedicareComplete SecureHorizons Premier (HMO) – $4,300

- AARP MedicareComplete SecureHorizons Value (HMO) – $5,300

- Aetna Medicare Choice Plan (PPO) – $6,000

- Aetna Medicare Select Plan (HMO) – $3,400

- Anthem MediBlue Coordination Plus (HMO) – $6,700

- Anthem MediBlue Plus (HMO) – $3,400

- Blue Shield 65 Plus (HMO) – $3,400

- Brand New Day Classic Care Drug Savings (HMO) – $3,400

- Brand New Day Classic Choice for Medi-Medi (HMO) – $6,700

- Care1st AdvantageOptimum Plan (HMO) – $3,400

- Coordinated Choice Plan (HMO) – $6,700

- Health Net Healthy Heart (HMO) – $3,400

- Health Net Seniority Plus Sapphire (HMO) – $6,700

- Health Net Seniority Plus Sapphire Premier (HMO) – $6,700

- Humana Gold Plus H5619-016 (HMO) – $4,900

- Humana Value Plus H5619-037 (HMO) – $6,700

- Kaiser Permanente Senior Advantage San Diego (HMO) – $4,900

- Scripps Classic offered by SCAN Health Plan (HMO) – $3,400

- Scripps Plus offered by SCAN Health Plan (HMO) – $6,700

- Scripps Signature offered by SCAN Health Plan (HMO) – $4,000

- Sharp Direct Advantage Gold Card (HMO) – $3,400

- Sharp Direct Advantage Platinum Card (HMO) – $3,300

- Sharp SecureHorizons Plan by UnitedHealthcare (HMO) – $3,400

In contrast, in a calendar year, your maximum OOP costs are either $0 with a Plan F Medicare Supplement or $183 with a Plan G Medicare Supplement!

Is Your MA Plan’s Maximum OOP Costs Really No More Than $6,700 Per Year?

If you stay within your MA plan’s network, your maximum OOP costs are not supposed to be more than $6,700 per calendar year. However, if you go outside of the plan’s network, your OOP costs can be significantly higher than that!

Suppose that you get really sick and need expensive treatment such as Chemotherapy, etc. in the second half of the year. You could end up paying up to $6,700 (or whatever your plan’s maximum OOP cost is) by the end of the calendar year and guess what? Your OOP maximum zeros out in January, and it starts all over again!

If you are still receiving expensive medical care in the beginning of the year, you could potentially end up paying your maximum OOP cost two different times in a

12-month period! For example, if your maximum OOP cost is $6,700, your total OOP cost in a 12-month period, not a calendar year, could be more than $13,400!

Which Plan Has Lower Co-Payments?

If you have an MA plan, you will make a co-payment almost every time you go to the doctor, see a specialist, a physical therapist, etc. With most Medicare Supplement plans, there are no co-payments for doctor’s visits, etc.

How Difficult is it to Switch From an MA Plan to Original Medicare and a Medicare Supplement Plan?

That depends if you are in a Special Enrollment Period (SEP).

Special Enrollment Period

If you currently have an MA plan, and you are in a SEP, you can switch to Original Medicare and to any six of the 10 “standardized” Medicare Supplement plans any time of the year, REGARDLESS of your health.

The six “guaranteed issue” Medicare Supplement plans are plans A, B, C, F, K, and L. In other words, if you are in a SEP, you are guaranteed the right to get a Plan F Medicare Supplement, but not a Plan G supplement, etc.

NOTE: You could apply for Plan G, but you would be medically underwritten, and you could be turned down for certain medical conditions.

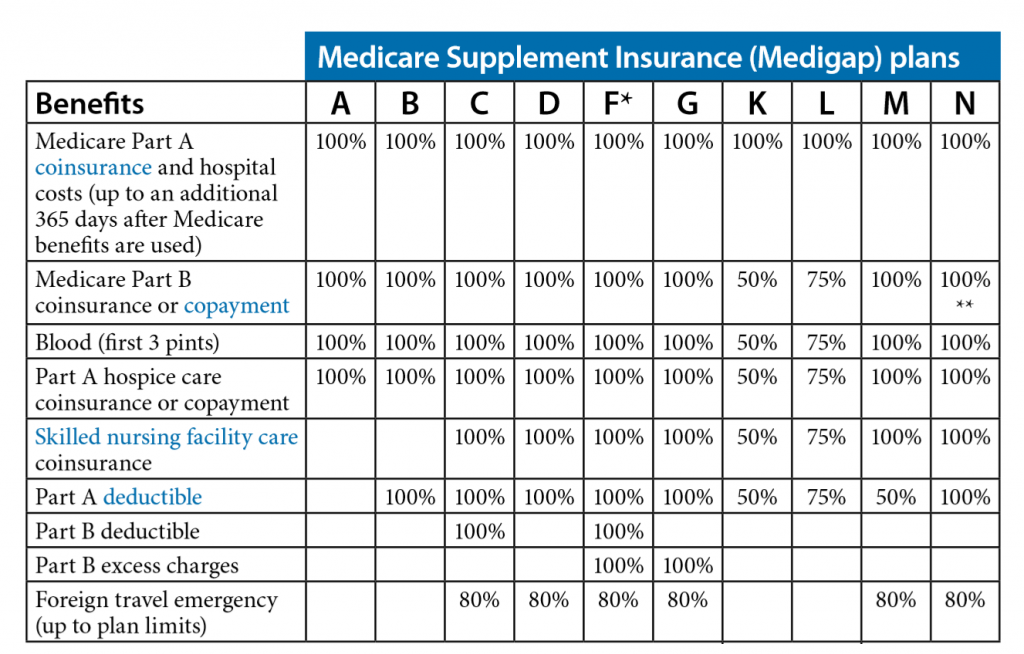

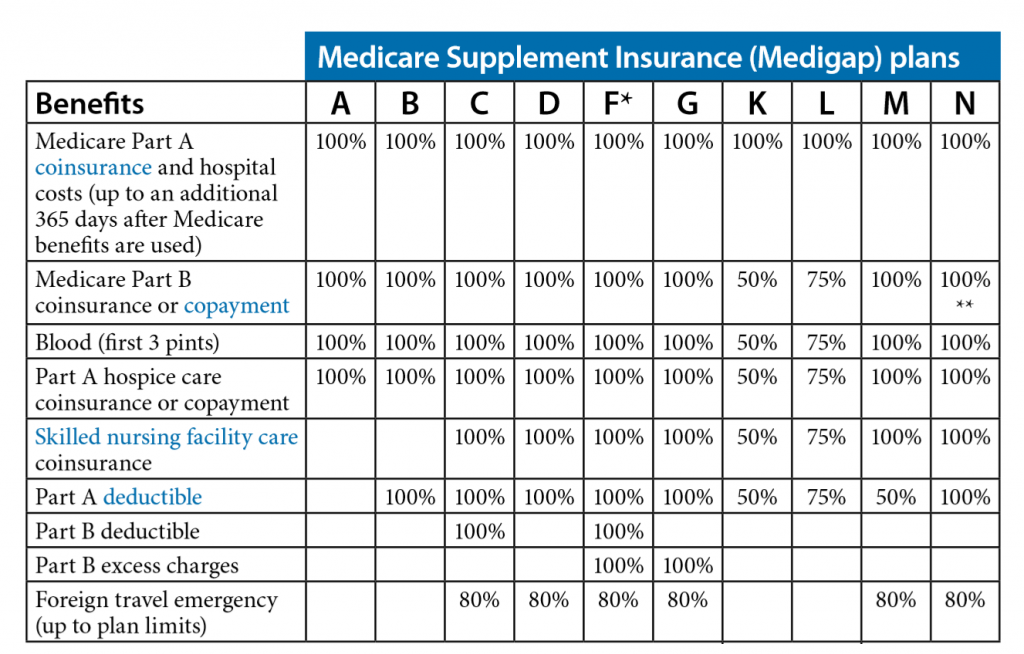

The 10 Standardized Medicare Supplement Plans

Nationwide, there are 10 “standardized” Medicare Supplement plans to choose from (Plans A through N). The term “standardized” means that the benefits and coverage for every Plan F, Plan G, etc. is exactly the same with every insurance carrier. Unlike MA plans, which are not standardized, it’s much easier to compare “apples with apples” with Medicare Supplement plans.

Medicare Supplement rates are not standardized. They vary significantly between insurance carriers. For that reason, it’s very important to shop around every year!

NOTE: In the preceding chart, notice that the only difference between Plan F and Plan G is the $183 per calendar year Part B deductible.

SEP Situations

Here are some SEP situations that would guarantee you the right to switch back to Original Medicare and a Medicare Supplement plan:

- The plan is leaving the Medicare program or stops service in your area.

- You move out of the plan’s service area.

- You leave the plan because the company has not followed certain rules or has misled you.

- You decide to switch to Original Medicare within the first year of joining an MA plan when first eligible for Medicare Part A at age 65.

If you are in one of these situations, you cannot be turned down for Medicare Supplement insurance coverage, regardless of your health!

If You Are Not In a Special Enrollment Period

If you are not in a SEP, you will have to wait until the AEP (between October 15th and December 7th) to switch back to Original Medicare (Part A and Part B) on January 1st of the following year.

Although you can switch back to Original Medicare, there is no guarantee that you will be able to get a Medicare Supplement plan because you will be medically underwritten, and you must be in relatively good health to qualify for a Medicare Supplement plan.

If You Have Serious Health Conditions, You May Not Be Able to Get a Medicare Supplement Plan!

If you are not in a SEP and you are coming off of an MA plan during the AEP, you would normally have to meet minimum underwriting requirements to qualify for a Medicare Supplement plan, and you could be turned down for coverage.

If you live in California and you have serious health issues, more than likely, I can still get you a Medicare Supplement without having to answer any medical questions on the application! Call me for more details!

The Pros and Cons of MA Plans and Medicare Supplement Plans

Is there really an advantage to having a Medicare Advantage plan? Let’s take a look at the pros and cons of each, and you can decide for yourself.

MA Plan Advantages

Here are some benefits of having an MA plan:

- MA premiums can be very low, and some plans have no monthly premiums at all.

- Some MA plans include Medicare prescription drug coverage (Part D).

- Maximum OOP costs are “limited.” Plans vary, but in 2017, the most you can pay in OOP costs is $6,700 per calendar year. (I wouldn’t really call this a “benefit” since $6,700 is a lot of money! With a Plan F Medicare Supplement, you won’t pay any OOP costs!)

- Some MA plans offer additional benefits such as vision, hearing, dental, and other health and wellness programs. (Note that some Medicare Supplement plans also offer additional benefits such as free gym memberships, vision, and hearing aid benefits.)

Medicare Supplement Plan Advantages

Here are some benefits of having a Medicare Supplement plan:

- You have much more FREEDOM of choice with a Medicare Supplement than you do with an MA plan because you can go to ANY doctor, hospital, specialist, or care facility in the United States as long as they accept Medicare. (You can’t do that with an MA plan.)

- You have much for financial stability with a Medicare Supplement than an MA plan because there are no unexpected spikes in costs and OOP expenses for co-payments, hospitalizations, surgeries, chemotherapy, etc.

- With a Plan F or Plan G Medicare Supplement, other than your premiums, your maximum OOP costs in a calendar year will be either $0 (Plan F) or $183 (Plan G) per calendar year in 2017. With an MA plan, your maximum OOP costs can be as high as $6,700 per calendar year!

- Chemotherapy is very expensive. With an MA plan, you have to pay the entire 20% Medicare Part B co-payment for chemotherapy, which can cost thousands of dollars. With a Plan F or Plan G Medicare Supplement, the most you will pay for Chemotherapy is either $0 (Plan F) or $183 (Plan G)!

- You are not limited to a specific geographic region or a restrictive network of doctors, hospitals, specialists, care facilities, etc. like you are with an MA plan. With most MA plans, you must use their providers or you may pay more or all of the costs if you go out of their network.

- With a Medicare Supplement, you can go directly to the specialist of your choice, ANYWHERE in the United States, as long as they accept Medicare. With most MA plans, you must go through your primary care doctor first (the “gatekeeper”) before you can see a specialist within your network.

- There are no HMO or PPO plans or networks with Medicare Supplements. If you have an MA plan and you go to a doctor, other health care provider, facility, or supplier that doesn’t belong to the plan’s network for non‑emergency or non-urgent care services, your services may not be covered, or your costs could be higher.

- If you want to go to a renowned treatment center such as the MD Anderson Cancer Treatment Center in Texas, you can do so with any Medicare Supplement, as long as they accept Medicare. You can’t do that with most MA plans.

- If you move to another part of the country, you can keep your Medicare Supplement, but you cannot keep your MA plan if you move out of your network.

- There are only 10 “standardized” Medicare Supplement plans to choose from, (Plan A through Plan N). Since Medicare Supplements are standardized, the coverage and benefits for every Plan F, Plan G, etc. is exactly the same with every insurance carrier, so it’s much easier to shop around and compare “apples with apples.” MA plans are not standardized, and the co-payments, deductibles, out of pocket costs, etc. vary significantly between MA plans, and they change every year making them unnecessarily complicated and confusing.

- Your Medicare Supplement plan cannot be cancelled as long as you pay your premiums. MA plans are annual contracts, and they can be cancelled or benefits changed at the end of each calendar year.

- There are no provider networks with Medicare Supplements. With MA plans, providers can join or leave a plan’s provider network anytime during the year meaning that you could have to start shopping around for a new doctor while simultaneously undergoing Chemotherapy or other specialized medical treatments.

- There is no AEP for Medicare Supplements, and you don’t have to shop around every year and make sure that your coverage, co-payments, co-insurance, deductibles, and benefits haven’t changed since the previous year. If there are any Medicare changes from one calendar year to the next, your Medicare Supplement will automatically pay the difference.

- You can travel around the US for as long as you want (or even move to a different geographic location), and your Medicare Supplement cannot be cancelled for leaving your “service area.” With most MA plans, if you travel outside of the MA plan’s service area for more than six months, you could be disenrolled from the plan.

- With most Medicare Supplements, there are no co-payments when you go to the doctor. With most MA plans, you have to pay co-payments when you go to the doctor.

- With Medicare Supplements, pre-certification is not required for surgeries, etc. as long as the procedure is “medically necessary.” With most MA plans, pre-certification is required for surgeries or before getting expensive treatments.

- You can switch Medicare Supplement plans or insurance carriers any time of the year as long as you meet minimum health and underwriting requirements. With an MA plan, you can only join or leave an MA plan during the AEP. Otherwise, you are locked into your plan for the entire calendar year, except for certain circumstances, such as moving out of your plan’s service area, etc.)

As you can see, you are much better off with a Medicare Supplement plan than you are with a Medicare Advantage plan!

Conclusion

If you currently have a Medicare Advantage (MA) plan, you have given up your Original Medicare rights that you have worked so hard for, and you are compromising your freedom to go to the best doctors, hospitals, specialists, neurosurgeons, care facilities, etc. in the United States.

I would strongly urge you to switch back to Original Medicare and get a Medicare Supplement plan during the upcoming AEP, between October 15th and December 7th)! Contact me TODAY for more information or a free quote!

As an independent insurance agent specializing in Medicare Supplements, I work with ALL of the major insurance carriers, not one particular company. I will shop around for you, every year, and save you money on your Medicare Supplement insurance!

If you live in California and you have a serious medical condition, more than likely, I can still get you a Medicare Supplement at a competitive price without answering any of the health questions on the application!

I hope that you have found this article to be helpful and informative. Please feel free to forward this article to anyone who may be interested.

Your comments and feedback are appreciated! If you have any questions, please contact me… I’m always happy to help!

Thank you!

Ron Lewis

www.MedigapExpress.com

Ron@RonLewisInsurance.com

866.718.1600 (Toll-free)

–