If you’ve ever tried to compare Medicare Prescription Drug Plans (PDPs), also known as Medicare Part D, you know how confusing it can be. There are dozens of options, and each plan has its own list of covered drugs (called a formulary), preferred pharmacies, and cost structure. What looks like a small difference in co-pays or premiums can easily add up to hundreds of dollars over the course of a year.

Why Most Agents No Longer Sell Prescription Drug Plans

You might assume that a licensed insurance agent can help you find the best plan, and in the past, many could. However, today’s system makes that much more difficult. Because of how Medicare’s certification and contracting rules work, most independent agents are not certified with every drug plan available in your area. They can only recommend or enroll you in a limited number of specific plans they are contracted with and certified to sell.

If another company offers a plan with lower co-pays or better coverage for your medications, your agent may not even be allowed to discuss it with you. Why? Because they don’t get paid for selling plans they’re not certified or contracted to represent. Even if they know a different plan would save you money, compliance rules and commission structures prevent them from showing it to you.

The Hidden Time and Cost Burden on Agents

Before an agent can help anyone with a PDP or a Medicare Advantage (MA) plan, they must complete extensive training and certification every year. This starts with the AHIP certification exam, which takes many agents 10–20 hours of study time to complete. The AHIP exam covers topics such as Medicare compliance, plan rules, CMS marketing guidelines, etc.

But that’s only the beginning. Agents must also spend time studying and taking individual certification exams for EVERY insurance company whose plans they want to sell. Each carrier’s certification process is different. Some require several hours of training, testing, and annual renewal. Altogether, a well-rounded agent could easily spend 50+ hours each year just keeping up with certifications before they can even begin helping clients.

Then there are the CMS compliance rules, which now require all sales calls related to PDPs and MA plans to be recorded and stored securely for 10 years! The added administrative burden and potential liability make it even less practical for agents to offer these plans, especially since commissions for prescription plans are typically under $100 per year per client. Many agents have simply decided that it’s not worth the time and effort.

How You Can Shop and Enroll in a Drug Plan On Your Own

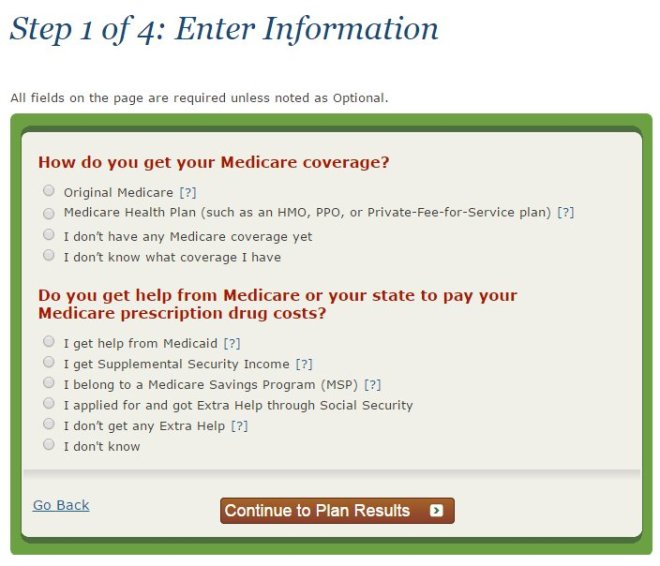

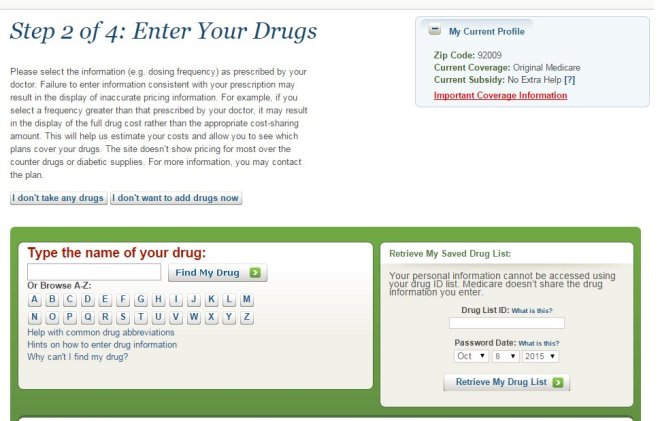

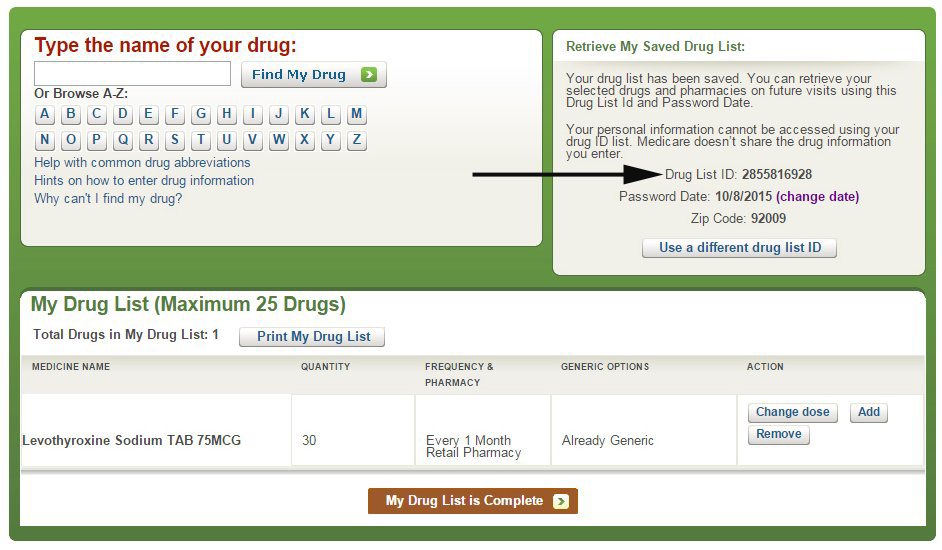

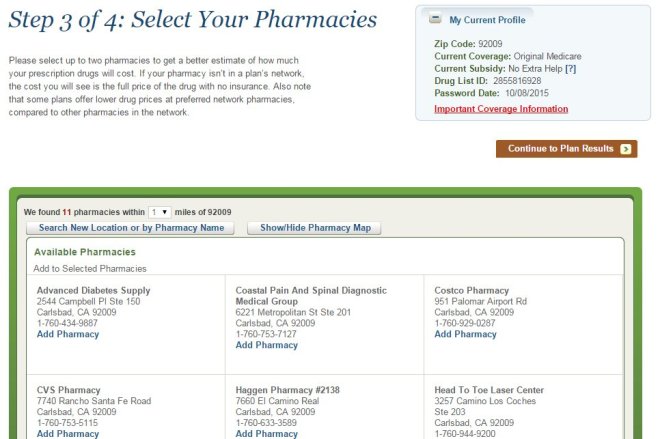

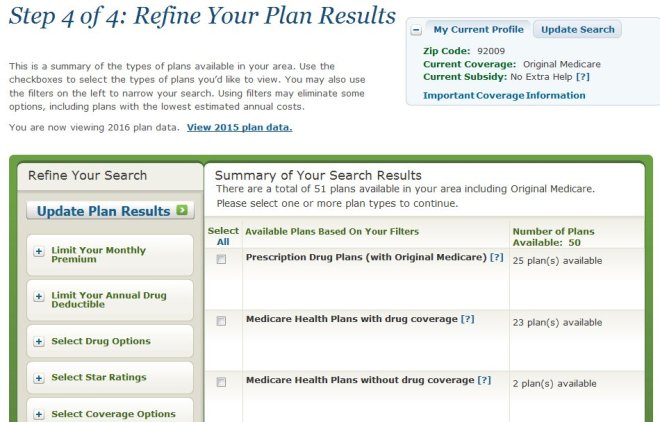

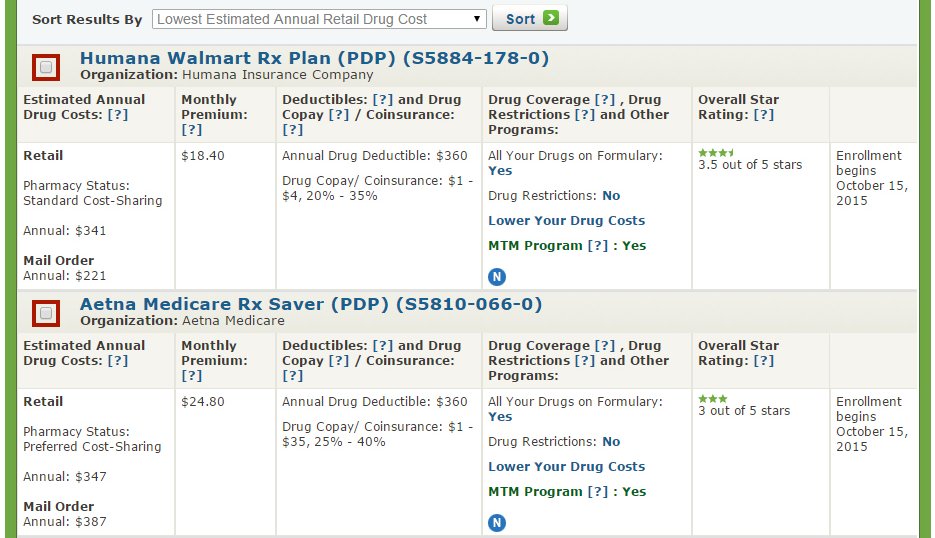

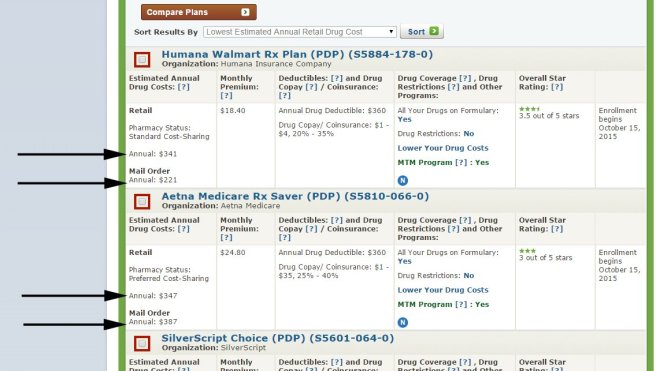

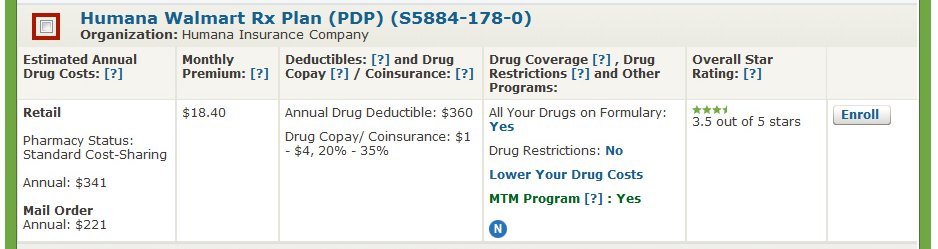

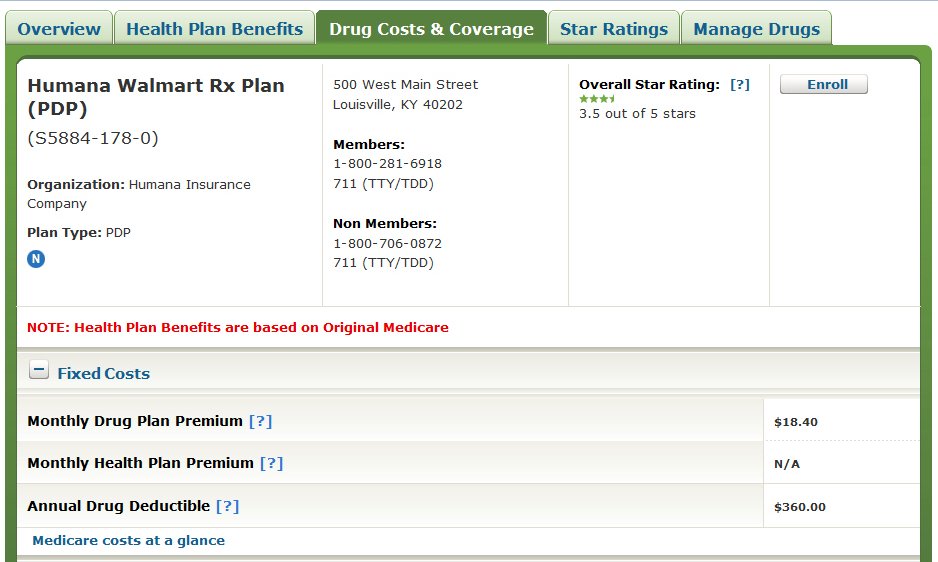

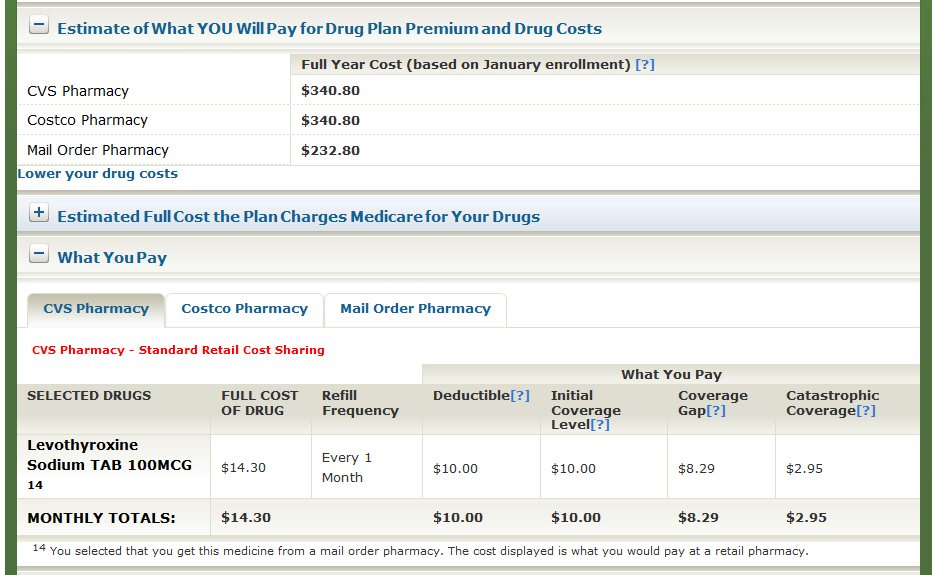

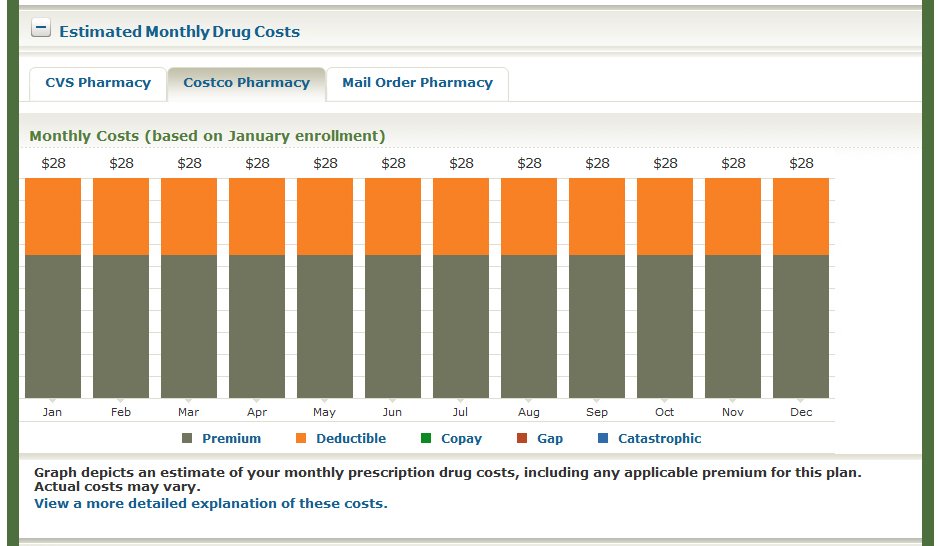

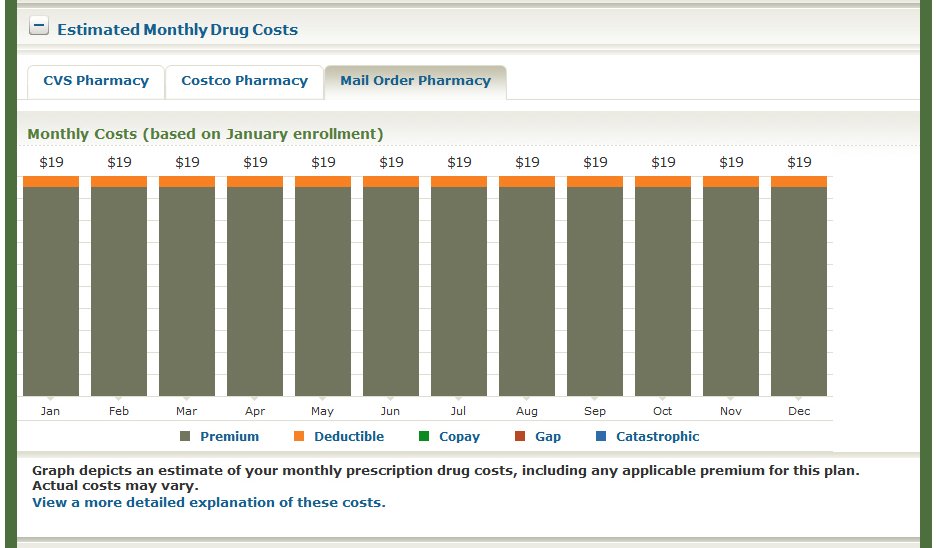

Fortunately, Medicare makes it easy for you to shop around on your own and sign up for a prescription drug plan at www.Medicare.gov by using the exact same tool that agents use.

This past year, I put together a short video that explains how to shop for and sign up for a Medicare prescription drug plan using the Medicare Plan Finder tool. It’s actually very easy, and there aren’t any significant changes since last year. Please click here to watch the video.

The Medicare Plan Finder is available 24/7 and it is updated every fall with the latest plan information. It allows you to make an informed decision without pressure or bias, and without worrying whether your agent is certified to sell a particular plan.

Review Your Coverage Each Fall

Even if you’re happy with your current PDP, it’s important to review your coverage each year during the Annual Election Period (AEP), which goes from October 15th through December 7th each year. PDPs are annual contracts, and drug prices, plan premiums, and pharmacy networks can change every year. What’s good this year may not be so good next year.

It only takes about 15 to 20 minutes to shop around and review your PDP options, and it could save you literally hundreds of dollars and ensure you have the right coverage for your specific prescriptions.

The Bottom Line

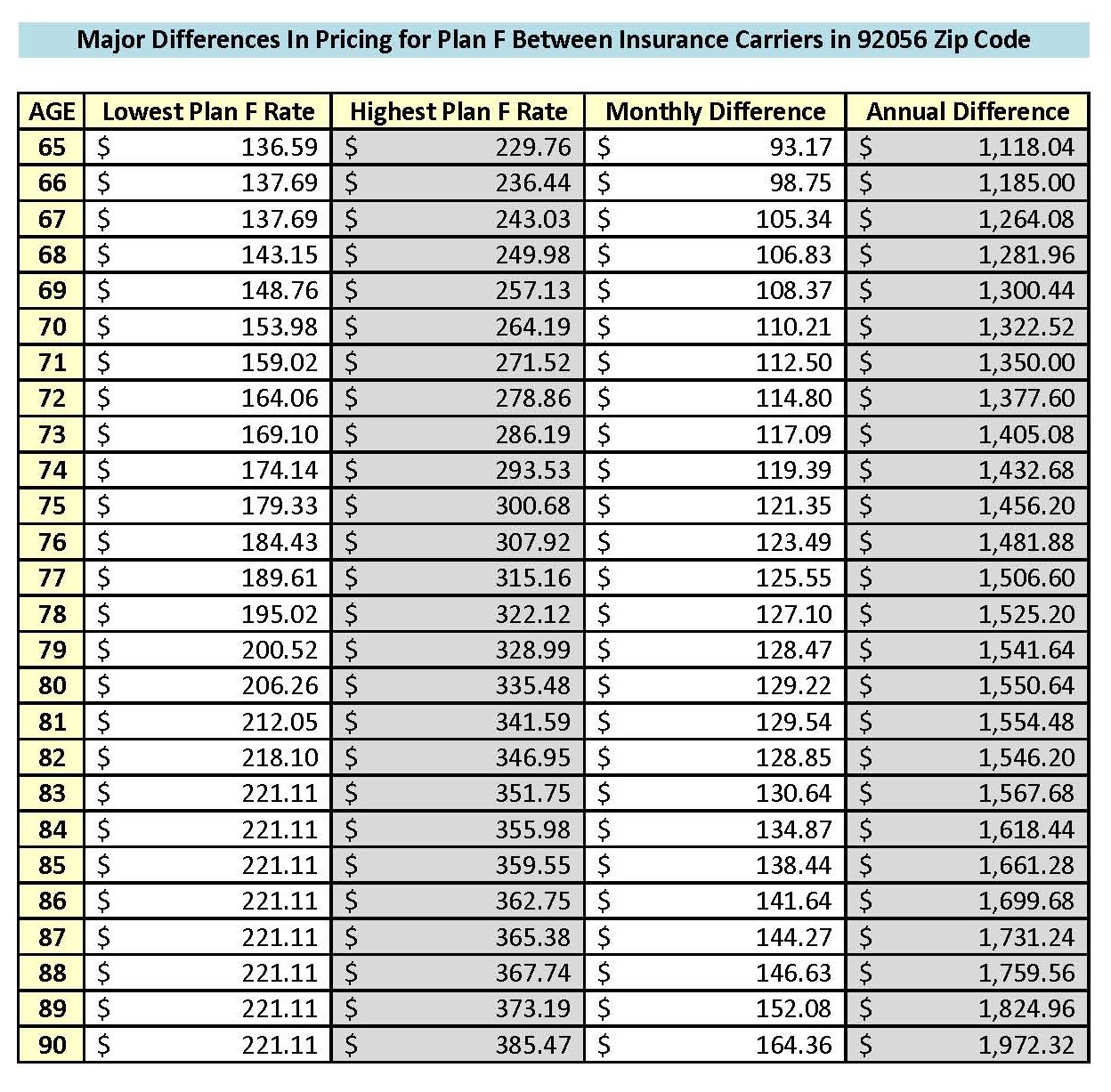

Most Medicare agents are honest, hardworking professionals who want to help their clients, but the system is stacked against them when it comes to prescription drug plans. Between certification costs, compliance rules, and low commissions, many agents have chosen to focus on Medicare Supplements, Medicare Advantage plans, or other types of insurance products instead.

By learning how to shop for your own prescription drug coverage at Medicare.gov, you can take control of your health care costs, stay informed, and make sure you’re always getting the best prescription drug plan every year.

About the Author

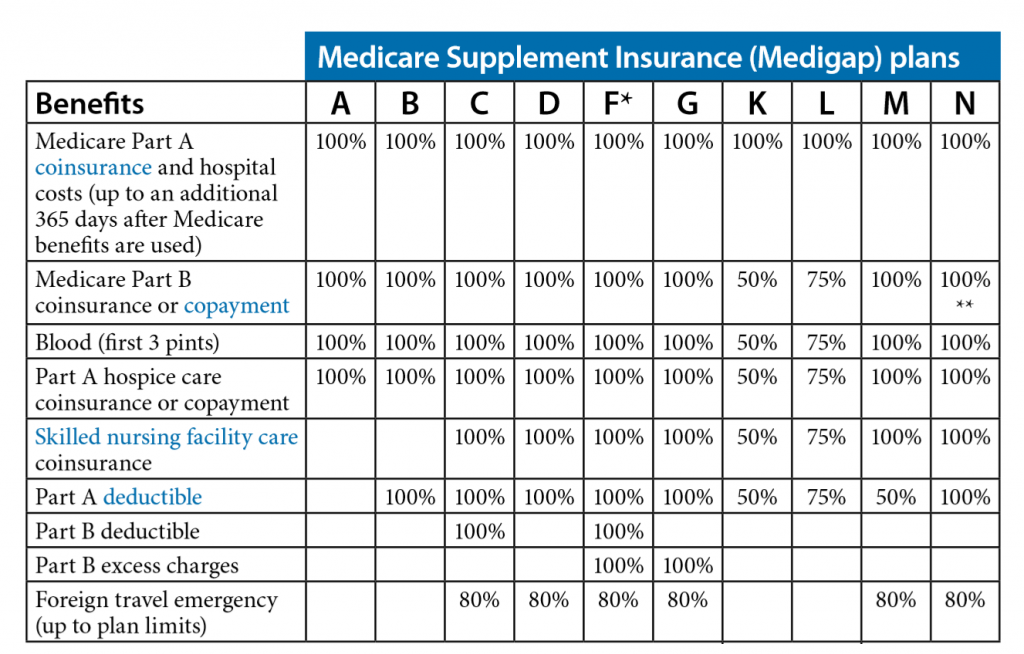

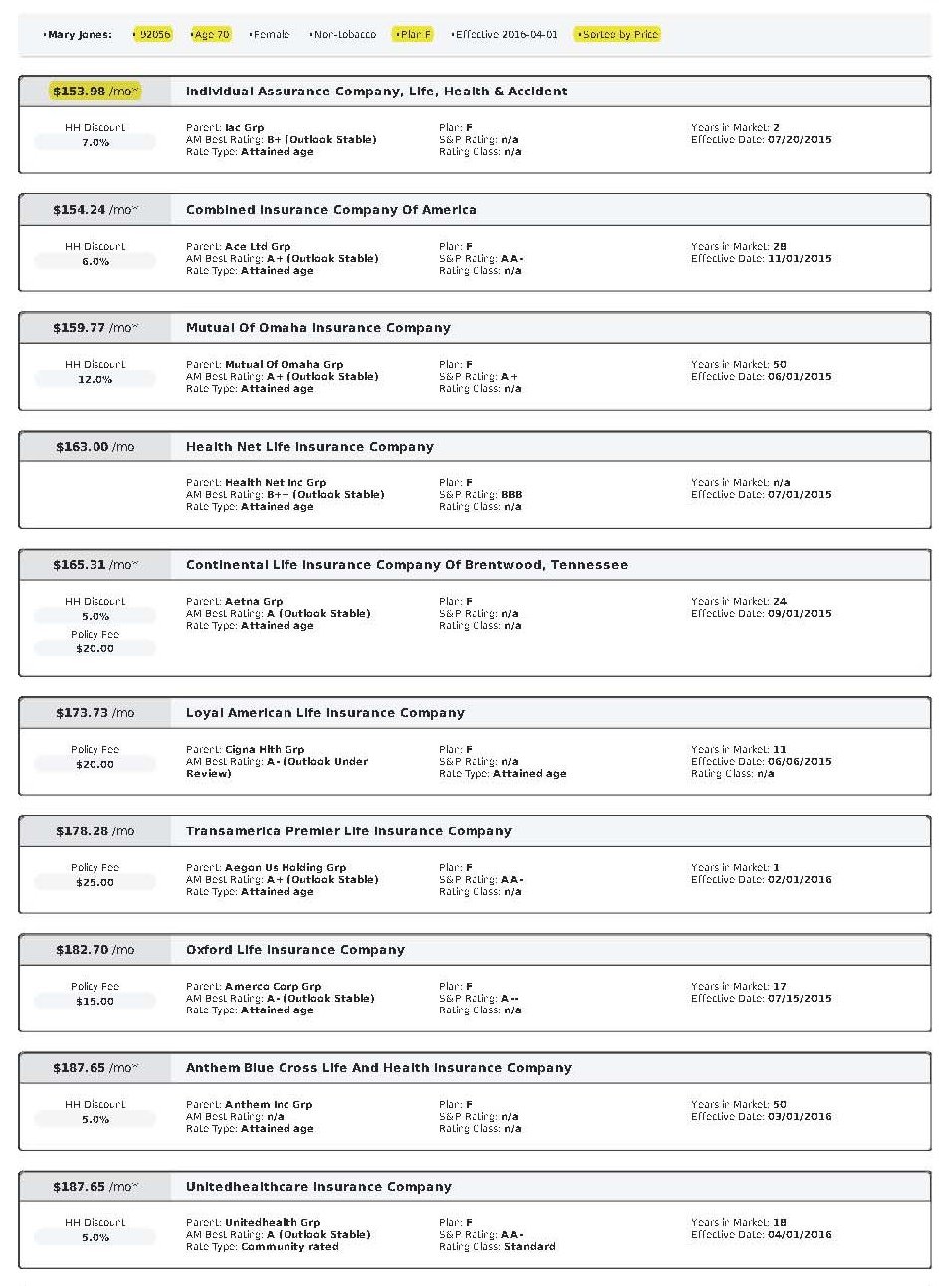

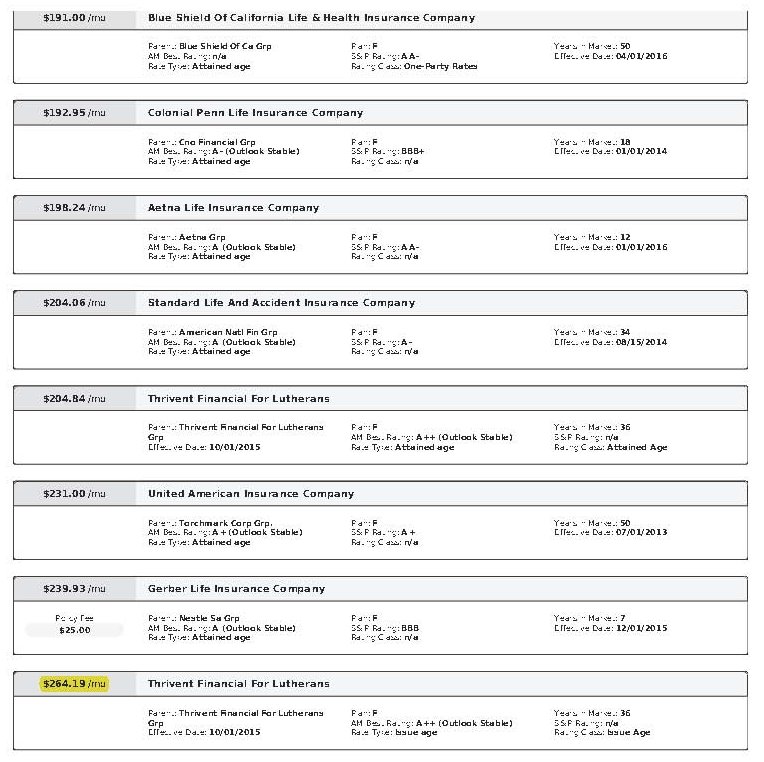

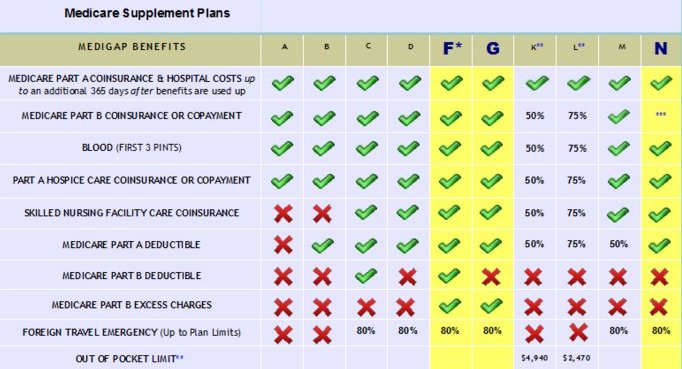

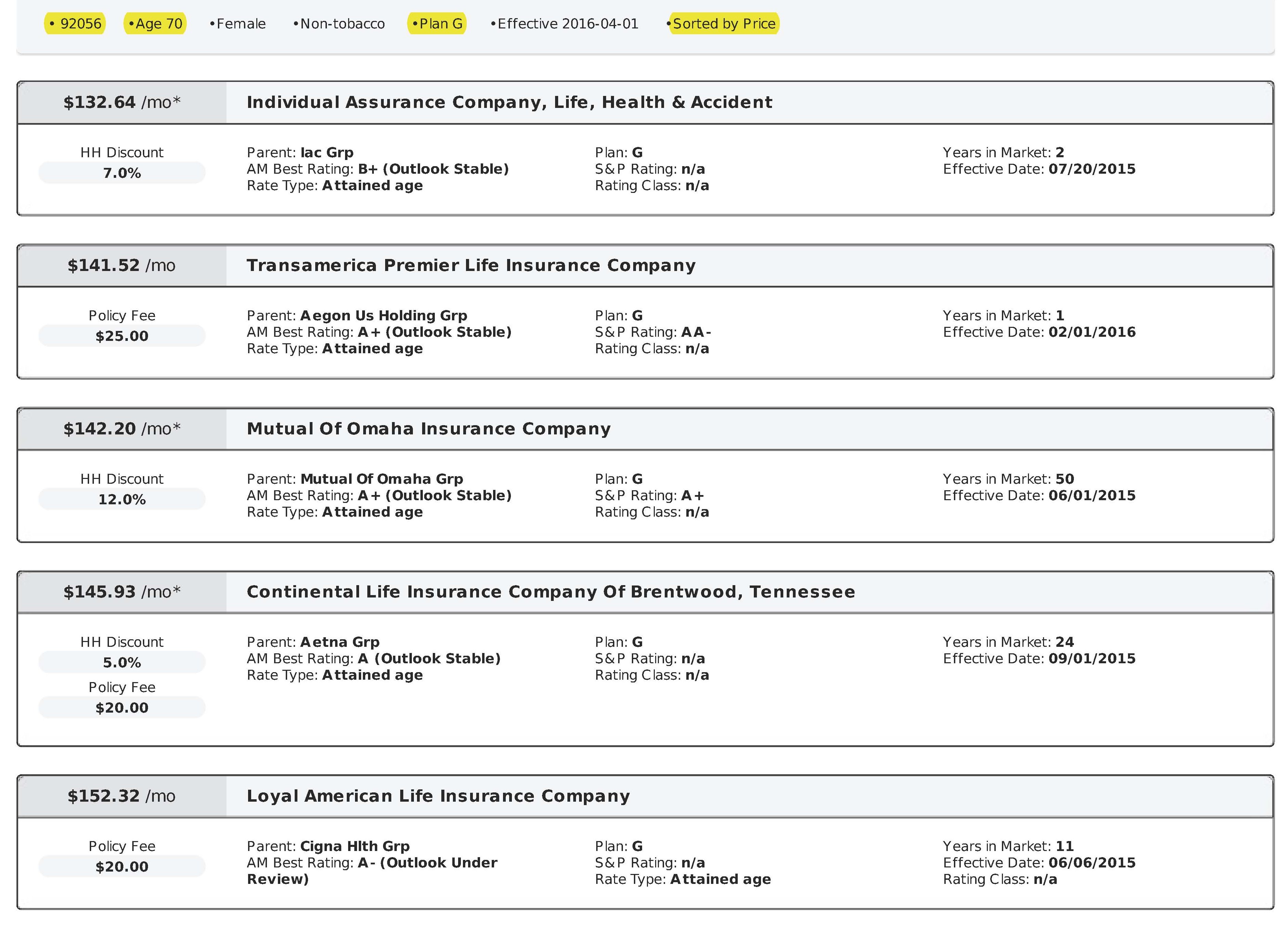

As an independent Medicare Supplement insurance specialist, I work with all the major carriers throughout California, Nevada, and several other states. I shop around for my clients every year during their 60-day annual open enrollment period under the California Birthday Rule to help them save money on their Medicare Supplement premiums. Many of my clients have saved hundreds, even thousands of dollars on the same exact plan and coverage! Please click here to see what my clients have to say about my services.

There is no charge for my services as I’m compensated by the insurance carriers, not my clients. My goal is to help you find the lowest premiums and provide the best personal service possible—year after year. Unlike many agents, I won’t disappear after you sign up!

If you enjoyed this blog and found it helpful, please leave your comments, questions, or feedback below and feel free to share this article with your friends!

Thank you!

Ron Lewis

Ron@RonLewisInsurance.com

www.MedigapShopper.com

(760) 525-5769 – Cell

(866) 718-1600 – Toll-free