Signing up for Medicare can seem like a confusing and daunting task, but it’s really not that bad. This article will hopefully answer any questions you have and make the Medicare maze easy to navigate.

What is Medicare?

Medicare is the federal health insurance program for:

- People who are 65 or older

- Certain younger people with disabilities

- People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Who is Eligible For Medicare?

You are generally eligible for Medicare if you are 65 or older, a U.S. citizen or permanent legal resident, and have lived in the U.S. for at least five year

What Are the Four Parts of Medicare?

Medicare is composed of four parts:

- Part A (Hospital insurance)

- Part B (Medical insurance)

- Part C (Medicare Advantage plans)

- Part D (Prescription drug plans)

NOTE: Medicare Parts A and B are also referred to as “Original Medicare.”

What Does Medicare Part A Cover?

Part A covers things like inpatient hospital stays, home health care and some skilled nursing facility care.

What Does Medicare Part B Cover?

Part B covers things like doctor visits, outpatient services, X-rays and lab tests, and preventive screenings.

What Does Medicare Part C Cover?

Part C is also known as Medicare Advantage (MA). An MA plan is a Medicare-approved plan from a private company that offers an alternative (replacement) to Original Medicare (see note below) for your health and drug coverage. These “bundled” plans include Part A, Part B, and often Part D. In most cases, you must only use doctors who are in the plan’s network. Most MA plans are HMO’s and are restrictive and limit your options to what doctors, specialist, hospitals, and care facilities you can go to.

IMPORTANT: A much better option to Part C, in my opinion, is a Medicare Supplement plan, also known as “Medigap” because it picks up the gap in coverage not covered by Medicare. With a Medigap plan, there are NO networks, and you have much greater freedom of choice as to which doctors, specialists, care facilities, etc. that you go to. You can go to any doctor, specialist, care facility, etc. ANYWHERE in the US as long as they accept Medicare, and most do, about 93%.

What Does Medicare Part D Cover?

Part D covers the cost of prescription drugs (including many recommended shots or vaccines).

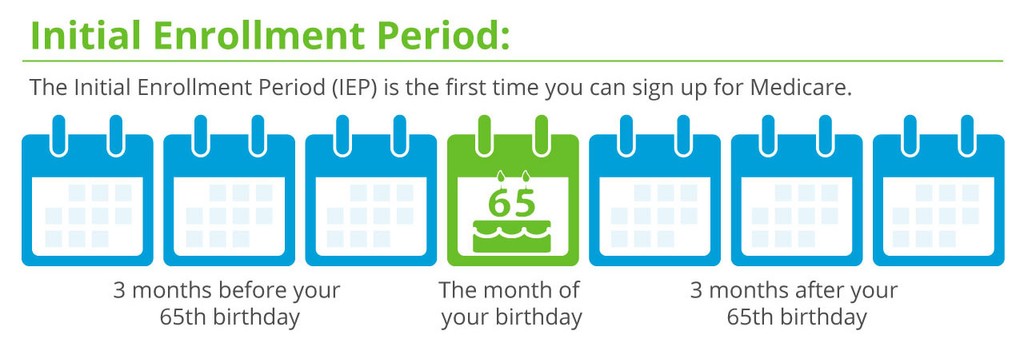

The Medicare Initial Enrollment Period (IEP)

If you are turning 65 and are eligible for Medicare, you can sign up for Original Medicare, aka Medicare Part A (Hospital insurance) and Part B (Medical insurance) during your Initial Enrollment Period (IEP), which typically starts three months before the month of your 65th birthday and ends three months after your birth month. For example, if your birthday is June 23rd, your IEP would begin on March 1st and end on September 30th of that year.

NOTE: Medicare normally begins on the 1st of the month of your 65th birthday. If you want your coverage to start then, you need to sign up for Medicare during the 3 months before the month of your birthday. Otherwise, your Medicare won’t start until sometime after your birthday month.

For most people, their Medicare normally begins on the 1st of the month of their 65th birthday. However, if your birthday is on the 1st of the month, your Medicare would begin on the 1st of the previous month. For example, if your birthday is June 1st, your Medicare would normally begin on May 1st.

NOTE: If your birthday is on the 1st of the month, your IEP begins and ends one month earlier as well. For example, if you turn 65 on June 1st, your IEP would begin on February 1st and end on August 31st.

Some People Are Automatically Enrolled in Medicare When They Turn 65 and Some Are Not

If you are currently receiving Social Security or Railroad Retirement Board benefits before you turn 65, you will normally be automatically enrolled in Medicare, and you’ll receive your Medicare card in the mail before your 65th birthday. You’ll still have an IEP, and during this seven-month window, you can still make Medicare coverage decisions such as signing up for a Medicare Supplement and a Prescription Drug Plan (PDP).

IMPORTANT: If you are not currently receiving Social Security or Railroad Retirement Board benefits before you turn 65, you’ll have to sign up for Medicare on your own. If that’s the case, be sure to write down your IEP dates on your calendar before you turn 65.

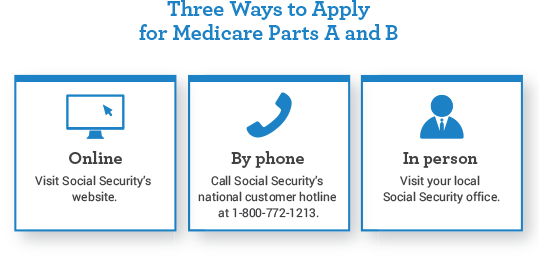

Three Ways to Sign Up for Medicare

There are the three different ways to sign up for Medicare:

- You can apply for Medicare online at the Social Security Administration’s website (https://secure.ssa.gov/iClaim/rib).

- You can call Social Security toll-free number at 1-800-772-1213 and sign up on the phone.

- You can visit your local Social Security office.

I know that it doesn’t seem intuitive that you would contact Social Security to sign up for Medicare, but you do! When you apply for Medicare, you will need to provide personal and financial information including your name, Social Security number, birth date, income, etc.

After you apply for Medicare, you will receive a confirmation notice in the mail indicating whether your application has been approved, etc. If you have any questions or concerns about the Medicare enrollment process, you can contact Medicare directly at 1-800-MEDICARE (1-800-633-4227).

Do I Need to Enroll in Medicare If I’m Working After Age 65

For most people, Medicare Part A (Hospital insurance) is free because you or your spouse paid Medicare taxes long enough while working, generally at least 10 years. However, Part B (Medical insurance) is not free. There is a monthly premium for Part B, which is currently $164.90 each month for most people (or higher depending on your income).

You’ll pay a higher monthly premium for Part B if your modified adjusted gross income (MAGI), as reported on your IRS tax return from 2 years ago, is more than $97,000 in 2023 if you file an individual tax return or are married and file separately, or $194,000 if you are married and file a joint tax return. Please click here for more detailed information about the Part B premiums. Social Security will tell you if you have to pay a higher premium because of your income.

NOTE: If you are planning to continue working past age 65, you may be able to delay enrolling in Medicare Part B and avoid paying the Medicare Part B monthly premium. Since Medicare Part A is usually free, most people sign up for it even if they are working.

If you have “creditable” health coverage from your employer or are covered under a spouse’s employer plan, you may qualify for a Special Enrollment Period (SEP), and be able to delay enrolling in Part B without a penalty.

Medicare defines “creditable coverage” as coverage that is at least as good as what Medicare provides.

Here are some situations that will affect when you should begin your Medicare coverage:

- If an employer has 20 or more employees, you can generally choose to delay Medicare enrollment, drop your employer coverage for Medicare, or have both Medicare and employer coverage.

- If an employer has fewer than 20 employees, you will generally need to enroll in Medicare during your IEP.

- If you have health coverage through a spouse’s employer, what you can do will depend on the employer’s rules. You may be able to delay signing up for Medicare or you may need to enroll at age 65.

IMPORTANT: When you are turning 65, if you aren’t sure if your employer plan provides creditable coverage, you should call Social Security to verify. Otherwise, you could end up paying a penalty.

What If I’m Coming Off An Employer Group Plan?

If you qualified to delay Medicare because you had creditable coverage from an employer, there is an 8-month Special Enrollment Period (SEP) for enrolling in Medicare Parts A and B.

IMPORTANT: Be careful because this SEP can be tricky. Although you have the entire 8 months to get Medicare Parts A & B, you only get the first 2 months to enroll in Part C or Part D without penalty. If you enroll after the two-month period, you’ll face late enrollment penalties for Part D (regardless of whether you end up with a stand-alone Part D plan or a Medicare Advantage plan that includes drug coverage).

What If I Don’t Enroll in Medicare On Time?

If you don’t sign up for Medicare Part A, Part B, or Part D on time, you will pay late enrollment penalties for life so make sure to sign up for Medicare coverage during your IEP unless you have other creditable coverage that’s comparable in value to Medicare, such as from an employer. Please click here for more detailed information.

It’s a good idea to start researching your Medicare options a few months before your 65th birthday to make sure you have enough time to enroll and choose the plan that’s right for you.

Original Medicare Will Not Cover All of Your Costs!

Original Medicare (Part A and Part B) does not cover 100% of your medical costs. Like most health insurance, Medicare generally comes with out-of-pocket (OOP) costs including co-payments, coinsurance, and deductibles. Medicare usually pays approximately 80% of allowable charges for covered services.

The Part A Deductible and Co-payments

If you’re a hospital inpatient, Medicare Part A generally covers your care for a limited time. A deductible or copay generally applies.

NOTE: The Part A deductible isn’t an annual deductible, it’s a “benefit period” deductible meaning there can be multiple Part A benefit periods and deductibles per calendar year. In 2023, the Part A deductible per benefit period is $1,600.

The Part A benefit period begins the day you go into a hospital or skilled nursing facility and ends when you have been out for 60 consecutive days in a row. It’s possible to have multiple benefit periods in a calendar year, and without a Medicare Supplement, you would have to pay the full deductible amount for each benefit period!

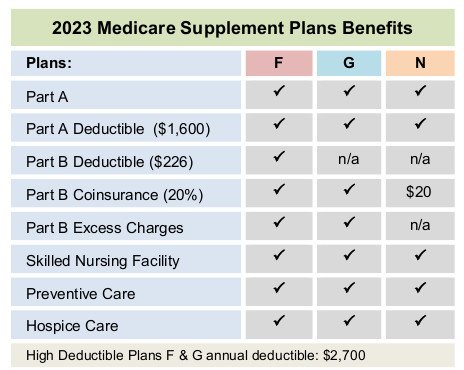

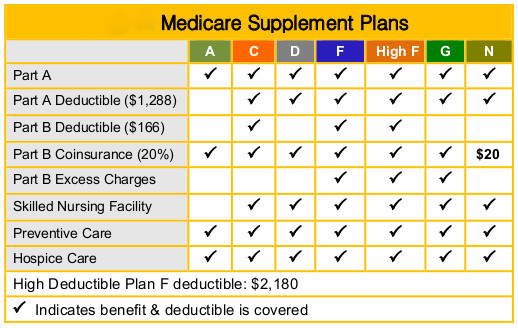

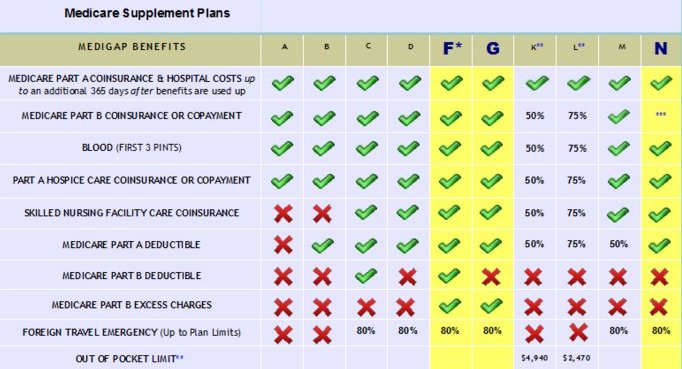

Most Medicare Supplements pay for all the Part A deductibles, co-payments, etc. With a Plan G Medicare Supplement, your only out-of-pocket cost for the entire year is the Part B deductible, which is currently $226 in 2023.

In 2023, after you pay the $1,600 Part A deductible for each benefit period, there are no hospital co-payments for the first 60 days, but there are co-payments if you are in a hospital for longer than 61 days. Most Medicare Supplements will cover all of these costs.

The Medicare Part B Deductible

In 2023, the Medicare Part B calendar year deductible is $226. Unlike Part A, the Part B deductible is payable only one time per calendar year.

What is the Maximum Out-of-Pocket Expense Limit Under Original Medicare?

Original Medicare (Part A and Part B) have no out-of-pocket maximum amount.

NOTE: A Plan G Medicare Supplement will pick up ALL Medicare-approved costs over and above the $226 Part B deductible!

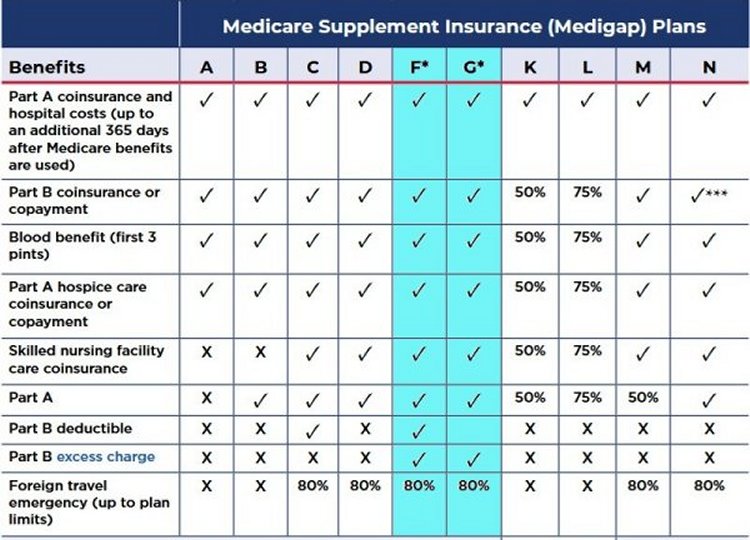

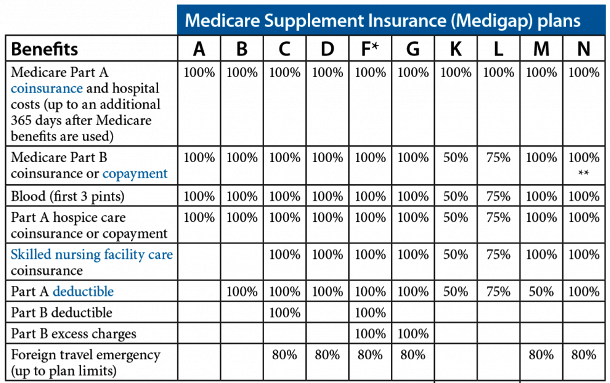

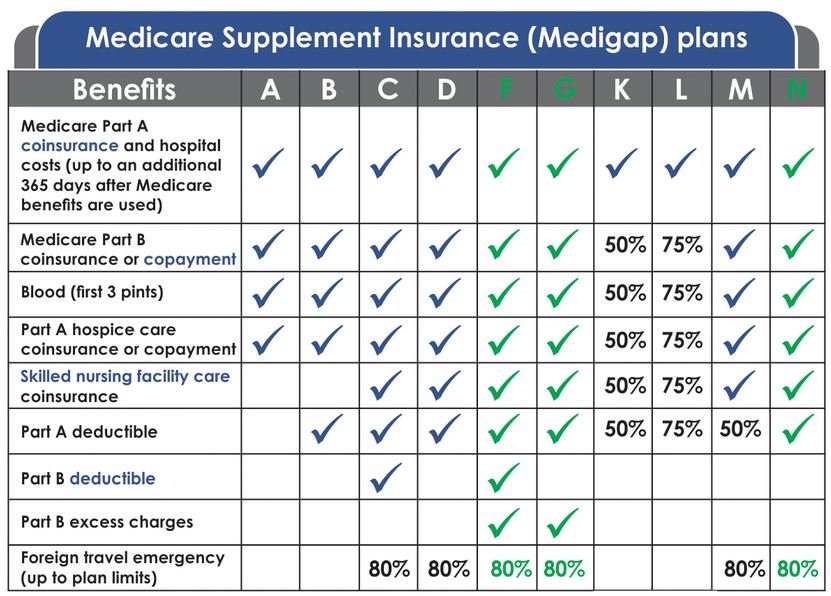

10 Standardized Medicare Supplement Plans to Choose From

Nationwide, there are 10 “standardized” Medicare Supplement plans to choose from, Plan A through Plan N. These plans are standardized meaning that Plan G is Plan G, Plan N is Plan N, etc. The coverage and benefits are exactly the same with every Plan G, Plan N, etc. making it easier to compare “apples with apples,” etc.

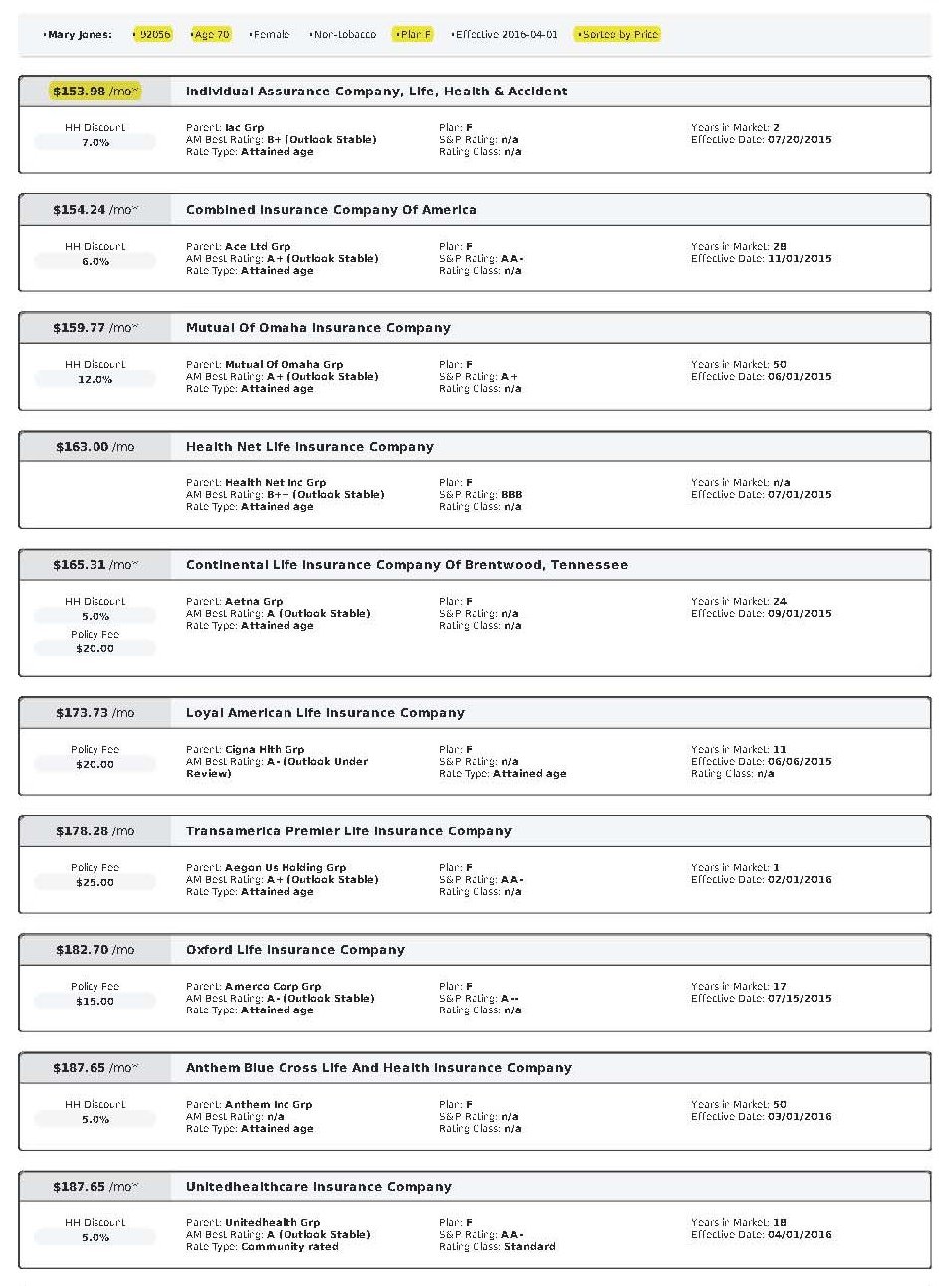

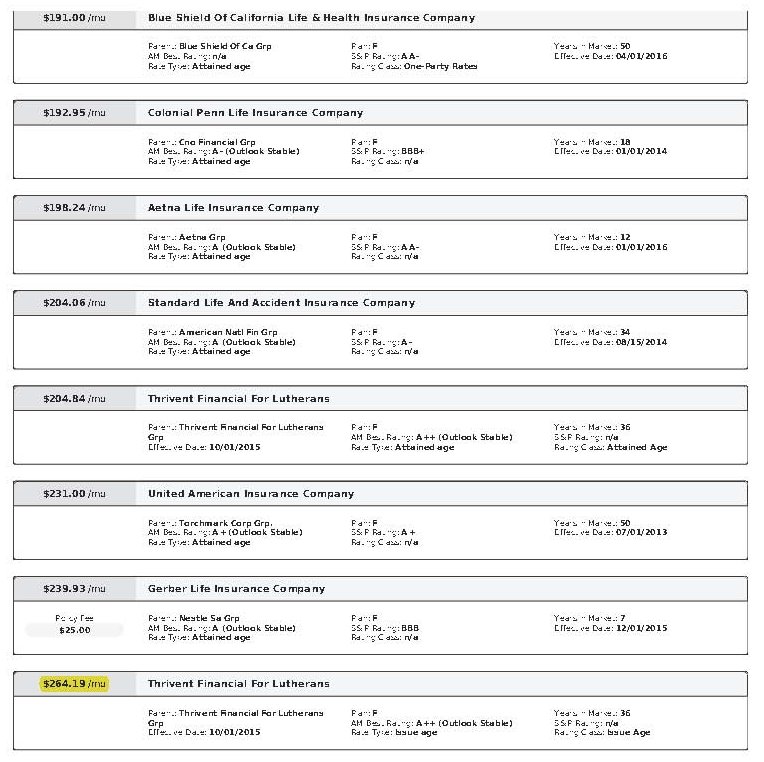

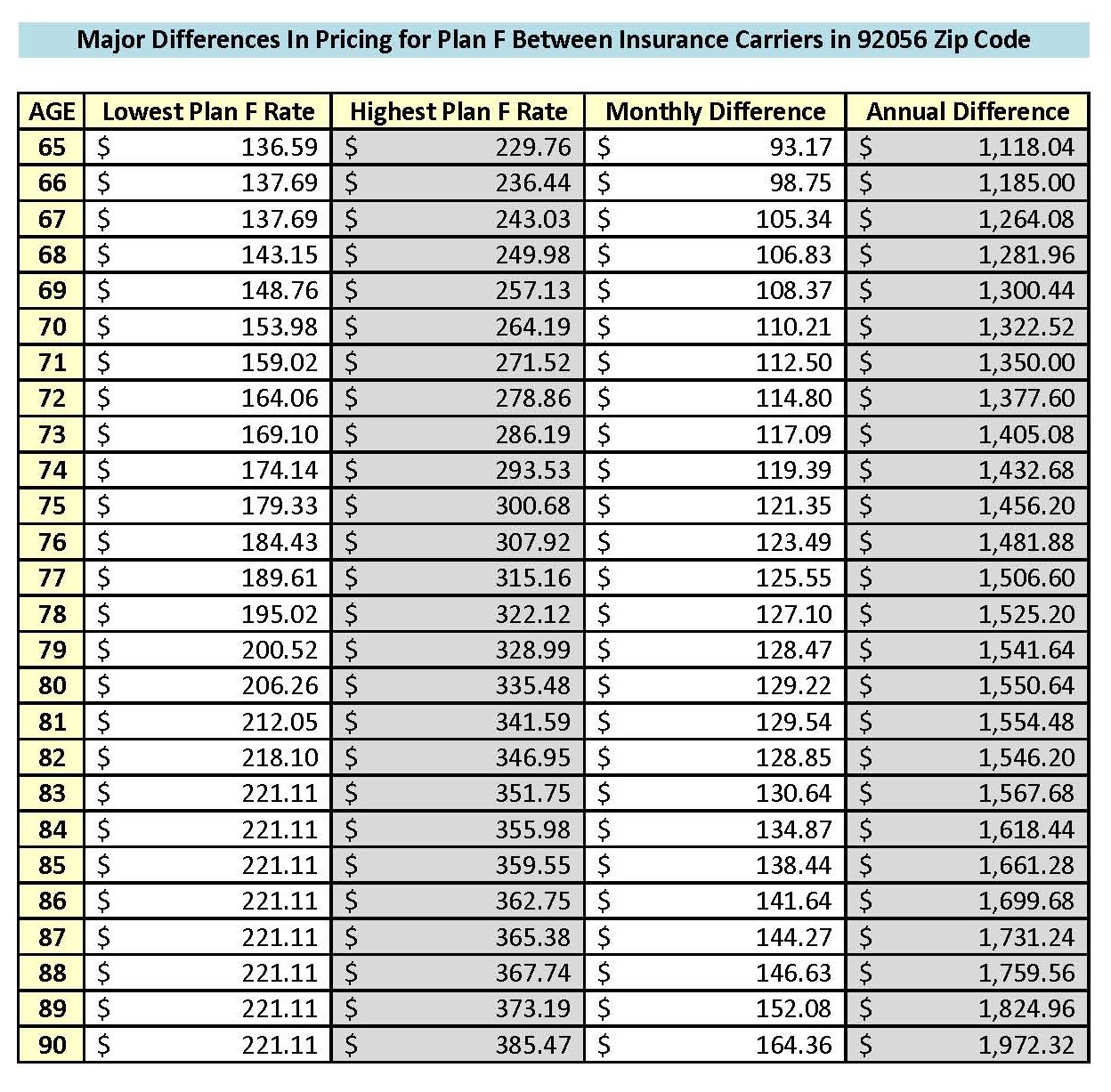

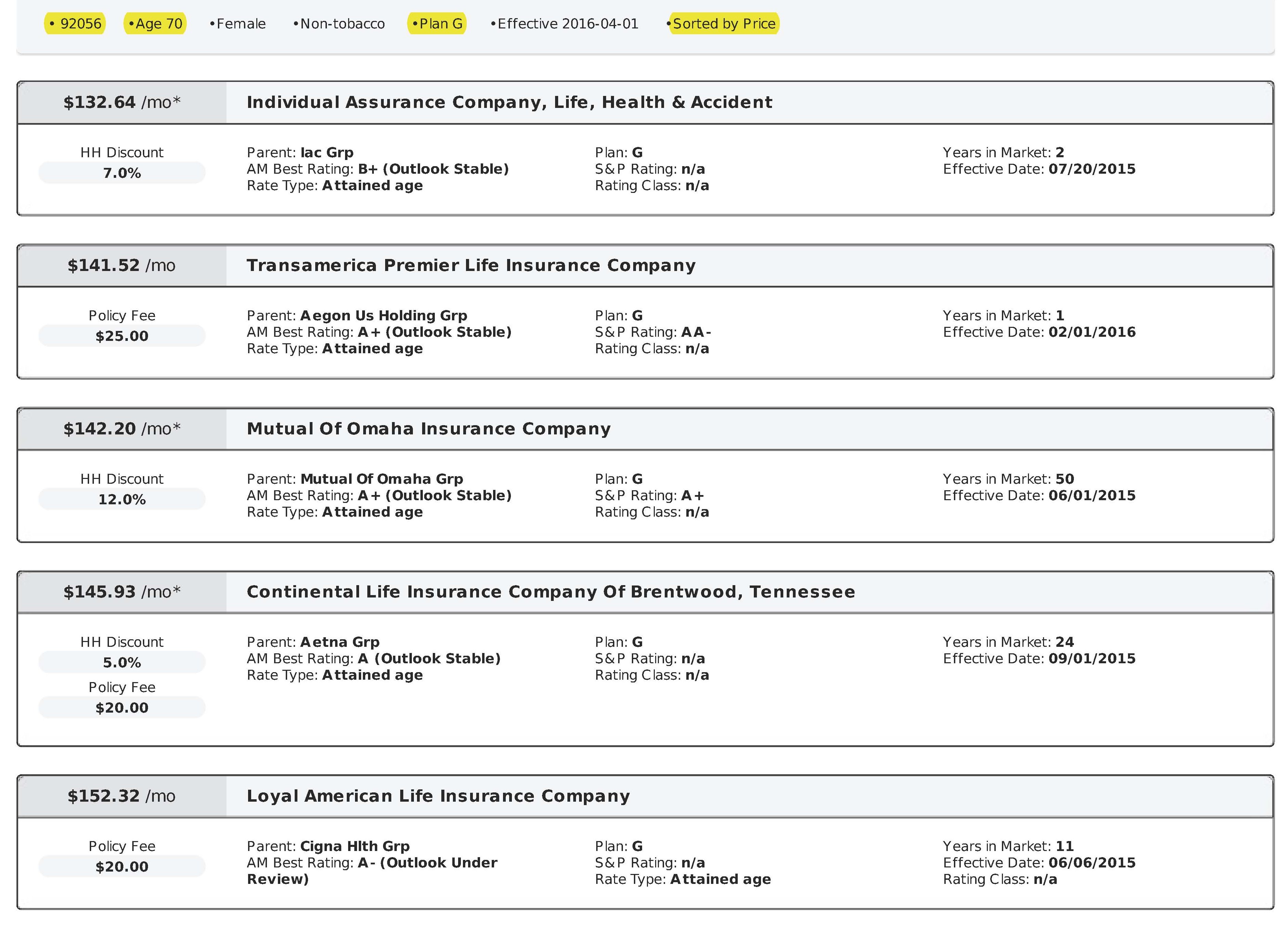

Although these plans are standardized, the rates are not standardized, so it is important to shop around and compare because the rates vary significantly between insurance carriers for the same identical plan and coverage.

Since there are co-payments, coinsurance, and deductibles and no out-of-pocket maximum with Original Medicare (Part A and Part B), most people get a Medicare Supplement plan in addition to Original Medicare to pay for most of these costs.

The Plan G Medicare Supplement is the Most Popular and Cost-Effective Plan

Of the 10 standardized Medicare Supplement plans, the three most popular plans are Plan F, Plan G, and Plan N. Of the three plans, Plan G is the best plan and most cost-effective because your only OOP cost for the entire year is the Medicare Part B deductible, which is $226 for all of 2023.

NOTE: The Part B deductible can change from year to year, but historically, it has never increased significantly. Once you meet this small annual deductible, you normally won’t have any other costs for the remainder of the year.

How Much Do Medicare Supplement Plans Cost?

In California, rates are based primarily on age and zip code, so Plan G will cost less for someone who is age 65 rather than age 85. For example, in the San Diego area (zip code 92024), the rates for age 65 range from $100 per month to $203 per month! For age 85 in the same zip code, the rates range from $221 per month to $395 per month!

The California Birthday Rule

In California, you can change your Medicare Supplement plan any time of the year, but you would normally have to be in relatively good health to do so because you will have to answer health questions and be medically underwritten. However, California is one of only a few states with a birthday rule called the California Birthday Rule.

Under this law, if you currently have a Medicare Supplement, you can apply for a new Medicare Supplement with “equal or fewer” benefits during the 60 days following your birthday each year, and you cannot be turned down for coverage. For example, if you have Plan G, you can switch to Plan G with any other insurance carrier, REGARDLESS OF YOUR HEALTH and without answering any health questions on the application.

NOTE: Only six states currently have a Medicare Supplement birthday rule including California, Idaho, Illinois, Louisiana, Nevada, and Oregon. Before 2022, only two states had a birthday rule.

It’s Important to Shop Around and Compare Medicare Supplement Rates Every Year!

Since there is such a large discrepancy in pricing and because Medicare Supplement rates are constantly changing as we get older, it’s important to take advantage of the California Birthday Rule and compare prices and shop around every year or two.

About Me

I hope that you have found this information to be interesting and informative. I’m an independent insurance agent with over 15 years of experience specializing in Medicare Supplement insurance, primarily in California. As an independent agent, I work with most of the major insurance carriers including Mutual of Omaha, Cigna, Blue Shield of CA, Anthem Blue Cross, Health Net, Aetna, etc. I have hundreds of clients, and I shop around for them every year around their birthday. Please click here to see some of my client testimonials.

If you have any questions, or if you know anyone that is turning 65 or starting Medicare, or if you would like for me to shop around for you, I’m happy to help, and there is no charge for my service!!! Please feel free to contact me! Also, please feel free to forward this blog on to anyone you know who may be interested.

Thank you!

Ron Lewis

CA agent #0B33674

NV agent #3822123

Ron@RonLewisInsurance.com

866.718.1600 (Toll-free)

760.525.5769 (Cell)

www.MedigapShopper.com